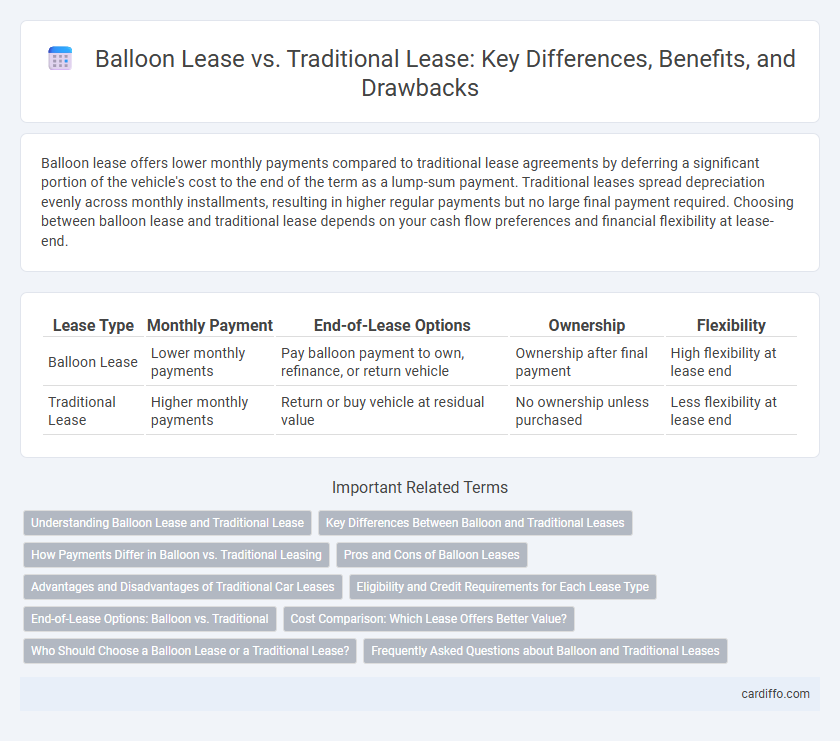

Balloon lease offers lower monthly payments compared to traditional lease agreements by deferring a significant portion of the vehicle's cost to the end of the term as a lump-sum payment. Traditional leases spread depreciation evenly across monthly installments, resulting in higher regular payments but no large final payment required. Choosing between balloon lease and traditional lease depends on your cash flow preferences and financial flexibility at lease-end.

Table of Comparison

| Lease Type | Monthly Payment | End-of-Lease Options | Ownership | Flexibility |

|---|---|---|---|---|

| Balloon Lease | Lower monthly payments | Pay balloon payment to own, refinance, or return vehicle | Ownership after final payment | High flexibility at lease end |

| Traditional Lease | Higher monthly payments | Return or buy vehicle at residual value | No ownership unless purchased | Less flexibility at lease end |

Understanding Balloon Lease and Traditional Lease

A Balloon Lease requires lower monthly payments with a larger final payment, making it ideal for those expecting a future cash influx. In contrast, a Traditional Lease spreads payments evenly over the lease term, providing predictable monthly costs without a large end balance. Understanding these differences helps lessees choose based on cash flow preferences and financial planning.

Key Differences Between Balloon and Traditional Leases

Balloon leases require a large final payment at the end of the lease term, while traditional leases spread out payments evenly throughout the duration. Balloon leases typically offer lower monthly payments but result in a significant lump sum due at lease-end, affecting budgeting and cash flow. Traditional leases provide predictable expenses with smaller, consistent payments and often include purchase options without a substantial final balloon amount.

How Payments Differ in Balloon vs. Traditional Leasing

Balloon leases feature lower monthly payments throughout the term, culminating in a large final "balloon" payment, whereas traditional leases maintain consistent, higher monthly payments without a lump sum at the end. This structure allows lessees in balloon leases to benefit from reduced cash flow during the lease but requires preparation for the significant end-of-term payment. Traditional leases spread the total cost evenly, providing predictable financial planning without unexpected final expenses.

Pros and Cons of Balloon Leases

Balloon leases offer lower monthly payments compared to traditional leases, improving cash flow for businesses or individuals during the lease term. However, they require a large final payment, often referred to as the "balloon payment," which can create financial strain if not planned for properly. Balloon leases provide flexibility but pose higher risk due to the substantial end-of-term lump sum, contrasting with the fixed, predictable payments of traditional leases.

Advantages and Disadvantages of Traditional Car Leases

Traditional car leases offer lower monthly payments compared to purchasing, fixed depreciation costs, and the convenience of driving a new vehicle every few years without long-term commitment. However, they require strict adherence to mileage limits, often have higher overall costs due to fees and penalties, and offer no ownership equity at lease end. This structure benefits drivers seeking short-term use but may disadvantage those with high mileage or a preference for vehicle ownership.

Eligibility and Credit Requirements for Each Lease Type

Balloon leases typically require higher credit scores and a stable income to qualify, as lenders assess the borrower's ability to make larger balloon payments at the lease end. Traditional leases generally have more lenient credit requirements, focusing on consistent monthly payments rather than a significant final lump sum. Eligibility for balloon leases may also include stricter debt-to-income ratios and more comprehensive financial documentation compared to traditional leases.

End-of-Lease Options: Balloon vs. Traditional

Balloon leases typically require a large lump sum payment at the end of the term, allowing lower monthly installments but necessitating careful financial planning for the balloon payment. Traditional leases offer fixed monthly payments throughout the lease duration, with options to return the vehicle, purchase at residual value, or extend the lease without a substantial final payment. End-of-lease options in balloon leases often focus on refinancing or paying off the balloon amount, whereas traditional leases prioritize straightforward lease termination or purchase decisions.

Cost Comparison: Which Lease Offers Better Value?

Balloon leases typically feature lower monthly payments than traditional leases, making them attractive for budget-conscious lessees seeking short-term affordability. Traditional leases, however, spread depreciation costs more evenly, often resulting in higher monthly payments but less financial burden at lease-end. Evaluating the total cost of ownership, including balloon payments or purchase options, determines which lease provides better value based on individual financial goals and vehicle usage.

Who Should Choose a Balloon Lease or a Traditional Lease?

Businesses seeking lower monthly payments and flexibility to pay a lump sum at the end often prefer balloon leases, especially when anticipating fluctuating cash flow or planning to upgrade assets regularly. Companies valuing predictable budgeting and complete asset ownership by lease end typically opt for traditional leases to ensure consistent expenses and straightforward financial planning. Balloon leases suit organizations prioritizing short-term cash management, whereas traditional leases benefit those aiming for long-term asset acquisition with stable payments.

Frequently Asked Questions about Balloon and Traditional Leases

Balloon leases feature lower monthly payments followed by a large final payment, appealing to lessees aiming for short-term affordability or anticipating future capital. Traditional leases maintain consistent monthly payments throughout the term, providing predictable budgeting without unexpected end-of-term costs. Common FAQs address eligibility criteria, tax implications, residual value calculations, and options at lease-end like buyout or renewal.

Balloon Lease vs Traditional Lease Infographic

cardiffo.com

cardiffo.com