Re-leasing a pet typically involves returning the animal after a lease period and opting for another pet lease agreement, often with lower upfront costs and shorter commitment. Financing a pet purchase requires taking out a loan or payment plan to own the pet outright, leading to higher long-term financial responsibility but full ownership benefits. Choosing between re-leasing and financing depends on budget flexibility, pet care preferences, and the desire for permanent ownership versus temporary companionship.

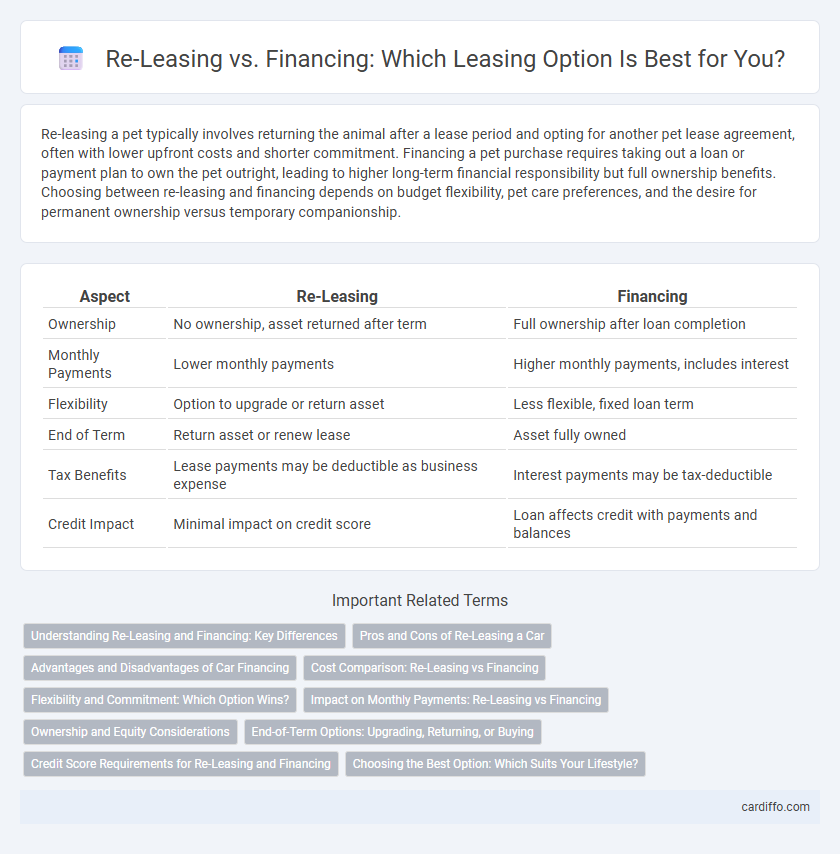

Table of Comparison

| Aspect | Re-Leasing | Financing |

|---|---|---|

| Ownership | No ownership, asset returned after term | Full ownership after loan completion |

| Monthly Payments | Lower monthly payments | Higher monthly payments, includes interest |

| Flexibility | Option to upgrade or return asset | Less flexible, fixed loan term |

| End of Term | Return asset or renew lease | Asset fully owned |

| Tax Benefits | Lease payments may be deductible as business expense | Interest payments may be tax-deductible |

| Credit Impact | Minimal impact on credit score | Loan affects credit with payments and balances |

Understanding Re-Leasing and Financing: Key Differences

Re-leasing involves extending or negotiating a new lease agreement on the same asset, allowing continued use without ownership transfer. Financing refers to obtaining funds to purchase the asset, which results in ownership but requires repayment with interest over time. Understanding these key differences helps businesses decide between maintaining operational flexibility through re-leasing or acquiring long-term asset control via financing.

Pros and Cons of Re-Leasing a Car

Re-leasing a car offers the advantage of lower monthly payments compared to financing, as well as the ability to drive a new vehicle every few years without the hassle of ownership. However, re-leasing often comes with mileage limits and potential excess wear-and-tear charges, which can lead to additional costs. Unlike financing, re-leasing does not build equity, meaning the lessee does not own the vehicle at the end of the term.

Advantages and Disadvantages of Car Financing

Car financing offers the advantage of ownership, allowing drivers to build equity and customize their vehicles without mileage restrictions common in leases. Monthly payments can be higher compared to leasing, and borrowers face depreciation risks, as the vehicle's value declines over time. Financing provides long-term cost savings, but the upfront down payment and maintenance responsibilities fall solely on the owner.

Cost Comparison: Re-Leasing vs Financing

Re-leasing often involves lower upfront costs and reduced financial risk compared to financing, which requires larger initial capital and accrues interest over time. Total cost of re-leasing can be higher in the long term due to recurring lease payments, whereas financing builds equity through ownership despite possible depreciation. Businesses must analyze factors like interest rates, lease terms, residual values, and tax implications to determine the most cost-effective strategy.

Flexibility and Commitment: Which Option Wins?

Re-leasing offers greater flexibility by allowing tenants to adjust lease terms or relocate with minimal penalties, ideal for businesses facing uncertain growth or market conditions. Financing commitments often involve fixed repayment schedules and longer terms, limiting the ability to adapt financial obligations quickly. For organizations prioritizing adaptability, re-leasing generally provides a strategic advantage over financing due to reduced long-term commitment constraints.

Impact on Monthly Payments: Re-Leasing vs Financing

Re-leasing typically results in lower monthly payments compared to financing since lease agreements cover depreciation over a shorter term and include residual value, reducing monthly costs. Financing monthly payments tend to be higher as they encompass the total vehicle price plus interest over the loan term. Consumers seeking lower initial monthly expenses often prefer re-leasing, while financing is suited for those aiming for eventual ownership despite higher payments.

Ownership and Equity Considerations

Re-leasing provides continued access to the asset without transferring ownership, which means no equity is built in the leased item. Financing options, such as purchasing through a loan, allow for ownership transfer and gradual equity accumulation as payments are made. Ownership under financing influences asset control, tax benefits, and the potential to leverage equity for future financial opportunities.

End-of-Term Options: Upgrading, Returning, or Buying

End-of-term options in leasing include upgrading to a newer model, returning the leased asset without further obligations, or purchasing the asset at a predetermined price. Choosing to upgrade allows lessees to access the latest technology with minimal hassle, while returning provides flexibility without ownership responsibilities. Opting to buy converts the lease into ownership, often beneficial for those satisfied with the asset's condition and value.

Credit Score Requirements for Re-Leasing and Financing

Re-leasing generally requires a moderate credit score, often around 600 or higher, as lessors seek assurance of consistent payment without the risk of long-term debt. Financing typically demands a higher credit score, usually above 650, to qualify for favorable interest rates and loan terms due to the lender's increased exposure to financial risk. Understanding these credit score benchmarks helps individuals choose the best option between re-leasing, which offers flexibility, and financing, which builds ownership.

Choosing the Best Option: Which Suits Your Lifestyle?

Choosing between re-leasing and financing depends on your financial stability, long-term plans, and lifestyle flexibility. Re-leasing offers lower monthly payments and the ability to upgrade assets frequently, ideal for those who prioritize short-term commitments and minimal maintenance responsibility. Financing suits individuals seeking ownership, equity building, and stable monthly expenses, making it a better fit for those planning long-term use and asset control.

Re-Leasing vs Financing Infographic

cardiffo.com

cardiffo.com