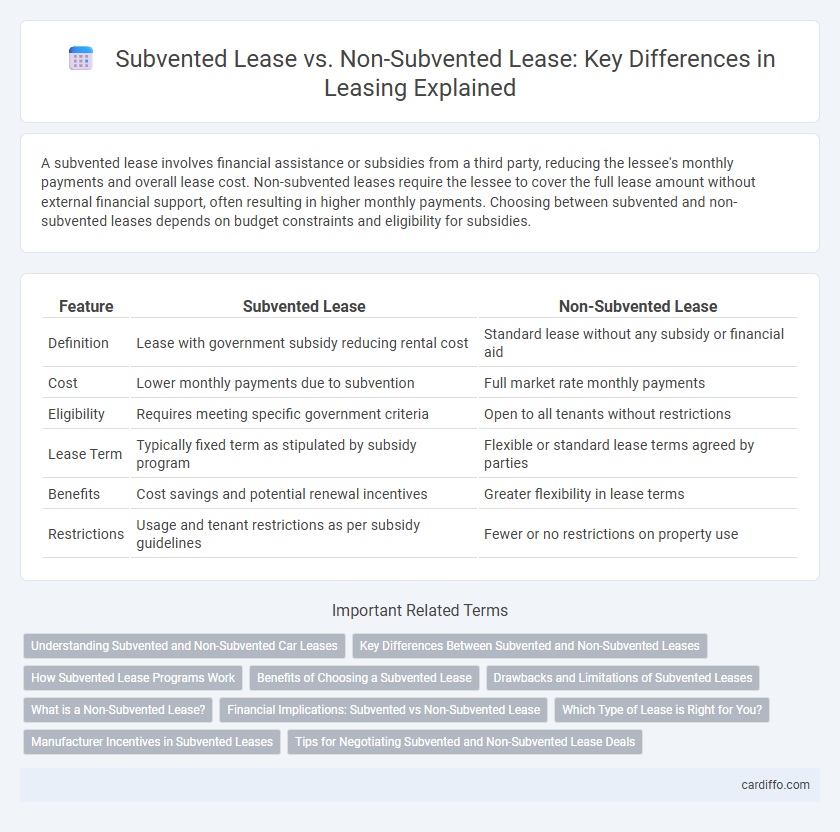

A subvented lease involves financial assistance or subsidies from a third party, reducing the lessee's monthly payments and overall lease cost. Non-subvented leases require the lessee to cover the full lease amount without external financial support, often resulting in higher monthly payments. Choosing between subvented and non-subvented leases depends on budget constraints and eligibility for subsidies.

Table of Comparison

| Feature | Subvented Lease | Non-Subvented Lease |

|---|---|---|

| Definition | Lease with government subsidy reducing rental cost | Standard lease without any subsidy or financial aid |

| Cost | Lower monthly payments due to subvention | Full market rate monthly payments |

| Eligibility | Requires meeting specific government criteria | Open to all tenants without restrictions |

| Lease Term | Typically fixed term as stipulated by subsidy program | Flexible or standard lease terms agreed by parties |

| Benefits | Cost savings and potential renewal incentives | Greater flexibility in lease terms |

| Restrictions | Usage and tenant restrictions as per subsidy guidelines | Fewer or no restrictions on property use |

Understanding Subvented and Non-Subvented Car Leases

Subvented car leases involve manufacturer-subsidized interest rates or monthly payments, reducing the overall leasing cost for consumers and offering better financial incentives. Non-subvented leases lack these subsidies, resulting in higher interest rates and monthly payments that reflect the full market cost of the vehicle. Understanding the difference between subvented and non-subvented leases helps consumers make informed decisions based on price sensitivity and lease term preferences.

Key Differences Between Subvented and Non-Subvented Leases

Subvented leases involve financial incentives or subsidies from manufacturers or dealers, reducing monthly payments and overall lease costs compared to non-subvented leases. Non-subvented leases require lessees to bear the full cost without any off-setting rebates, often resulting in higher monthly fees and down payments. The key differences lie in cost structure, with subvented leases offering lower payments through manufacturer contributions and non-subvented leases reflecting true market lease rates without discounts.

How Subvented Lease Programs Work

Subvented lease programs operate by having a third party, often a manufacturer or government agency, subsidize part of the lease payments to reduce the cost for the lessee. These programs typically cover a portion of the interest or principal, making the lease more affordable than a non-subvented lease, where no external financial support exists. The subsidy lowers monthly payments and can improve lease terms, attracting customers to lease vehicles, equipment, or property through favorable financing conditions.

Benefits of Choosing a Subvented Lease

Subvented leases offer significant financial advantages through manufacturer or dealer subsidies that reduce monthly payments and overall leasing costs. These incentives can include lower interest rates, cash rebates, and enhanced warranty coverage, providing lessees with better affordability and peace of mind. Compared to non-subvented leases, subvented leases often feature more favorable terms, making them a cost-effective choice for customers seeking high-value vehicle leasing options.

Drawbacks and Limitations of Subvented Leases

Subvented leases often come with restrictions such as limited flexibility in lease terms and mandatory adherence to specific usage guidelines, which can hinder tenant customization. These leases may also impose higher administrative oversight and reduce negotiation power for lessees compared to non-subvented leases. Furthermore, the financial benefits are offset by potential hidden costs and rigid eligibility criteria that restrict accessibility for certain businesses.

What is a Non-Subvented Lease?

A Non-Subvented Lease is a leasing agreement where the lessee assumes full responsibility for all costs without any financial incentives, rebates, or subsidies from the lessor or third parties. Unlike subvented leases, which offer reduced payments or special financing rates often sponsored by manufacturers or government programs, non-subvented leases require market-rate payments reflecting the fair market value of the asset. This lease type is common in commercial leasing where no promotional or financial assistance influences the lease terms.

Financial Implications: Subvented vs Non-Subvented Lease

Subvented leases reduce financial burdens by incorporating government or third-party subsidies, which lower monthly payments and overall leasing costs. Non-subvented leases require lessees to bear the full payment amounts without financial assistance, often resulting in higher expenses and less favorable cash flow. Choosing between subvented and non-subvented leases directly impacts budget planning, tax benefits, and total cost of ownership in leasing agreements.

Which Type of Lease is Right for You?

Choosing between a subvented lease and a non-subvented lease depends on your financial goals and budget flexibility. Subvented leases offer lower monthly payments through manufacturer incentives, making them ideal for cost-conscious lessees seeking short-term affordability. Non-subvented leases provide more negotiation freedom and potentially lower upfront costs, suitable for those prioritizing customizable terms over initial savings.

Manufacturer Incentives in Subvented Leases

Subvented leases leverage manufacturer incentives to lower monthly payments and reduce overall lease costs, making them more attractive to consumers compared to non-subvented leases. These incentives often include rebates, special financing rates, or guaranteed residual values directly supported by the manufacturer. Non-subvented leases lack such manufacturer support, leading to higher payments and less favorable lease terms.

Tips for Negotiating Subvented and Non-Subvented Lease Deals

When negotiating subvented leases, emphasize understanding the manufacturer's incentives and leverage these to secure lower monthly payments or favorable terms. For non-subvented leases, focus on evaluating the residual value and money factor carefully to avoid hidden costs and ensure competitive rates. Always request a detailed breakdown of fees and negotiate terms like mileage limits and wear-and-tear packages to optimize the lease agreement effectively.

Subvented Lease vs Non-Subvented Lease Infographic

cardiffo.com

cardiffo.com