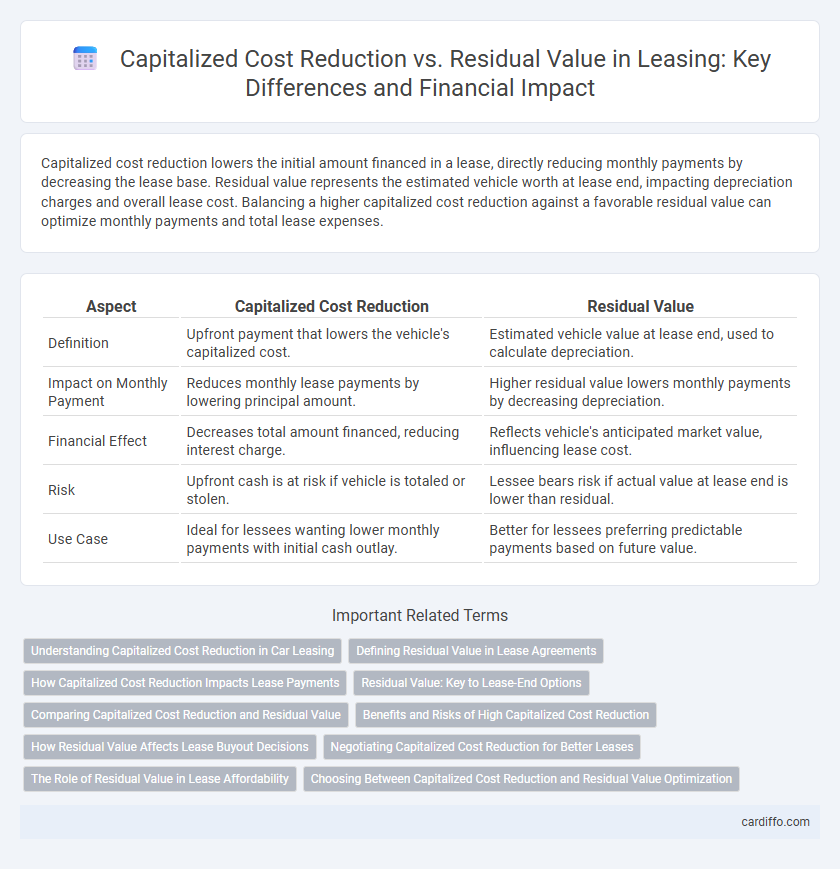

Capitalized cost reduction lowers the initial amount financed in a lease, directly reducing monthly payments by decreasing the lease base. Residual value represents the estimated vehicle worth at lease end, impacting depreciation charges and overall lease cost. Balancing a higher capitalized cost reduction against a favorable residual value can optimize monthly payments and total lease expenses.

Table of Comparison

| Aspect | Capitalized Cost Reduction | Residual Value |

|---|---|---|

| Definition | Upfront payment that lowers the vehicle's capitalized cost. | Estimated vehicle value at lease end, used to calculate depreciation. |

| Impact on Monthly Payment | Reduces monthly lease payments by lowering principal amount. | Higher residual value lowers monthly payments by decreasing depreciation. |

| Financial Effect | Decreases total amount financed, reducing interest charge. | Reflects vehicle's anticipated market value, influencing lease cost. |

| Risk | Upfront cash is at risk if vehicle is totaled or stolen. | Lessee bears risk if actual value at lease end is lower than residual. |

| Use Case | Ideal for lessees wanting lower monthly payments with initial cash outlay. | Better for lessees preferring predictable payments based on future value. |

Understanding Capitalized Cost Reduction in Car Leasing

Capitalized cost reduction in car leasing refers to the upfront payment made to lower the vehicle's capitalized cost, effectively reducing the monthly lease payments. This reduction differs from residual value, which is the estimated worth of the vehicle at the end of the lease term. Understanding how capitalized cost reduction impacts the total lease cost helps lessees make informed decisions about initial outlays and long-term financial commitments.

Defining Residual Value in Lease Agreements

Residual value in lease agreements refers to the estimated worth of a leased asset at the end of the lease term, which plays a crucial role in determining lease payments and overall cost. It is a key factor influencing the depreciation expense and impacts the capitalized cost reduction, which is the upfront payment applied to lower the lease amount. Accurately defining residual value helps lessees manage financial obligations by aligning the asset's anticipated future value with lease costs.

How Capitalized Cost Reduction Impacts Lease Payments

Capitalized cost reduction lowers the total amount financed in a lease, directly decreasing monthly lease payments by reducing the depreciated value of the vehicle. Unlike residual value, which represents the estimated worth of the vehicle at lease end and influences the lease's residual risk, the capitalized cost reduction is an upfront payment that decreases the lease principal. A higher capitalized cost reduction results in smaller monthly payments because the lease is based on the difference between the adjusted capitalized cost and the residual value.

Residual Value: Key to Lease-End Options

Residual value is the estimated worth of a leased asset at the end of the lease term, serving as a critical factor in determining lease payments and buyout options. A higher residual value lowers monthly lease costs and increases equity potential if the lessee opts to purchase the asset at lease-end. Understanding residual value enables lessees to make informed decisions about purchase, return, or lease extension options, optimizing financial outcomes.

Comparing Capitalized Cost Reduction and Residual Value

Capitalized cost reduction lowers the lease's starting value, directly decreasing monthly payments by reducing the amount financed. Residual value represents the estimated vehicle worth at lease end, influencing depreciation charges and total lease cost. Comparing these, capitalized cost reduction impacts initial lease calculations, while residual value affects the lease's overall financial outcome and potential buyout price.

Benefits and Risks of High Capitalized Cost Reduction

High capitalized cost reduction lowers monthly lease payments by decreasing the financed amount, enhancing affordability and cash flow management. However, a substantial upfront payment increases financial risk if the vehicle is totaled or stolen early in the lease term, potentially leading to unrecovered losses. Conversely, maintaining a higher residual value can preserve equity at lease-end but may result in higher monthly payments, impacting short-term budget flexibility.

How Residual Value Affects Lease Buyout Decisions

Residual value significantly impacts lease buyout decisions by determining the predetermined price to purchase the asset at lease end, influencing the overall cost-effectiveness of the buyout. A higher residual value often results in higher lease payments but lowers the buyout cost, while a lower residual value reduces monthly payments but increases the buyout price. Understanding residual value allows lessees to strategically evaluate whether purchasing the asset or returning it is more financially advantageous.

Negotiating Capitalized Cost Reduction for Better Leases

Negotiating a higher capitalized cost reduction directly lowers the amount financed in a lease, reducing monthly payments and overall lease expense. This upfront negotiation impacts the vehicle's adjusted capitalized cost, enhancing affordability without affecting the residual value predetermined by the leasing company. Understanding the balance between capitalized cost reduction and residual value empowers lessees to secure more favorable lease terms and maximize savings.

The Role of Residual Value in Lease Affordability

Residual value significantly influences lease affordability by determining the vehicle's estimated worth at lease-end, which directly impacts monthly payments. A higher residual value reduces depreciation costs, leading to lower capitalized cost reduction requirements and more manageable lease payments. Understanding the balance between capitalized cost reduction and residual value helps lessees optimize upfront costs while securing affordable lease terms.

Choosing Between Capitalized Cost Reduction and Residual Value Optimization

Choosing between capitalized cost reduction and residual value optimization depends on budgeting priorities and total lease cost management. Capitalized cost reduction lowers monthly payments upfront by reducing the vehicle's depreciated amount, while residual value optimization impacts the lease-end buyout price and overall lease term cost. Evaluating factors like expected mileage, lease duration, and vehicle depreciation trends helps determine the more cost-effective strategy for minimizing total lease expenses.

Capitalized Cost Reduction vs Residual Value Infographic

cardiffo.com

cardiffo.com