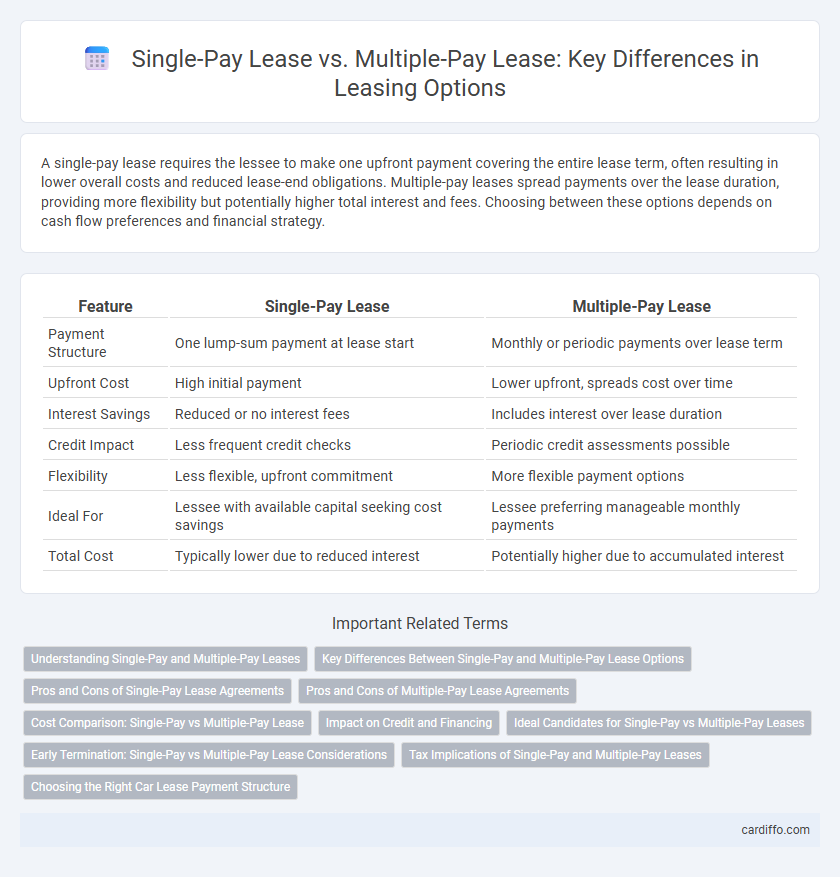

A single-pay lease requires the lessee to make one upfront payment covering the entire lease term, often resulting in lower overall costs and reduced lease-end obligations. Multiple-pay leases spread payments over the lease duration, providing more flexibility but potentially higher total interest and fees. Choosing between these options depends on cash flow preferences and financial strategy.

Table of Comparison

| Feature | Single-Pay Lease | Multiple-Pay Lease |

|---|---|---|

| Payment Structure | One lump-sum payment at lease start | Monthly or periodic payments over lease term |

| Upfront Cost | High initial payment | Lower upfront, spreads cost over time |

| Interest Savings | Reduced or no interest fees | Includes interest over lease duration |

| Credit Impact | Less frequent credit checks | Periodic credit assessments possible |

| Flexibility | Less flexible, upfront commitment | More flexible payment options |

| Ideal For | Lessee with available capital seeking cost savings | Lessee preferring manageable monthly payments |

| Total Cost | Typically lower due to reduced interest | Potentially higher due to accumulated interest |

Understanding Single-Pay and Multiple-Pay Leases

Single-pay leases require a single upfront payment covering the entire lease term, reducing monthly obligations and often securing better interest rates. Multiple-pay leases involve periodic payments, typically monthly, spreading costs over time and offering greater cash flow flexibility. Choosing between single-pay and multiple-pay leases depends on upfront capital availability and budget management preferences.

Key Differences Between Single-Pay and Multiple-Pay Lease Options

Single-Pay Lease requires a lump sum payment at the beginning of the lease term, eliminating monthly payments and often reducing overall lease costs due to lower interest fees. Multiple-Pay Lease divides the total lease amount into monthly or periodic installments, offering flexibility for cash flow management but potentially increasing the total cost over time. Key differences include payment timing, impact on cash flow, and overall financial savings, making the choice dependent on the lessee's financial strategy and budget preferences.

Pros and Cons of Single-Pay Lease Agreements

Single-Pay Lease agreements require one upfront payment covering the entire lease term, reducing monthly expenses and often resulting in lower overall lease costs due to upfront discounts. This arrangement minimizes administrative effort and avoids potential late payment fees but may limit cash flow flexibility and tie up capital that could be used elsewhere. Businesses must weigh the benefits of cost savings against the impact on liquidity when considering a Single-Pay Lease.

Pros and Cons of Multiple-Pay Lease Agreements

Multiple-pay lease agreements allow lessees to spread payments over the lease term, improving cash flow management and reducing financial strain compared to lump-sum single-pay leases. However, multiple payments may include higher overall costs due to interest or fees, increasing total lease expense. This structure offers flexibility but often comes with increased administrative complexity and potential penalties for missed payments.

Cost Comparison: Single-Pay vs Multiple-Pay Lease

Single-pay leases typically offer cost savings by requiring one upfront payment that reduces or eliminates monthly fees, lowering overall finance charges and interest expenses. Multiple-pay leases spread payments over the lease term but often incur higher cumulative costs due to added administrative fees and interest in each installment. Choosing single-pay leases can optimize total lease costs, especially when budget flexibility allows for upfront payment.

Impact on Credit and Financing

Single-pay leases typically result in a lower credit utilization ratio and may improve the credit score faster due to a single lump-sum payment reducing outstanding debt immediately. Multiple-pay leases spread out payments over time, which can maintain a steady cash flow but may appear as ongoing liabilities, potentially affecting credit risk assessments. Lenders may view single-pay leases as less risky, often leading to more favorable financing terms compared to multiple-pay leases with extended payment schedules.

Ideal Candidates for Single-Pay vs Multiple-Pay Leases

Single-pay leases are ideal for individuals with sufficient upfront capital who prefer simplicity and potentially lower overall costs, avoiding monthly payment obligations. Multiple-pay leases suit those who prefer spreading costs over time, maintaining monthly cash flow flexibility and aligning payments with regular income streams. Lease decision-making should consider personal financial stability, cash flow preferences, and long-term budget planning to select the most appropriate lease structure.

Early Termination: Single-Pay vs Multiple-Pay Lease Considerations

Early termination of a single-pay lease often results in forfeiture of the prepaid amount, limiting financial recovery options. In contrast, multiple-pay leases allow for pro-rated calculations, enabling lessees to stop payments after termination and potentially recover unused funds. Understanding the specific lease agreement's early termination clauses is crucial to minimize penalties and maximize financial benefits.

Tax Implications of Single-Pay and Multiple-Pay Leases

Single-pay leases require the entire lease payment upfront, often resulting in a larger immediate tax deduction for business use, while multiple-pay leases distribute payments over the lease term, allowing for consistent, periodic deductions. Tax regulations may limit the deductibility of single large payments, making multiple-pay leases more favorable for managing taxable income annually. Businesses should analyze IRS guidelines and consult tax advisors to optimize deductions based on their cash flow and tax strategy.

Choosing the Right Car Lease Payment Structure

Choosing the right car lease payment structure depends on your financial situation and payment preferences. Single-pay leases require a lump sum payment upfront, often leading to lower overall costs and interest savings. Multiple-pay leases spread payments over the lease term, offering flexibility and easier monthly budgeting but may result in higher total expenses.

Single-Pay Lease vs Multiple-Pay Lease Infographic

cardiffo.com

cardiffo.com