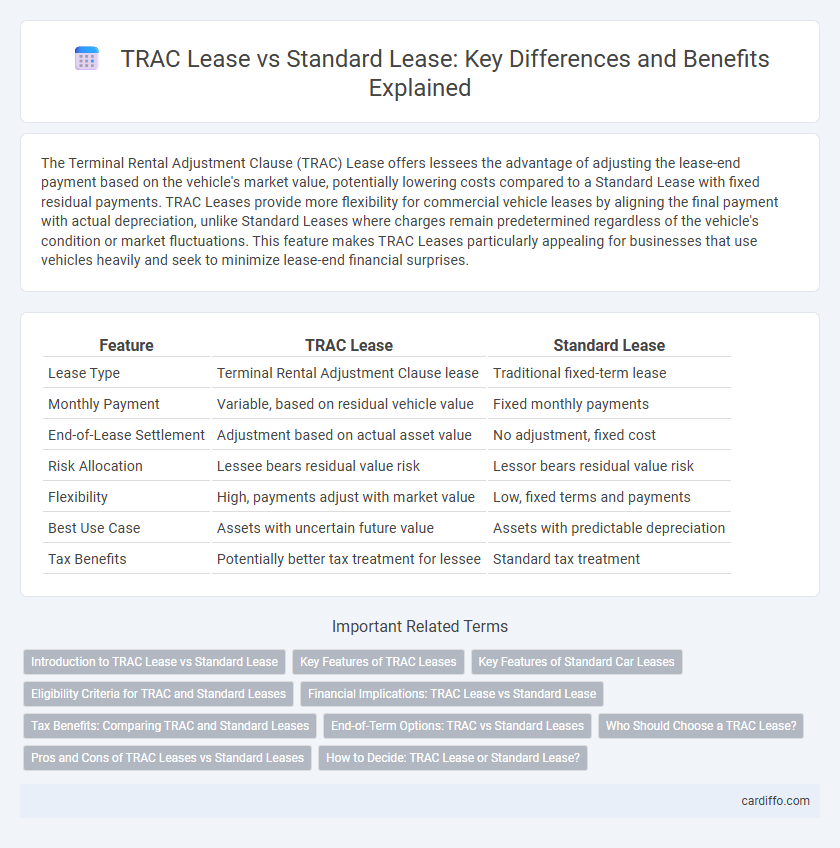

The Terminal Rental Adjustment Clause (TRAC) Lease offers lessees the advantage of adjusting the lease-end payment based on the vehicle's market value, potentially lowering costs compared to a Standard Lease with fixed residual payments. TRAC Leases provide more flexibility for commercial vehicle leases by aligning the final payment with actual depreciation, unlike Standard Leases where charges remain predetermined regardless of the vehicle's condition or market fluctuations. This feature makes TRAC Leases particularly appealing for businesses that use vehicles heavily and seek to minimize lease-end financial surprises.

Table of Comparison

| Feature | TRAC Lease | Standard Lease |

|---|---|---|

| Lease Type | Terminal Rental Adjustment Clause lease | Traditional fixed-term lease |

| Monthly Payment | Variable, based on residual vehicle value | Fixed monthly payments |

| End-of-Lease Settlement | Adjustment based on actual asset value | No adjustment, fixed cost |

| Risk Allocation | Lessee bears residual value risk | Lessor bears residual value risk |

| Flexibility | High, payments adjust with market value | Low, fixed terms and payments |

| Best Use Case | Assets with uncertain future value | Assets with predictable depreciation |

| Tax Benefits | Potentially better tax treatment for lessee | Standard tax treatment |

Introduction to TRAC Lease vs Standard Lease

A Terminal Rental Adjustment Clause (TRAC) lease differs from a standard lease by incorporating a provision that adjusts the final lease payment based on the residual value of the vehicle at lease-end. TRAC leases allow lessees to reduce or increase their last payment depending on the vehicle's market value, offering more flexibility compared to the fixed payments of standard leases. This structure can result in potential cost savings or additional expenses, making TRAC leases particularly advantageous for commercial vehicle leasing where asset depreciation can vary.

Key Features of TRAC Leases

TRAC leases include a Terminal Rental Adjustment Clause allowing lessees to adjust the final lease payment based on the asset's residual value, which can reduce end-of-lease costs. Unlike standard leases, TRAC leases offer flexibility in lease-end options, permitting purchase, return, or renewal with financial adjustments tied to market conditions. These leases are especially beneficial for equipment with variable resale values, optimizing cost-efficiency and risk management.

Key Features of Standard Car Leases

Standard car leases typically include fixed monthly payments based on the vehicle's expected depreciation and residual value, without adjustments tied to market conditions at lease end. These leases often have mileage limits and penalties for excess wear or use, ensuring predictable costs for lessees. Unlike Terminal Rental Adjustment Clause (TRAC) leases, standard leases do not offer the option to purchase the vehicle at a pre-agreed adjusted price or benefit from residual value adjustments.

Eligibility Criteria for TRAC and Standard Leases

The Terminal Rental Adjustment Clause (TRAC) Lease typically requires the lessee to be an individual or entity eligible under specific IRS regulations, often related to the use of the leased asset for business purposes and compliance with mileage or usage limits. In contrast, Standard Leases have broader eligibility criteria, allowing various types of lessees, including individuals and businesses, with fewer restrictions on asset usage. TRAC eligibility emphasizes strict adherence to terms that avoid excess wear or usage penalties, while Standard Leases offer flexible use without mandatory adjustments at lease-end.

Financial Implications: TRAC Lease vs Standard Lease

The Terminal Rental Adjustment Clause (TRAC) lease offers significant financial advantages over a standard lease by allowing residual value adjustments at lease-end, potentially lowering overall lease payments. In contrast, standard leases fix rental amounts without residual value fluctuations, reducing flexibility but providing predictable expenses. TRAC leases can improve cash flow management and tax benefits by aligning lease costs more closely with actual asset depreciation.

Tax Benefits: Comparing TRAC and Standard Leases

TRAC leases offer significant tax benefits by allowing lessees to deduct monthly rental payments as business expenses, reducing taxable income more effectively than standard leases. Unlike standard leases, TRAC leases often provide options to purchase or return the asset at lease-end with predictable residual values, influencing depreciation and tax treatment. The flexibility in structuring TRAC leases enhances cash flow management and potential tax savings compared to conventional leasing agreements.

End-of-Term Options: TRAC vs Standard Leases

Terminal Rental Adjustment Clause (TRAC) leases offer flexible end-of-term options, allowing lessees to return the equipment, purchase it at a fair market value, or extend the lease, optimizing financial outcomes. Standard leases typically require the lessee to purchase the asset at a predetermined price or return it without equity benefits, limiting flexibility. TRAC leases are preferred for equipment with unpredictable residual values, providing lessees with risk mitigation and potential cost savings at lease termination.

Who Should Choose a TRAC Lease?

Businesses expecting variable equipment usage and fluctuating residual values should consider a TRAC Lease for flexibility in managing lease-end obligations. Asset-intensive companies, such as transportation and construction firms, benefit from potential tax advantages and the ability to adjust payments based on the asset's market value. Standard leases may suit organizations seeking fixed costs and straightforward budgeting without end-of-lease financial risks.

Pros and Cons of TRAC Leases vs Standard Leases

TRAC leases allow lessees to benefit from vehicle depreciation adjustments upon lease termination, often resulting in lower monthly payments compared to standard leases. However, the potential for additional costs exists if the lessee's liability exceeds the residual value in a TRAC lease, unlike standard leases with fixed payments and predictable end-of-lease obligations. These differences make TRAC leases advantageous for businesses looking to maximize tax benefits and flexibility, while standard leases offer simplicity and financial certainty.

How to Decide: TRAC Lease or Standard Lease?

Choosing between a Terminal Rental Adjustment Clause (TRAC) lease and a standard lease depends on factors such as asset usage, financial goals, and risk tolerance. TRAC leases offer flexibility by allowing adjustment of lease-end payments based on the asset's residual value, benefiting lessees expecting high residual value or usage variance. Standard leases provide predictable costs without end-of-lease adjustments, ideal for businesses prioritizing fixed expenses and straightforward budgeting.

Terminal Rental Adjustment Clause (TRAC) Lease vs Standard Lease Infographic

cardiffo.com

cardiffo.com