A balloon payment loan requires a large lump sum payment at the end of the term, resulting in lower monthly payments compared to a traditional auto loan with fixed monthly installments. While balloon loans offer initial affordability, traditional auto loans provide predictable, consistent payments that fully amortize over the loan period. Choosing between the two depends on your financial strategy and ability to manage a significant final payment.

Table of Comparison

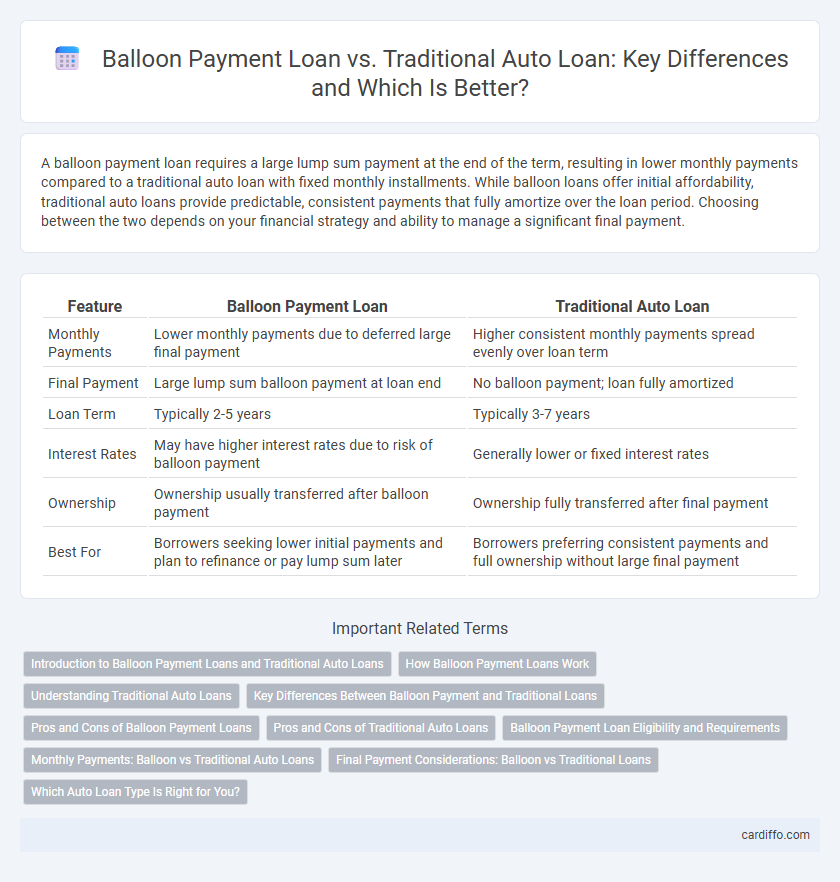

| Feature | Balloon Payment Loan | Traditional Auto Loan |

|---|---|---|

| Monthly Payments | Lower monthly payments due to deferred large final payment | Higher consistent monthly payments spread evenly over loan term |

| Final Payment | Large lump sum balloon payment at loan end | No balloon payment; loan fully amortized |

| Loan Term | Typically 2-5 years | Typically 3-7 years |

| Interest Rates | May have higher interest rates due to risk of balloon payment | Generally lower or fixed interest rates |

| Ownership | Ownership usually transferred after balloon payment | Ownership fully transferred after final payment |

| Best For | Borrowers seeking lower initial payments and plan to refinance or pay lump sum later | Borrowers preferring consistent payments and full ownership without large final payment |

Introduction to Balloon Payment Loans and Traditional Auto Loans

Balloon payment loans feature lower monthly payments with a large lump sum due at the end of the term, offering initial affordability compared to traditional auto loans that have consistent monthly payments throughout the loan period. Traditional auto loans spread the total repayment amount, including principal and interest, evenly over the loan tenure, providing predictable budgeting without a significant final payment. Understanding the differences between these loan structures helps borrowers choose financing that aligns with their cash flow and long-term financial strategies.

How Balloon Payment Loans Work

Balloon payment loans require borrowers to make lower monthly payments over the loan term, followed by a large lump-sum payment at the end. This structure reduces initial payment amounts compared to traditional auto loans, which spread payments evenly throughout the duration. Balloon loans are commonly used for auto financing when lower monthly cash flow is needed but a significant payment can be made upon loan maturity.

Understanding Traditional Auto Loans

Traditional auto loans involve fixed monthly payments spread evenly over the loan term, typically ranging from 36 to 72 months, allowing borrowers to repay the full vehicle cost with interest amortized over time. These loans commonly require a down payment, which helps reduce the principal balance and monthly payments, and end without a large lump sum due at the loan's conclusion. Borrowers benefit from predictable budgeting and full ownership of the vehicle once the final payment is made, contrasting with balloon payment loans that defer a substantial amount to the end of the term.

Key Differences Between Balloon Payment and Traditional Loans

Balloon payment loans require a large lump-sum payment at the end of the term, while traditional auto loans have fixed monthly payments that fully amortize the loan balance over the repayment period. Balloon loans typically offer lower monthly payments but involve higher financial risk due to the substantial final payment, whereas traditional loans provide predictable budgeting with consistent payments. The choice between these loans depends on a borrower's ability to manage the balloon payment and preference for payment structure.

Pros and Cons of Balloon Payment Loans

Balloon payment loans offer lower monthly payments compared to traditional auto loans, making them attractive for buyers seeking short-term affordability or planning to refinance before the final lump sum is due. The primary risk involves a large, final balloon payment that can strain finances if not anticipated or covered by a sale or refinance. This loan structure provides flexibility but requires careful financial planning to avoid default or high refinancing costs.

Pros and Cons of Traditional Auto Loans

Traditional auto loans offer predictable monthly payments and full ownership of the vehicle once the loan is paid off, making them ideal for buyers seeking straightforward financing without large end-of-term costs. These loans typically have fixed interest rates, which provide stability over the loan term, but monthly payments can be higher compared to balloon payment loans. One downside is that traditional loans may lock buyers into longer payment periods, increasing total interest paid and reducing flexibility for those wanting lower initial payments or the option to refinance easily.

Balloon Payment Loan Eligibility and Requirements

Balloon payment loans typically require a strong credit score, steady income, and a lower debt-to-income ratio compared to traditional auto loans. Lenders often mandate a comprehensive down payment and proof of consistent employment to qualify for the balloon payment structure. This loan type suits borrowers who anticipate a large lump-sum payment at the end of the term, influencing eligibility criteria tailored toward financial stability and payment planning.

Monthly Payments: Balloon vs Traditional Auto Loans

Balloon payment loans feature lower monthly payments compared to traditional auto loans due to smaller principal amortization during the loan term. Traditional auto loans require consistent monthly payments that fully amortize the loan, resulting in higher monthly costs but no large lump sum at the end. Borrowers choosing balloon loans must prepare for a significant final payment, impacting overall cash flow planning.

Final Payment Considerations: Balloon vs Traditional Loans

Balloon payment loans require a large lump-sum payment at the end of the loan term, significantly impacting the total cost and financial planning for borrowers compared to traditional auto loans with fixed, evenly distributed payments. The final balloon payment can lead to increased financial risk if the borrower is unprepared or unable to refinance, whereas traditional loans offer predictable final payment schedules that facilitate consistent budgeting. Understanding the implications of the balloon payment versus a fully amortized payment schedule is crucial when evaluating loan affordability and long-term financial commitments in auto financing.

Which Auto Loan Type Is Right for You?

Balloon payment loans feature lower monthly payments and a large final payment, making them ideal for drivers who plan to refinance or sell their vehicle before the balloon date. Traditional auto loans offer consistent monthly payments, providing predictable budgeting and full vehicle ownership at loan completion. Assess your financial stability, payment preferences, and long-term plans to determine which auto loan type aligns best with your needs.

Balloon Payment Loan vs Traditional Auto Loan Infographic

cardiffo.com

cardiffo.com