Balloon leases require a large final payment at the end of the term, reducing monthly installments compared to standard leases that have consistent payments throughout. Standard leases offer predictable costs, making budgeting easier, while balloon leases can be advantageous for those expecting increased future cash flow or planning to refinance the balloon payment. Choosing between a balloon lease and a standard lease depends on financial goals, cash flow preferences, and the ability to manage the lump-sum payment at lease end.

Table of Comparison

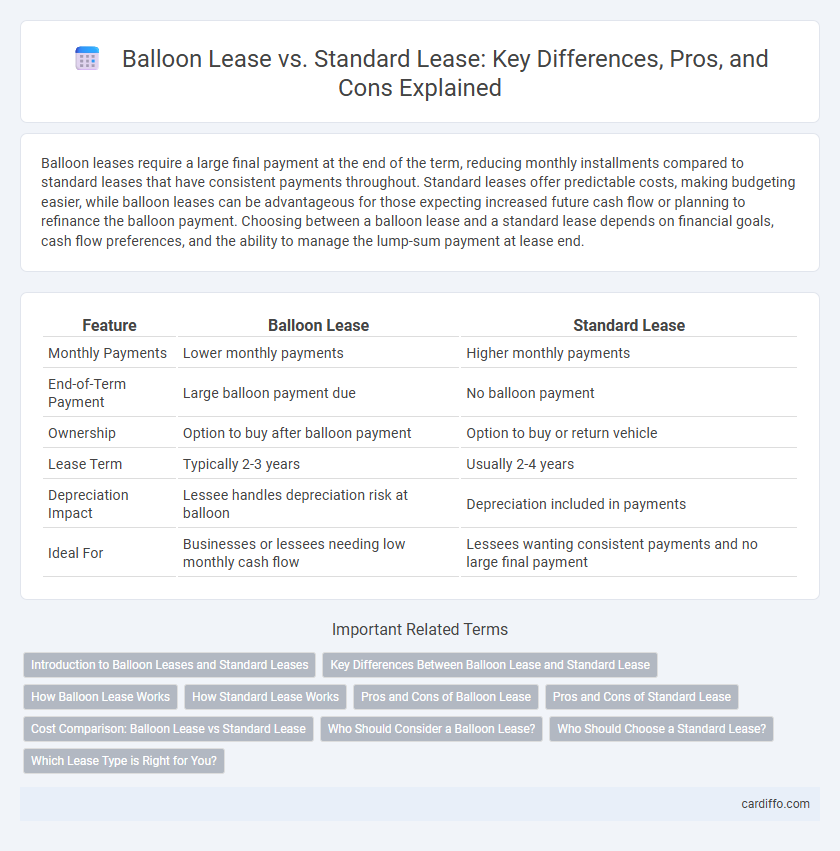

| Feature | Balloon Lease | Standard Lease |

|---|---|---|

| Monthly Payments | Lower monthly payments | Higher monthly payments |

| End-of-Term Payment | Large balloon payment due | No balloon payment |

| Ownership | Option to buy after balloon payment | Option to buy or return vehicle |

| Lease Term | Typically 2-3 years | Usually 2-4 years |

| Depreciation Impact | Lessee handles depreciation risk at balloon | Depreciation included in payments |

| Ideal For | Businesses or lessees needing low monthly cash flow | Lessees wanting consistent payments and no large final payment |

Introduction to Balloon Leases and Standard Leases

Balloon leases involve lower monthly payments with a large final lump-sum payment, providing flexibility for lessees anticipating increased future income or asset sales. Standard leases require consistent monthly payments spread evenly over the lease term, offering predictable budgeting and straightforward financial planning. Choosing between balloon and standard leases depends on cash flow preferences and long-term financial strategies.

Key Differences Between Balloon Lease and Standard Lease

A balloon lease requires a large final payment, known as the balloon payment, which significantly reduces monthly installments compared to a standard lease that spreads payments evenly over the term. Balloon leases often result in lower monthly costs but carry the risk of a substantial lump-sum payment or refinancing at lease-end. Standard leases provide predictable, consistent monthly payments with no large final payment, offering greater financial stability throughout the lease duration.

How Balloon Lease Works

A Balloon Lease requires lower monthly payments during the lease term with a large lump sum, or "balloon" payment due at the end to cover the remaining balance of the asset's value. This structure allows lessees to conserve cash flow but involves higher financial risk at lease maturity when the balloon payment is due. The final payment can be refinanced, paid off, or the asset returned depending on the lease agreement terms.

How Standard Lease Works

A Standard Lease requires fixed monthly payments over the entire term, typically covering the vehicle's depreciation, interest, and fees, resulting in predictable costs. At lease end, the vehicle is returned without any large balloon payment, offering simplicity and financial clarity. This leasing option suits drivers who prefer consistent budgeting without financial surprises.

Pros and Cons of Balloon Lease

Balloon leases offer lower monthly payments compared to standard leases, making them attractive for lessees seeking immediate cash flow relief. The balloon payment due at the end of the lease term poses a financial risk if not properly planned, potentially leading to refinancing challenges or lump-sum payment burdens. While balloon leases enhance affordability during the lease period, they require careful budgeting for the final balloon payment, unlike standard leases with evenly distributed costs.

Pros and Cons of Standard Lease

Standard leases offer predictable monthly payments and straightforward terms, making budgeting easier for lessees. However, they often come with higher monthly costs compared to balloon leases and may include penalties for exceeding mileage limits or excessive wear and tear. This type of lease is ideal for those seeking simplicity and consistent financial commitment without a large lump-sum payment at the end.

Cost Comparison: Balloon Lease vs Standard Lease

Balloon leases typically involve lower monthly payments than standard leases due to a large final payment, reducing initial cash outflow and improving short-term affordability. Standard leases feature consistent monthly payments without a balloon payment, leading to higher but predictable monthly costs over the lease term. Total cost of ownership varies; balloon leases may incur higher overall expenses if the final balloon payment is financed or if vehicle depreciation is underestimated.

Who Should Consider a Balloon Lease?

A balloon lease is ideal for businesses or individuals expecting increased cash flow in the future, allowing smaller monthly payments initially and a large final payment. Companies with seasonal income or startup ventures aiming to conserve capital early on should consider this option. Those seeking to maintain liquidity while planning for a substantial payoff at lease end often find balloon leases beneficial.

Who Should Choose a Standard Lease?

Customers seeking predictable monthly payments and straightforward ownership terms should opt for a Standard Lease. This option is ideal for drivers who plan to use the vehicle consistently over the lease term without significant variations in mileage. Standard Leases appeal to individuals who prefer simplicity and fixed costs without the large final payment typical of Balloon Leases.

Which Lease Type is Right for You?

Balloon leases offer lower monthly payments with a large payment due at the end, ideal for businesses expecting increased cash flow or selling the asset before the balloon payment. Standard leases require consistent monthly payments over the lease term, providing predictable expenses and easier budgeting for steady cash flow situations. Choosing between a balloon lease and a standard lease depends on your financial flexibility, asset usage plans, and long-term business goals.

Balloon Lease vs Standard Lease Infographic

cardiffo.com

cardiffo.com