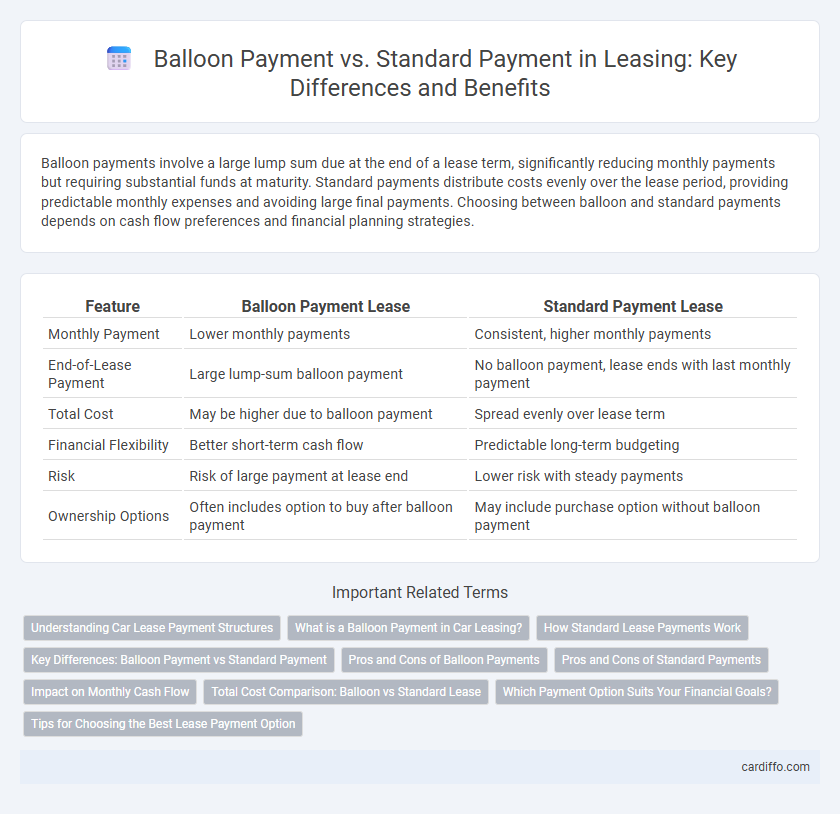

Balloon payments involve a large lump sum due at the end of a lease term, significantly reducing monthly payments but requiring substantial funds at maturity. Standard payments distribute costs evenly over the lease period, providing predictable monthly expenses and avoiding large final payments. Choosing between balloon and standard payments depends on cash flow preferences and financial planning strategies.

Table of Comparison

| Feature | Balloon Payment Lease | Standard Payment Lease |

|---|---|---|

| Monthly Payment | Lower monthly payments | Consistent, higher monthly payments |

| End-of-Lease Payment | Large lump-sum balloon payment | No balloon payment, lease ends with last monthly payment |

| Total Cost | May be higher due to balloon payment | Spread evenly over lease term |

| Financial Flexibility | Better short-term cash flow | Predictable long-term budgeting |

| Risk | Risk of large payment at lease end | Lower risk with steady payments |

| Ownership Options | Often includes option to buy after balloon payment | May include purchase option without balloon payment |

Understanding Car Lease Payment Structures

Balloon payment leases require lower monthly payments with a large lump sum due at the end of the term, often making them attractive for budget-conscious lessees seeking short-term affordability. Standard payment leases spread the total cost evenly across monthly installments, providing predictable expenses without a substantial final payment. Understanding these structures helps consumers choose between manageable monthly costs and potential end-of-lease financial obligations.

What is a Balloon Payment in Car Leasing?

A balloon payment in car leasing refers to a large, lump-sum payment due at the end of the lease term, significantly reducing monthly installments throughout the lease period. Unlike standard payments, which are evenly distributed over the lease duration, balloon payments lower monthly costs but require substantial funds at lease-end to fully pay off the vehicle. This structure appeals to lessees seeking lower monthly expenses with the option to either refinance, pay the lump sum, or return the car.

How Standard Lease Payments Work

Standard lease payments involve fixed monthly installments calculated based on the asset's depreciation, interest rates, and lease term, ensuring predictable costs for lessees. Each payment contributes to covering both the asset's value reduction and the financing charges, with no large lump-sum payments at the end of the lease. This structure contrasts with balloon payments, which require a significant final payment to balance the lease terms.

Key Differences: Balloon Payment vs Standard Payment

Balloon payment leases require a large lump-sum payment at the end of the term, significantly lowering monthly installments compared to standard payment leases, which distribute payments evenly over the lease period. Balloon payments can reduce short-term cash flow burden but increase financial risk at lease maturity due to the sizable final payment. Standard payment leases offer predictable budgeting with consistent monthly costs, making them suitable for those seeking stability without large end-of-lease expenses.

Pros and Cons of Balloon Payments

Balloon payments in leases offer lower monthly installments compared to standard payments, making cash flow management easier for lessees. The downside includes a large lump sum due at the end of the lease term, which can pose financial strain or require refinancing. Balloon payments can be advantageous for businesses anticipating increased future revenue but risky if cash flow projections fall short.

Pros and Cons of Standard Payments

Standard payments offer predictable monthly installments, simplifying budgeting and cash flow management throughout the lease term. They eliminate large end-of-lease financial burdens, reducing the risk of unexpected expenses compared to balloon payment structures. However, standard payments generally result in higher monthly costs, which may limit short-term cash availability for businesses.

Impact on Monthly Cash Flow

Balloon payments in leases reduce monthly cash flow obligations by deferring a large portion of the principal payment to the lease term's end, resulting in lower periodic payments compared to standard payment structures. Standard payments evenly amortize the lease cost, creating consistent monthly expenses but higher regular cash outflows than balloon payment schedules. The choice between these payment types directly affects budgeting flexibility and liquidity management throughout the lease period.

Total Cost Comparison: Balloon vs Standard Lease

Balloon payment leases typically result in lower monthly payments but culminate in a substantial final payment, increasing the overall total cost compared to standard leases, where payments are spread evenly to cover the full vehicle value. Standard leases often offer higher monthly payments but eliminate a large lump-sum payoff, potentially reducing financial risk and total cost when the asset depreciates less than anticipated. Evaluating total lease cost requires factoring in interest rates, residual value, and potential fees, with balloon leases sometimes leading to higher overall expenses despite initial affordability.

Which Payment Option Suits Your Financial Goals?

Balloon payment leases offer lower monthly installments with a large lump-sum due at the end, ideal for individuals anticipating increased future income or planning to refinance. Standard payment leases distribute costs evenly across the lease term, providing predictable budgeting and reduced financial risk for those seeking stability. Choosing between these options depends on your cash flow preferences and long-term financial plans for asset ownership or turnover.

Tips for Choosing the Best Lease Payment Option

When selecting between balloon payment and standard payment leases, evaluate your cash flow flexibility and long-term financial goals to ensure the payment structure aligns with your budget. Balloon payments offer lower monthly installments with a large sum due at lease end, suitable for businesses expecting increased future income or asset resale. Standard payments provide consistent monthly costs and easier budgeting, ideal for steady cash flow management and avoiding large end-of-term expenses.

Balloon Payment vs Standard Payment Infographic

cardiffo.com

cardiffo.com