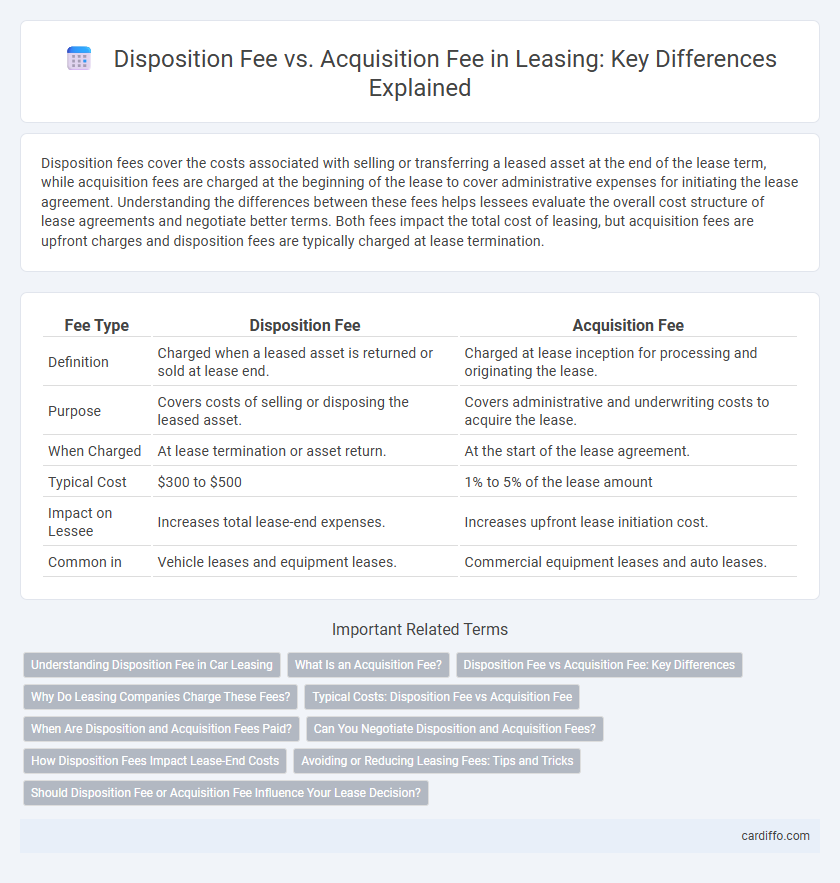

Disposition fees cover the costs associated with selling or transferring a leased asset at the end of the lease term, while acquisition fees are charged at the beginning of the lease to cover administrative expenses for initiating the lease agreement. Understanding the differences between these fees helps lessees evaluate the overall cost structure of lease agreements and negotiate better terms. Both fees impact the total cost of leasing, but acquisition fees are upfront charges and disposition fees are typically charged at lease termination.

Table of Comparison

| Fee Type | Disposition Fee | Acquisition Fee |

|---|---|---|

| Definition | Charged when a leased asset is returned or sold at lease end. | Charged at lease inception for processing and originating the lease. |

| Purpose | Covers costs of selling or disposing the leased asset. | Covers administrative and underwriting costs to acquire the lease. |

| When Charged | At lease termination or asset return. | At the start of the lease agreement. |

| Typical Cost | $300 to $500 | 1% to 5% of the lease amount |

| Impact on Lessee | Increases total lease-end expenses. | Increases upfront lease initiation cost. |

| Common in | Vehicle leases and equipment leases. | Commercial equipment leases and auto leases. |

Understanding Disposition Fee in Car Leasing

Disposition fee in car leasing is a charge paid at the end of a lease term to cover the cost of reselling or disposing of the vehicle. This fee typically ranges from $300 to $500 and is distinct from the acquisition fee, which is an upfront cost associated with initiating the lease. Understanding the disposition fee helps lessees avoid surprises and better manage the total cost of leasing a car.

What Is an Acquisition Fee?

An acquisition fee is a one-time charge paid by the lessee or borrower to the lessor or lender at the beginning of a lease or finance agreement, covering administrative costs related to processing and underwriting the contract. This fee typically ranges from $300 to $1,000 and is separate from monthly lease payments, reflecting the expenses incurred to secure the vehicle or equipment. Acquisition fees differ from disposition fees, which are charged at the end of the lease term for vehicle inspection and reconditioning before resale.

Disposition Fee vs Acquisition Fee: Key Differences

Disposition fees are charges imposed by lessors at the end of a lease to cover the cost of selling or disposing of the vehicle, typically ranging from $300 to $500. Acquisition fees are upfront costs paid at the lease's start to cover administrative expenses, generally amounting to $595 to $1,095. The key difference lies in timing and purpose: acquisition fees are initial charges to initiate the lease, while disposition fees are final charges related to lease termination and asset handling.

Why Do Leasing Companies Charge These Fees?

Leasing companies charge disposition fees to cover the costs associated with preparing a vehicle for resale, including inspection, cleaning, and marketing expenses. Acquisition fees are imposed to offset the administrative and processing costs involved in initiating a lease agreement, such as credit checks and documentation. Both fees help leasing companies manage operational expenses and maintain profitability while offering competitive lease terms to customers.

Typical Costs: Disposition Fee vs Acquisition Fee

Typical costs in leasing include the disposition fee, which covers the dealer's expense to sell or dispose of the vehicle at lease-end, usually ranging from $300 to $500. The acquisition fee is charged at lease initiation to cover administrative expenses and typically falls between $500 and $1,000. Understanding these fees helps lessees anticipate upfront and end-of-lease costs, impacting overall lease affordability.

When Are Disposition and Acquisition Fees Paid?

Disposition fees are typically paid at the end of a lease term when the lessee returns the vehicle to the lessor, covering the costs of preparing the vehicle for resale. Acquisition fees are paid upfront at the beginning of a lease agreement, either rolled into monthly payments or paid as a one-time fee, covering administrative costs related to processing and initiating the lease. Understanding the timing of these fees helps lessees plan their expenses throughout and after the lease period.

Can You Negotiate Disposition and Acquisition Fees?

Disposition fees and acquisition fees are often negotiable depending on the lessor and lease terms, although acquisition fees are typically set by the financing company and less flexible. Disposition fees cover the cost of selling or returning the leased vehicle, while acquisition fees are charged for initiating and processing the lease contract. Lessees should inquire and attempt to negotiate these fees before signing to potentially reduce overall lease costs.

How Disposition Fees Impact Lease-End Costs

Disposition fees directly increase lease-end costs by covering the expenses related to selling or disposing of the leased vehicle, which can add several hundred dollars to the total amount due at lease termination. These fees are distinct from acquisition fees, which are upfront charges included in the initial lease agreement and do not affect lease-end payments. Understanding disposition fees is crucial for lessees to accurately budget for final costs and avoid unexpected charges when returning the vehicle.

Avoiding or Reducing Leasing Fees: Tips and Tricks

Reducing leasing fees such as disposition and acquisition fees involves thorough negotiation and understanding the lease contract details. Requesting fee waivers or reductions as part of the lease agreement can significantly lower overall costs. Conducting market research on competitor lease offers and timing lease turnover strategically helps avoid excessive fees associated with vehicle disposition and acquisition.

Should Disposition Fee or Acquisition Fee Influence Your Lease Decision?

Disposition fees cover the cost of returning a leased vehicle at the end of the term, while acquisition fees are upfront charges associated with initiating the lease. When deciding on a lease, evaluate how each fee impacts total cost and monthly payments, as a high acquisition fee increases initial expense, whereas a high disposition fee affects end-of-lease affordability. Understanding the balance between these fees helps in choosing a lease agreement that aligns with your financial preferences and vehicle usage plans.

Disposition Fee vs Acquisition Fee Infographic

cardiffo.com

cardiffo.com