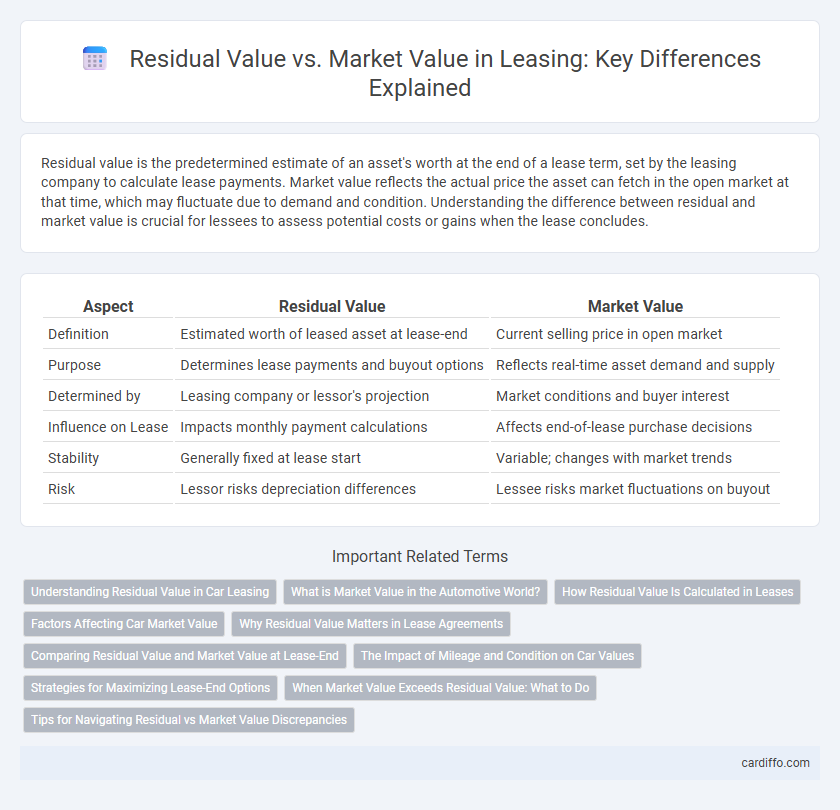

Residual value is the predetermined estimate of an asset's worth at the end of a lease term, set by the leasing company to calculate lease payments. Market value reflects the actual price the asset can fetch in the open market at that time, which may fluctuate due to demand and condition. Understanding the difference between residual and market value is crucial for lessees to assess potential costs or gains when the lease concludes.

Table of Comparison

| Aspect | Residual Value | Market Value |

|---|---|---|

| Definition | Estimated worth of leased asset at lease-end | Current selling price in open market |

| Purpose | Determines lease payments and buyout options | Reflects real-time asset demand and supply |

| Determined by | Leasing company or lessor's projection | Market conditions and buyer interest |

| Influence on Lease | Impacts monthly payment calculations | Affects end-of-lease purchase decisions |

| Stability | Generally fixed at lease start | Variable; changes with market trends |

| Risk | Lessor risks depreciation differences | Lessee risks market fluctuations on buyout |

Understanding Residual Value in Car Leasing

Residual value in car leasing represents the estimated worth of the vehicle at the end of the lease term, influencing monthly payments and overall cost efficiency. It is determined based on factors such as depreciation rates, vehicle make and model, and projected market demand. Understanding residual value helps lessees assess lease deals by comparing it with the vehicle's expected market value at lease-end, ensuring they avoid overpaying or unexpected costs.

What is Market Value in the Automotive World?

Market value in the automotive world represents the current price a vehicle can fetch on the open market, reflecting real-time supply and demand conditions. It is influenced by factors such as vehicle condition, mileage, age, and regional market trends. Understanding market value is crucial in lease agreements to assess potential equity or depreciation at lease end.

How Residual Value Is Calculated in Leases

Residual value in leases is calculated based on the estimated worth of the asset at the end of the lease term, factoring in depreciation, market trends, and historical data of similar assets. Leasing companies often use industry-specific depreciation rates and wholesale vehicle prices or asset appraisal reports to determine this value. Accurate residual value calculation ensures appropriate lease payments and protects both lessor and lessee from adverse financial outcomes.

Factors Affecting Car Market Value

Car market value is influenced by factors such as vehicle age, mileage, maintenance history, and overall condition. External elements like brand reputation, economic conditions, and demand for specific models also play critical roles. Seasonal trends and technological advancements further impact the resale or market value of leased vehicles.

Why Residual Value Matters in Lease Agreements

Residual value represents the estimated worth of a leased asset at the end of the lease term and directly impacts monthly lease payments by determining depreciation costs. Accurately forecasting residual value helps lessees avoid unexpected charges or losses when returning the asset, aligning lease costs with asset usage. Market value fluctuates with demand and condition, but residual value remains a contractual benchmark critical for fair lease pricing and risk management.

Comparing Residual Value and Market Value at Lease-End

Residual value represents the estimated worth of a leased asset at lease-end based on anticipated depreciation and usage, while market value reflects the actual price the asset can fetch in the open market at that time. Comparing residual value and market value at lease-end helps determine potential lease buyout costs or excess wear charges, influencing lessee financial decisions. Discrepancies between these values can affect lease pricing, return conditions, and the lessor's risk exposure.

The Impact of Mileage and Condition on Car Values

Residual value represents the estimated worth of a leased vehicle at the end of the lease term, influenced heavily by mileage and condition, which directly affect depreciation rates. Market value fluctuates based on current supply and demand but is similarly impacted by excessive miles and poor vehicle condition, often resulting in lower resale prices. Accurate assessment of mileage and wear helps align residual value expectations with realistic market outcomes, minimizing financial discrepancies for lessees and lessors.

Strategies for Maximizing Lease-End Options

Maximizing lease-end options requires carefully balancing residual value and market value to optimize financial outcomes. Negotiating a higher residual value reduces monthly payments and increases purchase options, while continuously monitoring market value ensures informed decisions about buyout or vehicle return. Leveraging market trend analysis and timing the lease-end strategically enables lessees to capitalize on favorable market conditions, minimizing costs and maximizing asset value.

When Market Value Exceeds Residual Value: What to Do

When market value exceeds residual value in a lease agreement, lessees often benefit by purchasing the asset at the lower residual value and potentially reselling it for a profit. Leasing companies may also offer lease-end options or early buyouts to capitalize on the asset's higher market value. Understanding the disparity between residual and market values allows both lessees and lessors to make informed decisions about asset disposition and financial outcomes.

Tips for Navigating Residual vs Market Value Discrepancies

When navigating residual value versus market value discrepancies in a lease, closely monitor depreciation trends and regional market conditions to anticipate potential gaps. Regularly compare the residual value set by the leasing company with real-time market valuations from trusted automotive sources. Consider negotiating lease-end options based on updated market data to minimize financial surprises and maximize lease benefits.

Residual Value vs Market Value Infographic

cardiffo.com

cardiffo.com