A single-pay lease requires the lessee to make one upfront payment covering the entire lease term, often resulting in lower overall costs and reduced finance charges compared to a monthly lease. Monthly leases spread payments across the lease duration, offering greater cash flow flexibility but potentially higher total expenses due to finance fees and interest. Choosing between a single-pay lease and a monthly lease depends on budget preferences and financial strategy.

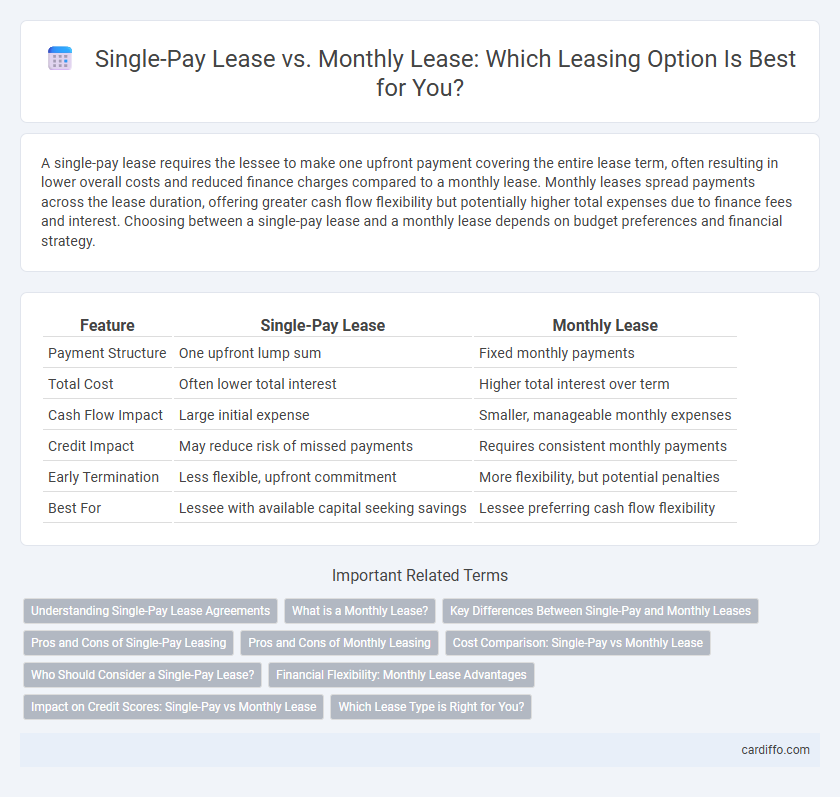

Table of Comparison

| Feature | Single-Pay Lease | Monthly Lease |

|---|---|---|

| Payment Structure | One upfront lump sum | Fixed monthly payments |

| Total Cost | Often lower total interest | Higher total interest over term |

| Cash Flow Impact | Large initial expense | Smaller, manageable monthly expenses |

| Credit Impact | May reduce risk of missed payments | Requires consistent monthly payments |

| Early Termination | Less flexible, upfront commitment | More flexibility, but potential penalties |

| Best For | Lessee with available capital seeking savings | Lessee preferring cash flow flexibility |

Understanding Single-Pay Lease Agreements

Single-pay lease agreements require the lessee to make one upfront payment covering the entire lease term, often resulting in lower overall costs compared to monthly leases. This type of lease reduces administrative fees and interest charges commonly added to monthly payments, providing financial predictability. Understanding the specific terms, including early termination policies and residual value, is crucial for lessees considering a single-pay lease.

What is a Monthly Lease?

A monthly lease is a rental agreement where tenants pay rent each month, offering flexibility without a long-term commitment. This type of lease typically renews automatically every 30 days until either party gives notice to terminate. Monthly leases are ideal for those needing short-term housing solutions or uncertain about their long-term plans.

Key Differences Between Single-Pay and Monthly Leases

Single-pay leases require one upfront payment covering the entire lease term, reducing monthly obligations and often resulting in lower overall costs due to reduced interest charges. Monthly leases spread payments evenly over the lease period, offering greater flexibility but potentially higher total expenses because of finance charges accrued monthly. Key differences include payment structure, cash flow impact, and overall cost efficiency, with single-pay leases minimizing ongoing payments and monthly leases providing budget-friendly installments.

Pros and Cons of Single-Pay Leasing

Single-pay leasing offers the advantage of a lower overall lease cost by reducing lease fees and money factor charges, resulting in potential savings compared to monthly payments. This type of lease eliminates the hassle of monthly billing and reduces the risk of late payment penalties, enhancing convenience for lessees. However, single-pay leases require a substantial upfront payment, which may strain cash flow and limit liquidity, and if the vehicle is totaled or stolen early in the lease term, the lessee may not recoup the full prepaid amount.

Pros and Cons of Monthly Leasing

Monthly leasing offers flexibility with shorter commitment periods, making it ideal for individuals uncertain about long-term plans or those with variable incomes. This option typically requires higher monthly payments compared to single-pay leases and may involve more frequent administrative tasks, such as monthly invoicing and payment processing. However, monthly leases provide easier budget management and the ability to upgrade or change terms more readily than single-pay leases.

Cost Comparison: Single-Pay vs Monthly Lease

Single-pay leases often provide a significant cost advantage by requiring one upfront payment that covers the entire lease term, reducing or eliminating monthly financing charges. Monthly leases spread out payments, potentially increasing total cost due to interest or fees added over time. Choosing a single-pay lease can result in lower overall expense and improved cash flow management compared to the cumulative cost of monthly lease payments.

Who Should Consider a Single-Pay Lease?

Single-pay leases suit individuals with stable finances seeking to avoid monthly payments while securing lower overall lease costs through a lump sum upfront. This option benefits those who drive limited miles annually and prioritize cash flow simplicity over flexible payment schedules. High-credit-score lessees often qualify for single-pay leases with favorable terms, reducing financial risk and administrative fees associated with monthly transactions.

Financial Flexibility: Monthly Lease Advantages

Monthly leases offer increased financial flexibility by allowing smaller, manageable payments spread over time, reducing the immediate cash outflow compared to single-pay leases. This payment structure improves budgeting predictability and cash flow management for both individuals and businesses. Furthermore, monthly leases often provide the option to adjust lease terms or terminate early with fewer financial penalties, accommodating changing financial situations.

Impact on Credit Scores: Single-Pay vs Monthly Lease

Single-pay leases can positively impact credit scores by reducing the risk of missed payments, as the full lease amount is paid upfront, lowering the likelihood of late or defaulted payments reported to credit bureaus. Monthly leases require consistent on-time payments, and any missed or late installments may negatively affect credit scores due to reported delinquencies. Credit scoring models favor steady, punctual credit behavior, making single-pay leases potentially more beneficial for maintaining or improving credit scores compared to monthly lease agreements.

Which Lease Type is Right for You?

Single-pay leases require a one-time payment covering the entire lease term, often resulting in lower overall costs and simplified budgeting for those with available funds upfront. Monthly leases distribute payments into manageable installments, offering flexibility and easier cash flow management for individuals preferring regular, predictable expenses. Choosing between single-pay and monthly leases depends on your financial situation, cash flow preferences, and long-term budget planning.

Single-pay lease vs monthly lease Infographic

cardiffo.com

cardiffo.com