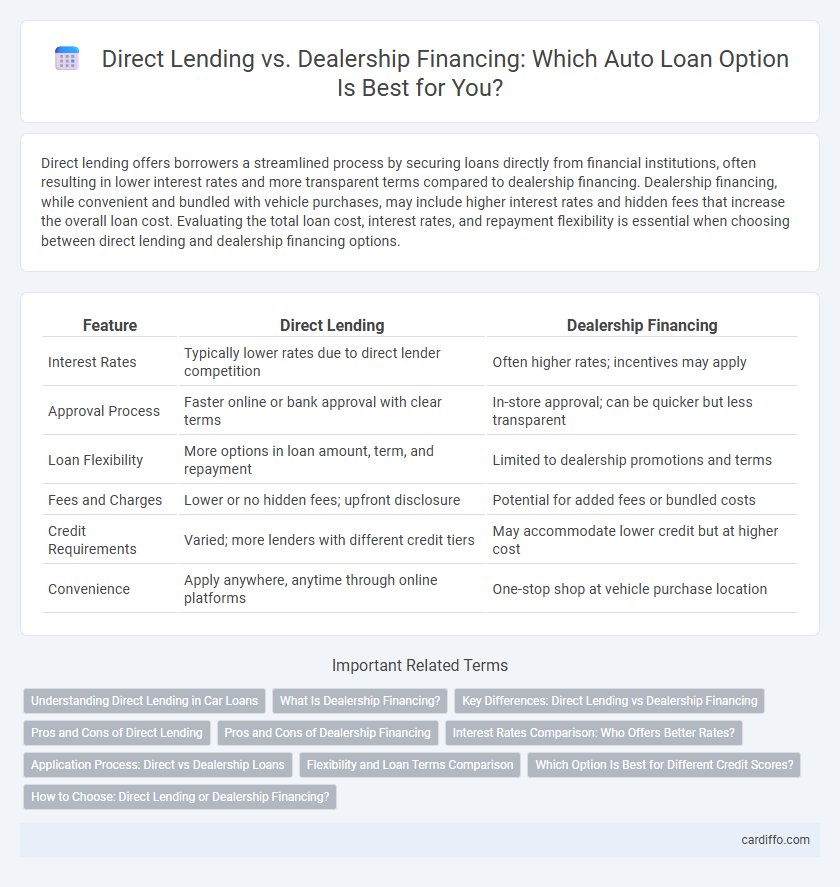

Direct lending offers borrowers a streamlined process by securing loans directly from financial institutions, often resulting in lower interest rates and more transparent terms compared to dealership financing. Dealership financing, while convenient and bundled with vehicle purchases, may include higher interest rates and hidden fees that increase the overall loan cost. Evaluating the total loan cost, interest rates, and repayment flexibility is essential when choosing between direct lending and dealership financing options.

Table of Comparison

| Feature | Direct Lending | Dealership Financing |

|---|---|---|

| Interest Rates | Typically lower rates due to direct lender competition | Often higher rates; incentives may apply |

| Approval Process | Faster online or bank approval with clear terms | In-store approval; can be quicker but less transparent |

| Loan Flexibility | More options in loan amount, term, and repayment | Limited to dealership promotions and terms |

| Fees and Charges | Lower or no hidden fees; upfront disclosure | Potential for added fees or bundled costs |

| Credit Requirements | Varied; more lenders with different credit tiers | May accommodate lower credit but at higher cost |

| Convenience | Apply anywhere, anytime through online platforms | One-stop shop at vehicle purchase location |

Understanding Direct Lending in Car Loans

Direct lending in car loans involves borrowing directly from a bank, credit union, or online lender, providing borrowers with upfront knowledge of loan terms and interest rates. This method often results in lower interest rates compared to dealership financing due to reduced fees and increased competition among direct lenders. Understanding direct lending helps borrowers make informed decisions and negotiate better deals when purchasing a vehicle.

What Is Dealership Financing?

Dealership financing refers to loans arranged through a car dealership, where the dealer acts as an intermediary between the buyer and the lender, often offering promotional interest rates or incentives. This type of financing streamlines the purchasing process by allowing buyers to secure a loan directly at the point of sale without seeking external credit approvals. Dealership financing typically includes options such as manufacturer-backed incentives, making it an attractive choice for customers looking for convenience and competitive loan terms.

Key Differences: Direct Lending vs Dealership Financing

Direct lending involves borrowers obtaining loans directly from financial institutions, often resulting in lower interest rates and greater loan term flexibility. Dealership financing typically includes loans arranged through car dealerships, which may offer convenience but often at higher interest rates and with less negotiation room. Key differences include the source of funds, cost of borrowing, and loan customization options available to the borrower.

Pros and Cons of Direct Lending

Direct lending offers borrowers competitive interest rates and faster approval processes by eliminating intermediaries, which often reduces overall loan costs. However, it may lack the convenience and specialized vehicle financing options found in dealership financing, potentially limiting flexibility for car buyers. Borrowers using direct lending should carefully evaluate lender terms and compare them with dealership incentives to ensure the best financial outcome.

Pros and Cons of Dealership Financing

Dealership financing offers convenience by bundling the loan process directly with the vehicle purchase, enabling faster approval and the possibility of promotional interest rates. However, interest rates from dealerships tend to be higher compared to direct lending institutions, increasing the overall loan cost. Limited negotiation flexibility and potential pressure to accept add-ons or warranties can lead to less favorable loan terms for the borrower.

Interest Rates Comparison: Who Offers Better Rates?

Direct lending often provides lower interest rates compared to dealership financing due to reduced overhead costs and direct borrower-lender relationships. Dealership financing typically carries higher rates because dealerships factor in convenience fees and commissions within loan terms. Borrowers seeking cost-effective loans should evaluate interest rate offers from banks, credit unions, and third-party lenders before committing to dealership financing.

Application Process: Direct vs Dealership Loans

Direct lending applications typically involve submitting financial documents directly to a lender online or in-person, streamlining approval with fewer intermediaries. Dealership financing requires completing paperwork through the dealer, who acts as a middleman between borrowers and lenders, often resulting in longer processing times. Loan approval criteria for direct loans are generally more transparent, while dealership loans may include dealership-imposed fees that affect the total cost.

Flexibility and Loan Terms Comparison

Direct lending offers greater flexibility in loan terms, including customizable repayment schedules and tailored interest rates to fit individual credit profiles. Dealership financing often comes with more rigid loan structures, typically featuring fixed terms and rates determined by the dealership's partnered lenders. Borrowers benefit from direct lending's adaptability, enabling improved management of loan durations and monthly payments compared to the standardized options available through dealership financing.

Which Option Is Best for Different Credit Scores?

Direct lending often benefits borrowers with higher credit scores by offering lower interest rates and more flexible terms, while dealership financing tends to be more accessible for those with lower credit scores despite higher costs. Borrowers with excellent credit (above 750) usually secure better deals through direct lenders, as banks and credit unions can tailor loans competitively. Customers with fair or poor credit (below 650) might find dealership financing easier to obtain but should carefully compare total loan costs to avoid excessive fees.

How to Choose: Direct Lending or Dealership Financing?

Choosing between direct lending and dealership financing involves comparing interest rates, loan terms, and total costs to determine the most affordable option. Direct lending often offers pre-approved loans with competitive rates from banks or credit unions, enabling borrowers to negotiate better deals without dealership pressure. Dealership financing provides convenience and promotional offers like 0% APR but can come with higher overall costs, making it essential to evaluate loan details carefully before deciding.

Direct Lending vs Dealership Financing Infographic

cardiffo.com

cardiffo.com