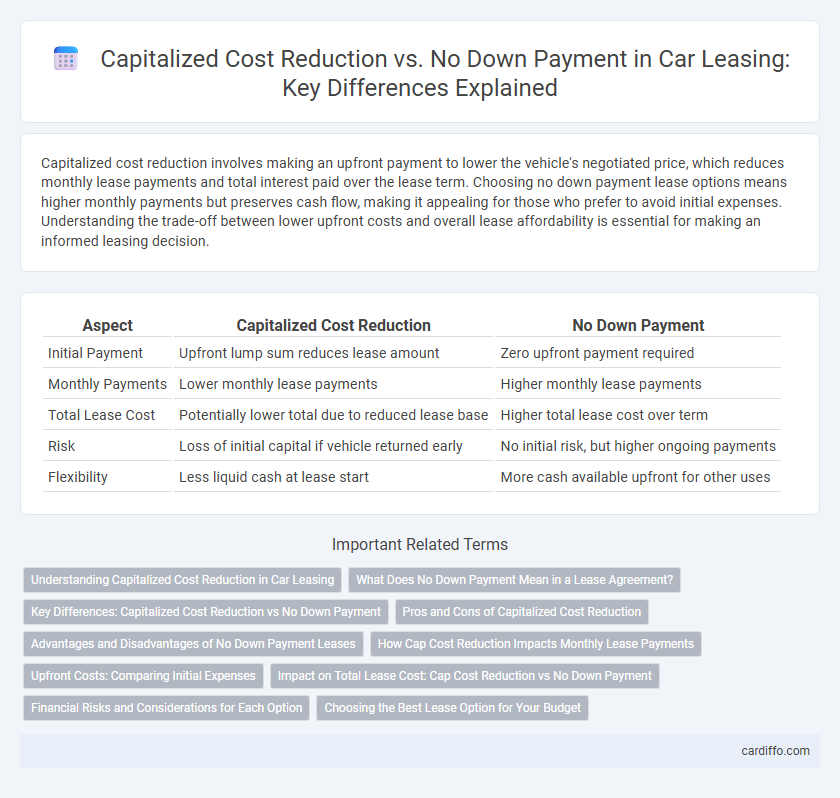

Capitalized cost reduction involves making an upfront payment to lower the vehicle's negotiated price, which reduces monthly lease payments and total interest paid over the lease term. Choosing no down payment lease options means higher monthly payments but preserves cash flow, making it appealing for those who prefer to avoid initial expenses. Understanding the trade-off between lower upfront costs and overall lease affordability is essential for making an informed leasing decision.

Table of Comparison

| Aspect | Capitalized Cost Reduction | No Down Payment |

|---|---|---|

| Initial Payment | Upfront lump sum reduces lease amount | Zero upfront payment required |

| Monthly Payments | Lower monthly lease payments | Higher monthly lease payments |

| Total Lease Cost | Potentially lower total due to reduced lease base | Higher total lease cost over term |

| Risk | Loss of initial capital if vehicle returned early | No initial risk, but higher ongoing payments |

| Flexibility | Less liquid cash at lease start | More cash available upfront for other uses |

Understanding Capitalized Cost Reduction in Car Leasing

Capitalized Cost Reduction in car leasing refers to the upfront payment made to lower the vehicle's capitalized cost, directly reducing monthly lease payments and the overall lease expense. Opting for no down payment means the lessee finances the entire capitalized cost, resulting in higher monthly payments but less upfront cash needed. Understanding Capitalized Cost Reduction helps lessees balance initial expenditure against monthly affordability and total lease cost.

What Does No Down Payment Mean in a Lease Agreement?

No down payment in a lease agreement means the lessee does not pay any initial capitalized cost reduction, which typically lowers the vehicle's lease price and monthly payments. Without a down payment, the total lease amount is spread evenly across the monthly payments, potentially resulting in higher monthly costs compared to leases with capitalized cost reductions. This option can benefit lessees seeking to reduce upfront expenses but may increase the overall financial commitment over the lease term.

Key Differences: Capitalized Cost Reduction vs No Down Payment

Capitalized cost reduction involves making an upfront payment to lower the vehicle's capitalized cost, which directly reduces monthly lease payments and overall financing charges. No down payment leases eliminate the initial out-of-pocket expense but typically result in higher monthly payments and increased total lease costs due to the larger principal amount financed. Choosing between these options impacts cash flow, lease affordability, and the total cost of leasing over the term.

Pros and Cons of Capitalized Cost Reduction

Capitalized Cost Reduction lowers monthly lease payments by reducing the vehicle's adjusted capitalized cost but requires an upfront cash payment, which can affect initial budget flexibility. This payment reduces the interest paid over the lease term, potentially lowering total lease costs, but if the vehicle is stolen or totaled early, that money is often non-refundable. Opting for no down payment maximizes liquidity and reduces upfront expenses but results in higher monthly payments and possibly more interest over the lease duration.

Advantages and Disadvantages of No Down Payment Leases

No down payment leases eliminate the initial cash outlay, preserving upfront capital and improving monthly cash flow management. However, they often result in higher monthly payments and increased total lease costs compared to leases with capitalized cost reduction. This option is advantageous for lessees prioritizing liquidity but may lead to higher long-term financial commitments and less equity built into the lease agreement.

How Cap Cost Reduction Impacts Monthly Lease Payments

Capitalized cost reduction directly lowers the amount financed in a lease agreement, resulting in reduced monthly lease payments by decreasing the lease's adjusted capitalized cost. Without a down payment, the full capitalized cost is financed, leading to higher monthly payments throughout the lease term. This impact on monthly payments makes capitalized cost reduction a critical factor for lessees seeking to improve cash flow during the lease period.

Upfront Costs: Comparing Initial Expenses

Capitalized cost reduction lowers upfront lease expenses by reducing the amount financed, resulting in lower monthly payments and less interest over the lease term. Opting for no down payment eliminates immediate cash outlay but typically increases monthly payments and total lease cost due to higher capitalized cost. Evaluating initial expenses involves balancing immediate affordability with long-term financial impact on the lease agreement.

Impact on Total Lease Cost: Cap Cost Reduction vs No Down Payment

A capitalized cost reduction lowers the total lease cost by decreasing the vehicle's adjusted capitalized cost, which directly reduces monthly payments and finance charges over the lease term. Opting for no down payment means the entire lease cost is financed, resulting in higher monthly payments and greater interest accumulation. Over the lease duration, applying a cap cost reduction generally leads to significant savings compared to leasing without an upfront payment.

Financial Risks and Considerations for Each Option

Choosing a Capitalized Cost Reduction in a lease reduces monthly payments by lowering the financed amount but increases the risk of losing the upfront cash if the vehicle is totaled or stolen. Opting for No Down Payment preserves cash flow and minimizes the initial financial burden, yet results in higher monthly payments and greater exposure to negative equity if the lease is terminated early. Evaluating personal cash reserves and risk tolerance is essential to balance immediate affordability against potential long-term financial loss.

Choosing the Best Lease Option for Your Budget

Capitalized cost reduction lowers your monthly lease payments by applying a down payment toward the vehicle's initial value, reducing the amount financed and interest paid over the lease term. Opting for no down payment means higher monthly payments but preserves your upfront cash flow and reduces financial risk if the vehicle is totaled or stolen. Evaluating your cash availability, monthly budget, and risk tolerance helps determine whether capitalized cost reduction or no down payment aligns best with your lease financial goals.

Capitalized Cost Reduction vs No Down Payment Infographic

cardiffo.com

cardiffo.com