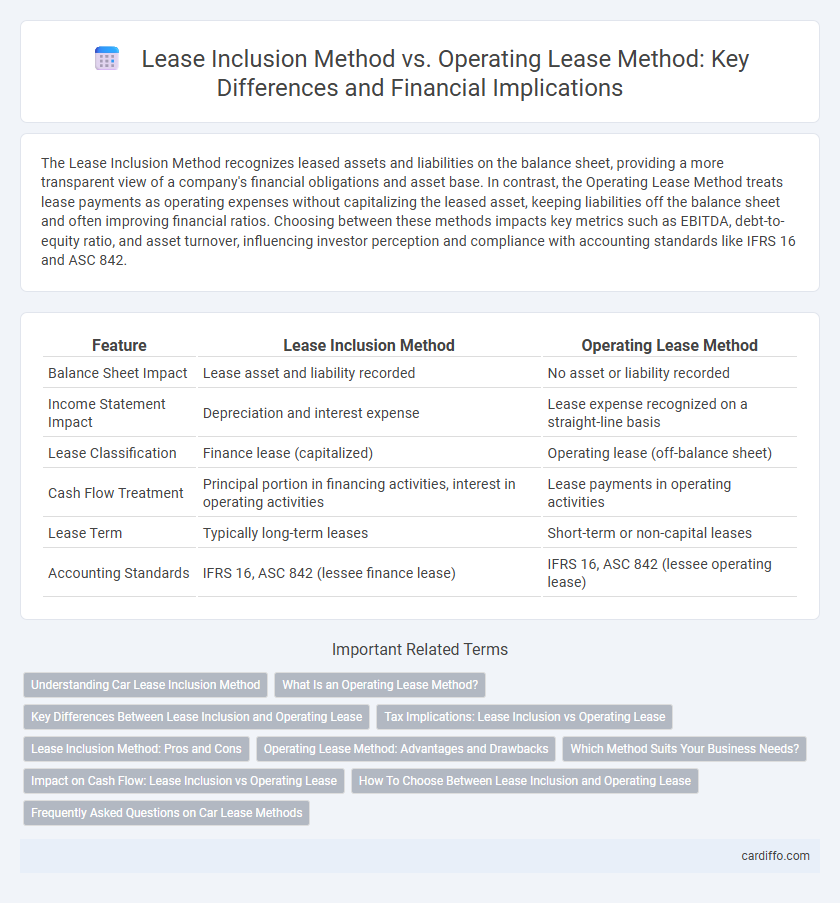

The Lease Inclusion Method recognizes leased assets and liabilities on the balance sheet, providing a more transparent view of a company's financial obligations and asset base. In contrast, the Operating Lease Method treats lease payments as operating expenses without capitalizing the leased asset, keeping liabilities off the balance sheet and often improving financial ratios. Choosing between these methods impacts key metrics such as EBITDA, debt-to-equity ratio, and asset turnover, influencing investor perception and compliance with accounting standards like IFRS 16 and ASC 842.

Table of Comparison

| Feature | Lease Inclusion Method | Operating Lease Method |

|---|---|---|

| Balance Sheet Impact | Lease asset and liability recorded | No asset or liability recorded |

| Income Statement Impact | Depreciation and interest expense | Lease expense recognized on a straight-line basis |

| Lease Classification | Finance lease (capitalized) | Operating lease (off-balance sheet) |

| Cash Flow Treatment | Principal portion in financing activities, interest in operating activities | Lease payments in operating activities |

| Lease Term | Typically long-term leases | Short-term or non-capital leases |

| Accounting Standards | IFRS 16, ASC 842 (lessee finance lease) | IFRS 16, ASC 842 (lessee operating lease) |

Understanding Car Lease Inclusion Method

The Car Lease Inclusion Method records the leased vehicle as an asset on the lessee's balance sheet, recognizing both the right-of-use asset and the lease liability, aligning with IFRS 16 and ASC 842 standards. This method captures depreciation expense and interest on the lease liability, providing a more accurate reflection of financial obligations compared to the Operating Lease Method, which treats lease payments as operating expenses. Understanding this inclusion method is essential for transparent financial reporting and compliance with contemporary lease accounting regulations.

What Is an Operating Lease Method?

The operating lease method classifies a lease as an off-balance-sheet financing arrangement, where lease payments are treated as rental expenses without recognizing the leased asset or liability on the lessee's balance sheet. Under this method, lease expenses are recorded on the income statement over the lease term, reflecting usage without asset capitalization. Operating leases commonly apply to short-term or low-value asset leases, enabling companies to avoid asset depreciation and interest expense recognition.

Key Differences Between Lease Inclusion and Operating Lease

The Lease Inclusion Method, often referred to as capital lease accounting, requires lessees to recognize leased assets and liabilities on the balance sheet, reflecting the asset's value and associated debt. In contrast, the Operating Lease Method treats lease payments as operating expenses, leaving the leased asset and obligations off the balance sheet, thus not affecting asset or liability totals. This fundamental difference impacts financial ratios, with lease inclusion increasing leverage and asset turnover metrics, while operating leases maintain a cleaner balance sheet appearance.

Tax Implications: Lease Inclusion vs Operating Lease

Lease Inclusion Method requires lessees to capitalize lease assets and liabilities on the balance sheet, impacting taxable income through depreciation and interest expense deductions. Operating Lease Method treats lease payments as operating expenses, reducing taxable income evenly over the lease term without asset capitalization. Tax implications vary as the inclusion method may lead to higher initial deductions, while the operating lease method offers consistent expense recognition.

Lease Inclusion Method: Pros and Cons

The Lease Inclusion Method records leased assets and liabilities on the balance sheet, enhancing transparency and providing a more accurate representation of a company's financial obligations. This method improves debt-to-equity ratio analysis but may result in higher reported liabilities, potentially impacting borrowing capacity and investor perception. However, it involves complex accounting requirements and increased administrative effort compared to the Operating Lease Method.

Operating Lease Method: Advantages and Drawbacks

The Operating Lease Method offers advantages such as keeping liabilities off the balance sheet, which enhances financial ratios and provides greater flexibility in asset management. This method reduces the impact on debt covenants and preserves borrowing capacity, making it attractive for short-term or low-value asset leases. However, drawbacks include potentially higher overall lease expenses and less control over the leased asset, along with challenges in accurately reflecting the company's long-term financial obligations.

Which Method Suits Your Business Needs?

Choosing between the Lease Inclusion Method and the Operating Lease Method depends on your business's financial reporting goals and asset management priorities. The Lease Inclusion Method capitalizes assets and liabilities on the balance sheet, providing a clearer picture of long-term obligations, while the Operating Lease Method keeps leases off-balance-sheet, preserving financial ratios and flexibility. Businesses with a focus on transparency and asset leverage often prefer the Lease Inclusion Method, whereas those prioritizing operational flexibility and weaker balance sheet impact may lean towards the Operating Lease Method.

Impact on Cash Flow: Lease Inclusion vs Operating Lease

The Lease Inclusion Method capitalizes lease obligations on the balance sheet, affecting cash flow by increasing reported liabilities and impacting debt covenants, while the Operating Lease Method records lease expenses as operating costs without recognizing liabilities, thereby preserving off-balance-sheet financing and maintaining higher reported cash flow from operations. Cash flow under the Lease Inclusion Method reflects principal and interest payments separately in financing and operating activities, whereas the Operating Lease Method typically records lease payments entirely within operating cash flows, leading to differences in cash flow presentation and analysis. Understanding these distinctions is crucial for accurate financial modeling and cash flow forecasting in lease accounting.

How To Choose Between Lease Inclusion and Operating Lease

Choosing between Lease Inclusion Method and Operating Lease Method depends on the lease term length and control over the asset. Lease Inclusion, also known as Capital Lease, is appropriate when the lease transfers ownership by the end of the term or includes a bargain purchase option, meeting criteria under ASC 842 or IFRS 16 standards. Operating Lease applies when the lessee does not obtain ownership rights or control, allowing lease payments to be treated as operating expenses without asset capitalization.

Frequently Asked Questions on Car Lease Methods

The Lease Inclusion Method records leased vehicles as assets and liabilities on the balance sheet, providing a clearer representation of financial obligations compared to the Operating Lease Method, which treats leases as off-balance-sheet expenses. Frequently asked questions about car lease methods often address the impact on financial ratios, tax implications, and the differences in lease classification under accounting standards such as IFRS 16 or ASC 842. Understanding these distinctions helps lessees and lessors accurately report lease transactions, ensuring compliance and informed financial decision-making.

Lease Inclusion Method vs Operating Lease Method Infographic

cardiffo.com

cardiffo.com