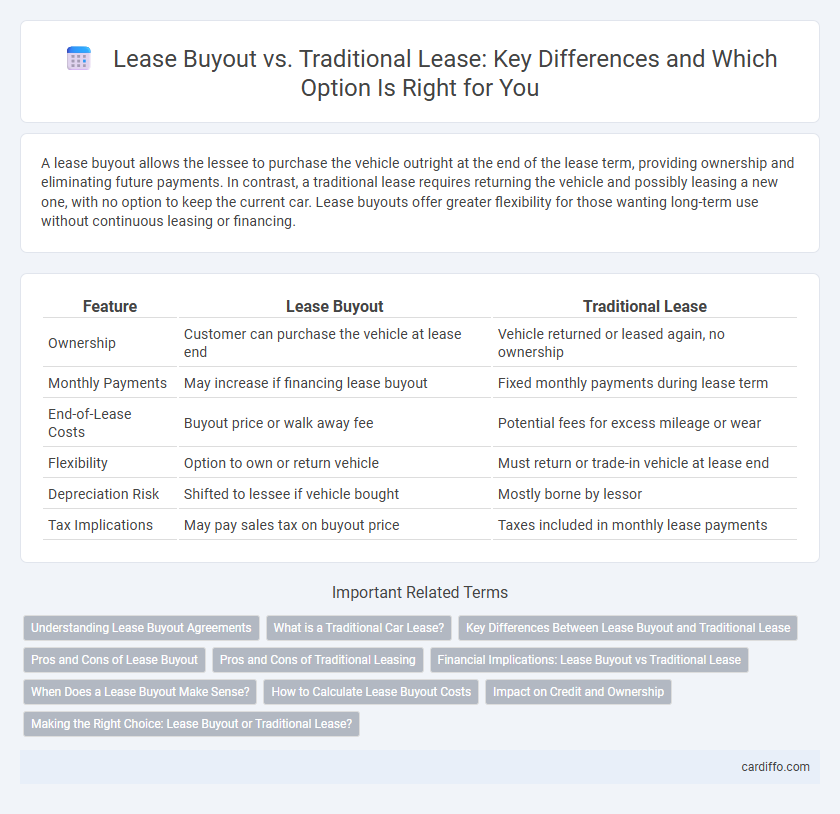

A lease buyout allows the lessee to purchase the vehicle outright at the end of the lease term, providing ownership and eliminating future payments. In contrast, a traditional lease requires returning the vehicle and possibly leasing a new one, with no option to keep the current car. Lease buyouts offer greater flexibility for those wanting long-term use without continuous leasing or financing.

Table of Comparison

| Feature | Lease Buyout | Traditional Lease |

|---|---|---|

| Ownership | Customer can purchase the vehicle at lease end | Vehicle returned or leased again, no ownership |

| Monthly Payments | May increase if financing lease buyout | Fixed monthly payments during lease term |

| End-of-Lease Costs | Buyout price or walk away fee | Potential fees for excess mileage or wear |

| Flexibility | Option to own or return vehicle | Must return or trade-in vehicle at lease end |

| Depreciation Risk | Shifted to lessee if vehicle bought | Mostly borne by lessor |

| Tax Implications | May pay sales tax on buyout price | Taxes included in monthly lease payments |

Understanding Lease Buyout Agreements

Lease buyout agreements allow lessees to purchase the leased asset before the lease term ends, offering flexibility compared to traditional leases where returning the asset is mandatory. These agreements typically involve a predetermined buyout price, which can be lower than the asset's market value, making them economically advantageous in certain scenarios. Understanding the specific terms and conditions of lease buyouts is essential to evaluate potential cost savings and ownership benefits versus continuing with traditional lease payments.

What is a Traditional Car Lease?

A traditional car lease involves paying a fixed monthly amount to use a vehicle for a set period, typically 24 to 36 months, with mileage limits and maintenance responsibilities outlined in the contract. At the end of the lease term, lessees must return the vehicle to the dealership unless they opt to purchase it at a predetermined residual value. This structure contrasts with lease buyout options, which allow consumers more flexibility to own the vehicle after or during the lease term.

Key Differences Between Lease Buyout and Traditional Lease

Lease buyout involves purchasing the leased asset, typically a vehicle, at the end or during the lease term, allowing ownership transfer, whereas traditional lease requires returning the asset without ownership rights. Lease buyout often incurs a one-time payment equal to the residual value or negotiated price, contrasting with ongoing monthly payments in a traditional lease. Traditional leases emphasize flexibility with lower upfront costs, while lease buyouts emphasize asset acquisition and long-term cost savings.

Pros and Cons of Lease Buyout

Lease buyout offers the advantage of ownership at the end of the lease term, eliminating mileage restrictions and wear-and-tear fees associated with traditional leases. The upfront cost or higher monthly payments in a lease buyout can be a drawback compared to the typically lower initial expenses of traditional leases. Consumers benefit from flexibility in lease buyouts but risk potential depreciation losses, whereas traditional leases provide predictable costs and easy vehicle upgrades without ownership responsibilities.

Pros and Cons of Traditional Leasing

Traditional leasing offers lower monthly payments compared to purchasing, making it a cost-effective way to drive a new vehicle with minimal upfront costs. However, mileage limits and potential wear-and-tear fees can result in additional expenses at lease-end, restricting flexibility. The lack of ownership equity and continuous leasing cycles may lead to higher long-term costs compared to lease buyout options.

Financial Implications: Lease Buyout vs Traditional Lease

Lease buyout offers potential long-term savings by allowing lessees to own the vehicle outright after the buyout price is paid, eliminating monthly lease payments and avoiding mileage penalties. Traditional leases often involve lower monthly payments but can result in higher total costs due to fees for excess mileage, wear and tear, and lease-end charges. Financially, a lease buyout is advantageous for drivers who plan to keep the vehicle beyond the lease term, while traditional leasing suits those prioritizing lower upfront costs and vehicle flexibility.

When Does a Lease Buyout Make Sense?

A lease buyout makes sense when the vehicle's market value exceeds the remaining lease balance, allowing the lessee to gain equity by purchasing the car. It is typically beneficial if you plan to keep the vehicle long-term, avoiding excessive mileage fees or wear-and-tear charges. Comparing buyout costs with current market prices and lease-end fees helps determine if exercising the buyout option provides better financial value than returning the vehicle at lease expiration.

How to Calculate Lease Buyout Costs

Calculating lease buyout costs involves determining the remaining value of the vehicle minus any lease payments already made, plus fees such as purchase option fees and applicable taxes. The residual value specified in the lease agreement is a key factor, representing the vehicle's estimated worth at lease end. Understanding these components helps compare lease buyout expenses to traditional lease payments, aiding in making cost-effective decisions.

Impact on Credit and Ownership

Lease buyout allows lessees to gain ownership of the vehicle, positively influencing credit by demonstrating asset acquisition and responsibility. Traditional leases keep credit impact limited to timely payment history without building equity or ownership. Opting for a lease buyout can enhance credit profiles over time, while traditional leases offer no long-term ownership benefits.

Making the Right Choice: Lease Buyout or Traditional Lease?

Choosing between a lease buyout and a traditional lease hinges on factors such as your financial situation, vehicle usage, and long-term ownership goals. Lease buyouts offer the advantage of owning the vehicle by paying a predetermined price, which can be cost-effective for high-mileage drivers or those seeking to avoid lease-end charges. Traditional leases provide lower monthly payments and flexibility to drive a new vehicle every few years, making them ideal for individuals who prefer frequently upgrading their cars without the commitment of ownership.

Lease buyout vs traditional lease Infographic

cardiffo.com

cardiffo.com