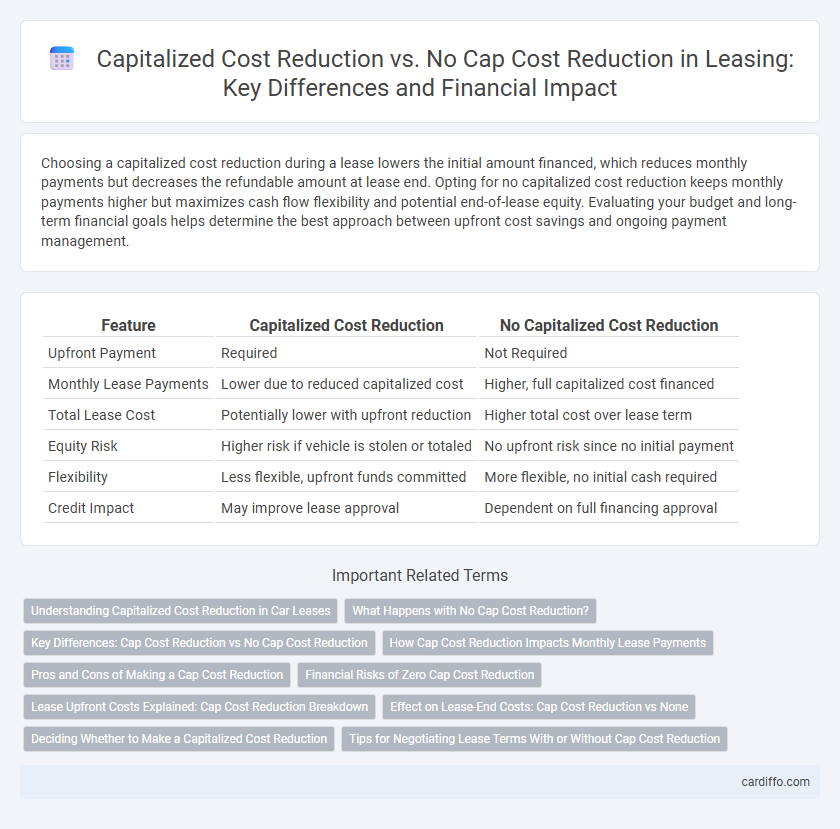

Choosing a capitalized cost reduction during a lease lowers the initial amount financed, which reduces monthly payments but decreases the refundable amount at lease end. Opting for no capitalized cost reduction keeps monthly payments higher but maximizes cash flow flexibility and potential end-of-lease equity. Evaluating your budget and long-term financial goals helps determine the best approach between upfront cost savings and ongoing payment management.

Table of Comparison

| Feature | Capitalized Cost Reduction | No Capitalized Cost Reduction |

|---|---|---|

| Upfront Payment | Required | Not Required |

| Monthly Lease Payments | Lower due to reduced capitalized cost | Higher, full capitalized cost financed |

| Total Lease Cost | Potentially lower with upfront reduction | Higher total cost over lease term |

| Equity Risk | Higher risk if vehicle is stolen or totaled | No upfront risk since no initial payment |

| Flexibility | Less flexible, upfront funds committed | More flexible, no initial cash required |

| Credit Impact | May improve lease approval | Dependent on full financing approval |

Understanding Capitalized Cost Reduction in Car Leases

Capitalized Cost Reduction in car leases directly lowers the vehicle's negotiated price, reducing the total lease amount and monthly payments. Opting for no Capitalized Cost Reduction means higher monthly payments, as the full lease amount is financed without upfront cost reduction. Understanding this key difference helps lessees manage cash flow and overall lease affordability effectively.

What Happens with No Cap Cost Reduction?

With no capitalized cost reduction in a lease agreement, the entire negotiated price of the vehicle is used as the basis for calculating monthly lease payments, resulting in higher monthly costs. This absence of an upfront payment means the lessee finances the full vehicle price plus taxes and fees over the lease term. Consequently, the total lease cost increases, making the monthly payments less affordable compared to a lease with a cap cost reduction.

Key Differences: Cap Cost Reduction vs No Cap Cost Reduction

Capitalized Cost Reduction (Cap Cost Reduction) lowers the vehicle's capitalized cost, directly reducing monthly lease payments and overall lease expenses. Without Cap Cost Reduction, monthly payments are higher since the full negotiated price is financed through the lease term. Key differences include immediate payment impact and total lease cost savings, with Cap Cost Reduction providing upfront financial leverage compared to no reduction.

How Cap Cost Reduction Impacts Monthly Lease Payments

Capitalized cost reduction lowers the vehicle's principal lease amount, directly decreasing monthly lease payments by spreading a smaller balance over the lease term. Without a cap cost reduction, the full negotiated price is financed, resulting in higher monthly payments since interest and depreciation apply to the entire amount. Leasing with a cap cost reduction reduces monthly financial obligations but requires upfront cash, affecting overall cash flow and lease affordability.

Pros and Cons of Making a Cap Cost Reduction

Making a capitalized cost reduction in a lease lowers the monthly payments by reducing the total amount financed, which can improve cash flow and decrease interest paid over the lease term. However, this upfront payment is non-refundable and increases initial out-of-pocket expenses, limiting liquidity. Opting for no capitalized cost reduction preserves cash for other uses but results in higher monthly lease payments and total lease costs due to financing the entire capitalized cost.

Financial Risks of Zero Cap Cost Reduction

Opting for zero capitalized cost reduction in a lease increases the monthly payments and overall financial exposure, as the entire lease amount remains financed without upfront equity to offset depreciation risks. This approach elevates the lessee's vulnerability to negative equity if the asset's residual value declines below projections, potentially resulting in higher costs at lease-end. Without an initial capitalized cost reduction, lessees face greater risk of payment shock and increased interest expenses, reducing financial flexibility during the lease term.

Lease Upfront Costs Explained: Cap Cost Reduction Breakdown

Capitalized cost reduction in a lease directly lowers the vehicle's capitalized cost, reducing monthly lease payments by decreasing the amount financed. Without a cap cost reduction, upfront costs typically include acquisition fees, taxes, and the first month's payment, resulting in higher monthly payments throughout the lease term. Understanding the breakdown of capitalized cost reductions helps lessees manage upfront expenses effectively and optimize overall lease costs.

Effect on Lease-End Costs: Cap Cost Reduction vs None

Capitalized cost reduction lowers the initial lease amount, resulting in lower monthly payments but often increases the lease-end purchase price due to reduced depreciation allocation. Choosing no capitalized cost reduction keeps monthly payments higher but can decrease the residual value balance owed at lease-end, potentially lowering buyout costs. Understanding these trade-offs helps lessees manage total lease-end expenses effectively.

Deciding Whether to Make a Capitalized Cost Reduction

Making a capitalized cost reduction lowers the total amount financed on a lease, resulting in reduced monthly payments and less interest over the lease term. However, opting against a capitalized cost reduction preserves upfront cash flow and may offer greater flexibility for unexpected expenses or investment opportunities. Carefully evaluating monthly budget constraints and overall lease cost-effectiveness helps determine whether applying a capitalized cost reduction aligns with financial goals.

Tips for Negotiating Lease Terms With or Without Cap Cost Reduction

When negotiating lease terms, understanding the impact of Capitalized Cost Reduction (Cap Cost Reduction) is crucial for optimizing monthly payments and overall lease value. Without a Cap Cost Reduction, focusing on negotiating factors such as the money factor, residual value, and allowable mileage can help secure favorable lease conditions. Carefully assessing trade-in values and incentives before deciding on Cap Cost Reduction ensures better financial outcomes in lease agreements.

Capitalized Cost Reduction vs No Cap Cost Reduction Infographic

cardiffo.com

cardiffo.com