The money factor in leasing represents the cost of financing expressed as a decimal, which is converted to an interest rate by multiplying by 2400. Unlike traditional interest rates, the money factor includes both the rent charge and financing costs, making it essential to understand when comparing lease offers. Evaluating the money factor against the interest rate helps consumers identify the true cost of leasing and negotiate better terms.

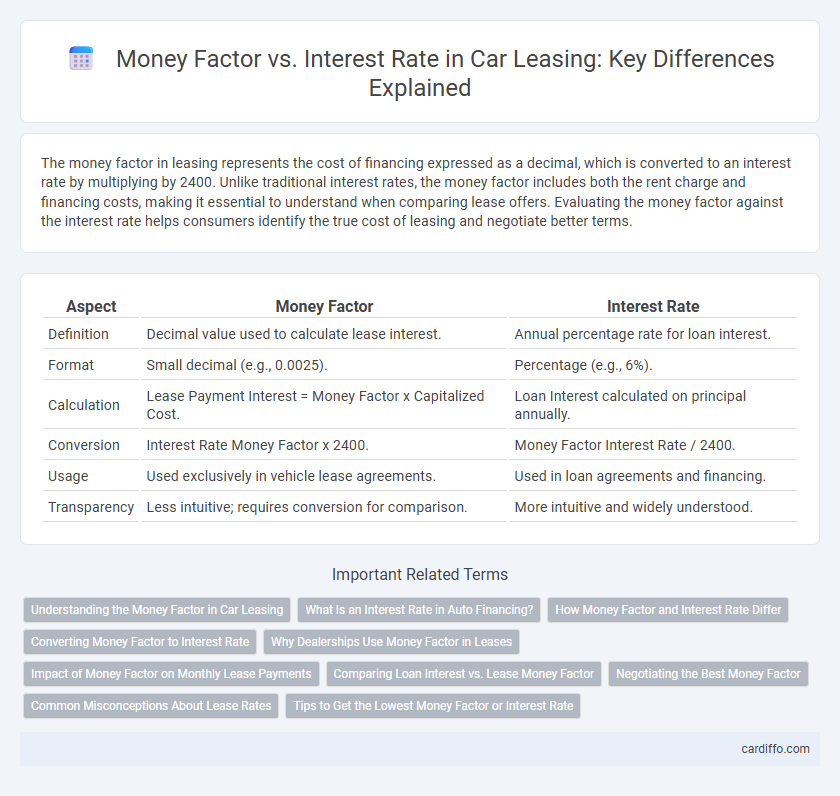

Table of Comparison

| Aspect | Money Factor | Interest Rate |

|---|---|---|

| Definition | Decimal value used to calculate lease interest. | Annual percentage rate for loan interest. |

| Format | Small decimal (e.g., 0.0025). | Percentage (e.g., 6%). |

| Calculation | Lease Payment Interest = Money Factor x Capitalized Cost. | Loan Interest calculated on principal annually. |

| Conversion | Interest Rate Money Factor x 2400. | Money Factor Interest Rate / 2400. |

| Usage | Used exclusively in vehicle lease agreements. | Used in loan agreements and financing. |

| Transparency | Less intuitive; requires conversion for comparison. | More intuitive and widely understood. |

Understanding the Money Factor in Car Leasing

The money factor in car leasing represents the lease's financing cost, expressed as a small decimal that, when multiplied by 2,400, approximates the annual interest rate. Unlike traditional interest rates shown as percentages, the money factor reflects how interest accrues daily over the lease term, affecting monthly lease payments. Understanding the money factor helps consumers compare lease offers accurately and negotiate better terms for their vehicle lease.

What Is an Interest Rate in Auto Financing?

An interest rate in auto financing represents the percentage charged on the principal amount of a loan or lease, reflecting the cost of borrowing money to purchase or lease a vehicle. It determines the total amount of interest paid over the term, directly impacting monthly payments and overall financing costs. Unlike the money factor used in leases, which is a decimal figure converted to an interest rate for comparison, the interest rate is expressed as an annual percentage rate (APR).

How Money Factor and Interest Rate Differ

Money factor and interest rate are both used to calculate financing costs in leases but differ fundamentally in their representation and application. Money factor is expressed as a small decimal (e.g., 0.0025) that, when multiplied by 2400, approximates the equivalent interest rate percentage in leases. Unlike traditional interest rates used in loans, the money factor directly influences the monthly lease payment, offering a more precise measure of lease financing costs.

Converting Money Factor to Interest Rate

The money factor in a lease can be converted to an interest rate by multiplying it by 2400, which provides an equivalent annual percentage rate (APR) for easier comparison with traditional loan rates. For example, a money factor of 0.00125 corresponds to an interest rate of 3%. Understanding this conversion helps lessees evaluate lease financing costs against conventional car loan interest rates effectively.

Why Dealerships Use Money Factor in Leases

Dealerships use the money factor in leases because it simplifies the calculation of financing costs by expressing interest as a small decimal rather than an annual percentage rate, making monthly lease payments easier to determine. The money factor is directly multiplied by the lease's capitalized cost to calculate the finance charge, providing transparency and flexibility in lease agreements. This method helps dealerships manage risk and adjust rates efficiently based on market conditions without complex interest rate conversions.

Impact of Money Factor on Monthly Lease Payments

The money factor directly influences monthly lease payments by determining the financing charge applied throughout the lease term. A lower money factor reduces the cost of borrowing, resulting in more affordable monthly payments, while a higher money factor increases those payments significantly. Understanding the money factor's relationship to the interest rate, where multiplying the money factor by 2400 approximates the APR, helps lessees better evaluate lease offers.

Comparing Loan Interest vs. Lease Money Factor

Loan interest rates represent the annual percentage cost of borrowing money for a purchase, expressed as a percentage. Lease money factors, often displayed as a small decimal number such as 0.0025, directly correlate to lease interest rates by multiplying the money factor by 2400 to approximate an equivalent annual interest rate percentage. Comparing loan interest versus lease money factor reveals that while loans charge interest on the principal balance, lease payments use the money factor combined with depreciation and fees, resulting in different cost structures and overall expenses.

Negotiating the Best Money Factor

Understanding the money factor is crucial when negotiating a lease, as it directly impacts your monthly payments by representing the lease's financing cost in decimal form. Unlike interest rates, money factors can be negotiated with the leasing company or dealership to reduce overall lease expenses, often translating to substantial savings over the lease term. Research current market averages and use your credit score as leverage to secure the lowest possible money factor for a cost-effective lease agreement.

Common Misconceptions About Lease Rates

Money factor and interest rate are often confused but represent different calculations in leasing; the money factor is a decimal figure used to determine monthly lease interest, while the interest rate is an annual percentage rate reflecting borrowing costs. Many lessees mistakenly assume the money factor can be directly converted to an interest rate by multiplying by 2400, though this conversion is an approximation that may not accurately reflect true financing costs. Understanding the distinction helps consumers avoid overpaying on lease deals by recognizing that lower money factors indicate less financing cost, regardless of advertised interest rates.

Tips to Get the Lowest Money Factor or Interest Rate

Negotiating the lowest money factor or interest rate in a lease requires a strong credit score, as lenders offer better terms to low-risk customers. Researching and comparing offers from multiple dealerships or financial institutions can uncover competitive rates that significantly reduce lease cost. Requesting a breakdown of all fees and incentives helps identify hidden costs and leverage promotions to secure the best possible money factor.

Money Factor vs Interest Rate Infographic

cardiffo.com

cardiffo.com