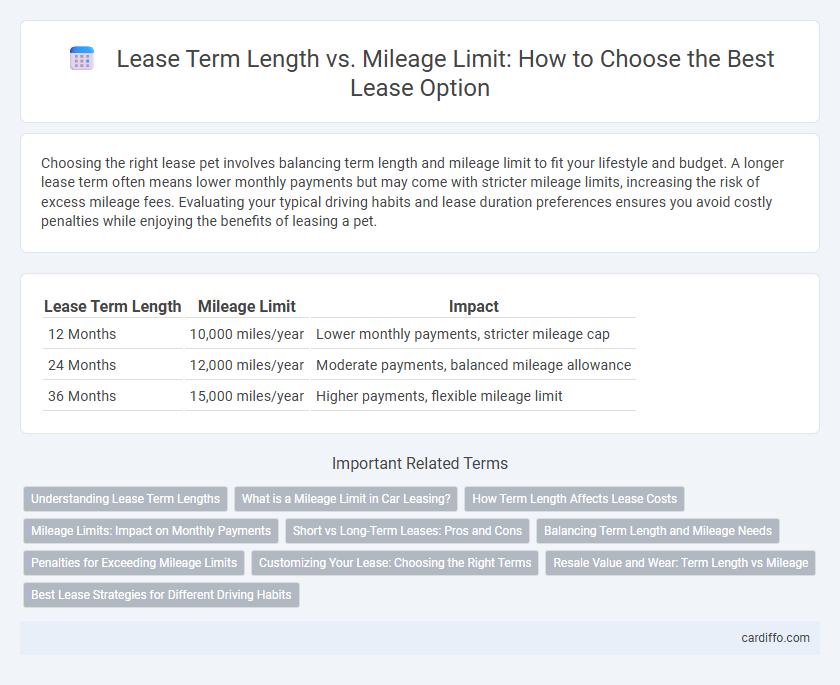

Choosing the right lease pet involves balancing term length and mileage limit to fit your lifestyle and budget. A longer lease term often means lower monthly payments but may come with stricter mileage limits, increasing the risk of excess mileage fees. Evaluating your typical driving habits and lease duration preferences ensures you avoid costly penalties while enjoying the benefits of leasing a pet.

Table of Comparison

| Lease Term Length | Mileage Limit | Impact |

|---|---|---|

| 12 Months | 10,000 miles/year | Lower monthly payments, stricter mileage cap |

| 24 Months | 12,000 miles/year | Moderate payments, balanced mileage allowance |

| 36 Months | 15,000 miles/year | Higher payments, flexible mileage limit |

Understanding Lease Term Lengths

Lease term lengths typically range from 24 to 48 months, directly affecting monthly payments and vehicle depreciation. Shorter lease terms often have higher monthly payments but allow for more frequent vehicle upgrades, while longer terms lower monthly costs but may increase maintenance expenses. Understanding the balance between lease duration and mileage limits is crucial to avoid excess mileage charges and optimize lease value.

What is a Mileage Limit in Car Leasing?

A mileage limit in car leasing refers to the maximum number of miles a lessee is allowed to drive during the lease term without incurring additional fees. This limit is typically specified in the lease agreement, often ranging from 10,000 to 15,000 miles annually, and exceeding it results in per-mile penalties. Understanding the mileage limit is crucial to avoid costly charges and to ensure the lease terms align with your driving habits.

How Term Length Affects Lease Costs

Longer lease terms typically result in lower monthly payments because the vehicle's depreciation is spread over more months, but they may increase overall interest costs. Shorter term lengths often mean higher monthly payments but allow lessees to switch to newer models more frequently, potentially reducing maintenance expenses. Mileage limits directly impact lease costs, as exceeding these limits can result in significant fees, making it crucial to align term length with anticipated annual mileage to optimize total lease expenses.

Mileage Limits: Impact on Monthly Payments

Mileage limits in lease agreements directly influence monthly payments, with higher mileage allowances typically resulting in increased monthly costs. Exceeding the predetermined mileage cap can lead to substantial penalties at lease-end, often calculated per excess mile. Carefully selecting a mileage limit aligned with driving habits optimizes payment efficiency and minimizes unexpected fees.

Short vs Long-Term Leases: Pros and Cons

Short-term leases offer flexibility and lower commitment, ideal for those who prefer frequent vehicle updates or anticipate changes in mileage needs, but they generally come with higher monthly payments and stricter mileage limits. Long-term leases provide lower monthly costs and higher mileage allowances, suited for consistent drivers seeking predictable expenses, though they require longer financial commitment and can incur sizable penalties for excess mileage. Balancing term length with mileage limits depends on individual driving habits and financial priorities, making careful evaluation essential for lease agreements.

Balancing Term Length and Mileage Needs

Lease agreements require careful balancing of term length and mileage limits to avoid excess fees and maintain vehicle condition. Selecting a shorter term length with a higher mileage allowance suits drivers with extensive travel needs, while longer terms with lower mileage caps benefit those with limited yearly driving. Accurate assessment of annual mileage ensures the lease aligns with personal driving habits, optimizing overall cost efficiency.

Penalties for Exceeding Mileage Limits

Exceeding mileage limits on a vehicle lease typically results in penalties calculated per mile over the agreed allowance, often ranging from $0.15 to $0.30 per excess mile. These charges can significantly increase the total cost of the lease if the driver exceeds the annual mileage cap by a large margin. Understanding and negotiating appropriate mileage limits at the start of the lease helps avoid unexpected fees at lease-end inspections.

Customizing Your Lease: Choosing the Right Terms

Customizing your lease involves balancing term length and mileage limits to fit your driving habits and financial goals. Shorter lease terms offer flexibility and frequent access to new models, while longer leases typically lower monthly payments but may impose stricter mileage limits. Selecting optimal mileage allowances prevents costly penalties, ensuring your lease aligns with actual usage for maximum savings.

Resale Value and Wear: Term Length vs Mileage

Lease agreements with shorter term lengths typically maintain higher resale value due to reduced wear and lower mileage accumulation, preserving the vehicle's condition. Higher mileage limits can accelerate depreciation by increasing wear and tear, negatively impacting the lease-end resale value. Balancing term length and mileage limits helps optimize return on investment by sustaining the vehicle's market appeal.

Best Lease Strategies for Different Driving Habits

Selecting the optimal lease term length and mileage limit depends on your driving habits and lifestyle demands. For drivers with high annual mileage, leases with higher mileage allowances and shorter term lengths prevent excess mileage fees and provide flexibility for vehicle upgrades. Conversely, low-mileage drivers benefit from longer lease terms paired with lower mileage limits, maximizing cost efficiency and maintaining lease-end condition without penalty.

Term Length vs Mileage Limit Infographic

cardiffo.com

cardiffo.com