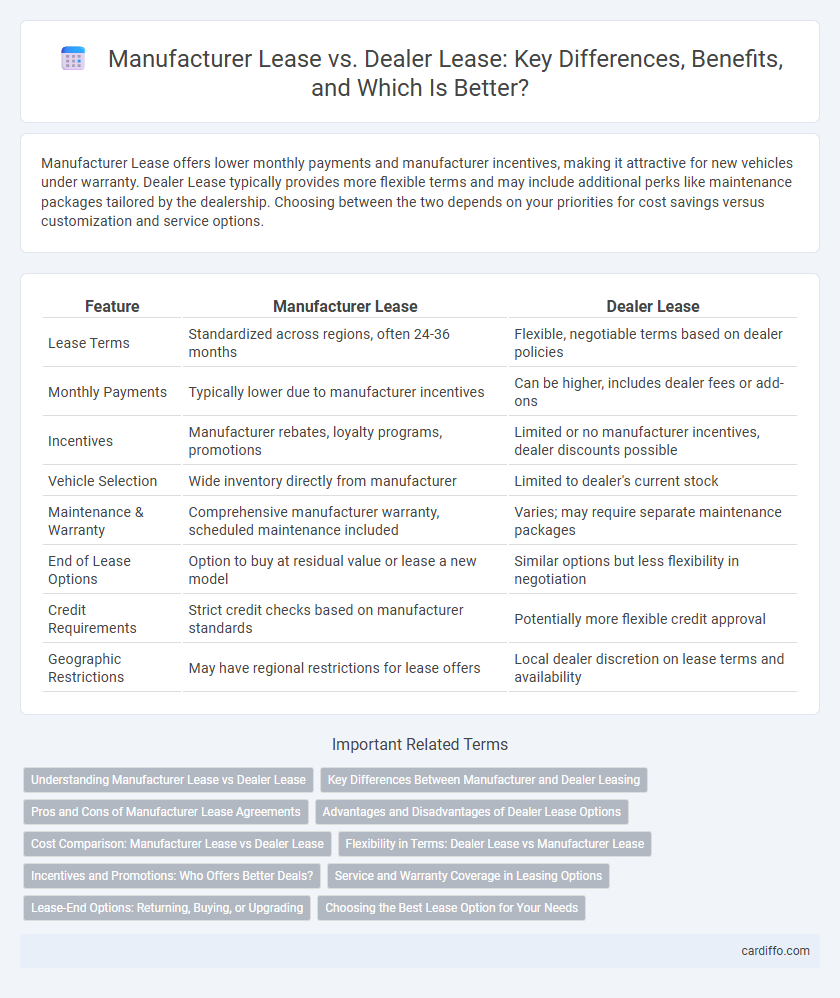

Manufacturer Lease offers lower monthly payments and manufacturer incentives, making it attractive for new vehicles under warranty. Dealer Lease typically provides more flexible terms and may include additional perks like maintenance packages tailored by the dealership. Choosing between the two depends on your priorities for cost savings versus customization and service options.

Table of Comparison

| Feature | Manufacturer Lease | Dealer Lease |

|---|---|---|

| Lease Terms | Standardized across regions, often 24-36 months | Flexible, negotiable terms based on dealer policies |

| Monthly Payments | Typically lower due to manufacturer incentives | Can be higher, includes dealer fees or add-ons |

| Incentives | Manufacturer rebates, loyalty programs, promotions | Limited or no manufacturer incentives, dealer discounts possible |

| Vehicle Selection | Wide inventory directly from manufacturer | Limited to dealer's current stock |

| Maintenance & Warranty | Comprehensive manufacturer warranty, scheduled maintenance included | Varies; may require separate maintenance packages |

| End of Lease Options | Option to buy at residual value or lease a new model | Similar options but less flexibility in negotiation |

| Credit Requirements | Strict credit checks based on manufacturer standards | Potentially more flexible credit approval |

| Geographic Restrictions | May have regional restrictions for lease offers | Local dealer discretion on lease terms and availability |

Understanding Manufacturer Lease vs Dealer Lease

Manufacturer leases often provide lower interest rates and proprietary incentives directly from the vehicle producer, enhancing cost savings for lessees. Dealer leases may include flexible negotiation options and localized promotions but can carry higher interest rates or fewer manufacturer incentives. Understanding these distinctions helps lessees optimize financial benefits by selecting between manufacturer-backed lease deals and dealer-specific leasing arrangements.

Key Differences Between Manufacturer and Dealer Leasing

Manufacturer leases typically offer lower monthly payments and often include incentives such as warranty coverage and maintenance packages directly from the automaker. Dealer leases may provide more flexible terms and negotiate incentives unique to the dealership, but can come with higher interest rates or additional fees. Understanding these distinctions helps lessees evaluate cost savings, warranty benefits, and lease-end options between manufacturer and dealer lease agreements.

Pros and Cons of Manufacturer Lease Agreements

Manufacturer lease agreements offer structured financing options directly from the vehicle maker, often including promotional rates, warranty coverage, and flexible lease terms that enhance affordability and reliability. These leases tend to have stricter mileage limits and potential penalties for excessive wear, which may increase costs over the lease term compared to dealer leases. While manufacturer leases provide trusted service networks and inclusion of certified maintenance plans, they sometimes lack the negotiation flexibility found in dealer lease agreements.

Advantages and Disadvantages of Dealer Lease Options

Dealer lease options often provide more flexible terms and incentives such as lower upfront costs and promotional rates compared to manufacturer leases. These leases may include customized packages, easier credit approval, and local service perks but can carry higher interest rates and less transparency in fees. Choosing a dealer lease requires careful analysis of total lease costs and potential limitations on vehicle selection or lease-end conditions.

Cost Comparison: Manufacturer Lease vs Dealer Lease

Manufacturer leases typically offer lower monthly payments and more attractive incentives due to direct manufacturer subsidies, resulting in overall reduced leasing costs. Dealer leases often include additional fees and less favorable terms, which can increase the total cost despite potentially shorter contract durations. Comparing residual values, mileage limits, and incentives is essential to identify the most cost-effective option between manufacturer and dealer leases.

Flexibility in Terms: Dealer Lease vs Manufacturer Lease

Dealer leases often provide greater flexibility in terms, allowing customization of mileage limits, down payments, and lease durations to suit individual needs. Manufacturer leases typically have more standardized terms with limited negotiation options but may include manufacturer incentives and maintenance packages. Choosing between dealer lease and manufacturer lease depends on the lessee's preference for tailored flexibility versus structured benefits.

Incentives and Promotions: Who Offers Better Deals?

Manufacturer leases often provide better incentives and promotions compared to dealer leases, including lower monthly payments, cashback offers, and loyalty bonuses tied directly to the brand. Dealers may offer localized discounts and flexible terms but generally cannot match the manufacturer's nationwide special lease rates or manufacturer-sponsored financial incentives. Analyzing lease deals requires comparing manufacturer rebates, residual values, and money factor offers against dealer promotions to identify the most cost-effective option.

Service and Warranty Coverage in Leasing Options

Manufacturer leases often provide comprehensive service and warranty coverage directly through authorized dealerships, ensuring consistency and access to manufacturer-approved parts and repairs. Dealer leases may offer more flexible service packages but can vary significantly in warranty terms and authorized service providers. Choosing between the two depends on the desired balance between standardized manufacturer care and potentially customized dealership offerings.

Lease-End Options: Returning, Buying, or Upgrading

Manufacturer leases typically offer flexible lease-end options including returning the vehicle, purchasing it at a predetermined residual value, or upgrading to a new model with promotional incentives. Dealer leases may have less standardized buyout terms, often requiring negotiation for purchase price or lease extension, but can provide personalized upgrade offers tied to dealer inventory. Understanding residual values, lease-end fees, and available incentives is essential when deciding between manufacturer versus dealer lease agreements.

Choosing the Best Lease Option for Your Needs

Manufacturer leases often provide lower monthly payments and exclusive incentives, appealing to buyers seeking brand-specific models and warranty benefits. Dealer leases may offer flexible terms and a broader selection of vehicles, suitable for customers prioritizing customization and negotiation opportunities. Evaluating total lease costs, mileage allowances, and maintenance packages will help determine the best lease option aligned with your financial goals and driving habits.

Manufacturer Lease vs Dealer Lease Infographic

cardiffo.com

cardiffo.com