Usage-based pet insurance leverages real-time data from devices like activity trackers to tailor premiums based on the pet's behavior and health patterns, offering personalized cost savings. Standard pet insurance charges fixed premiums regardless of individual pet activities, providing predictable but potentially less customized coverage. Choosing between these options depends on the owner's preference for premium flexibility versus stable, consistent monthly payments.

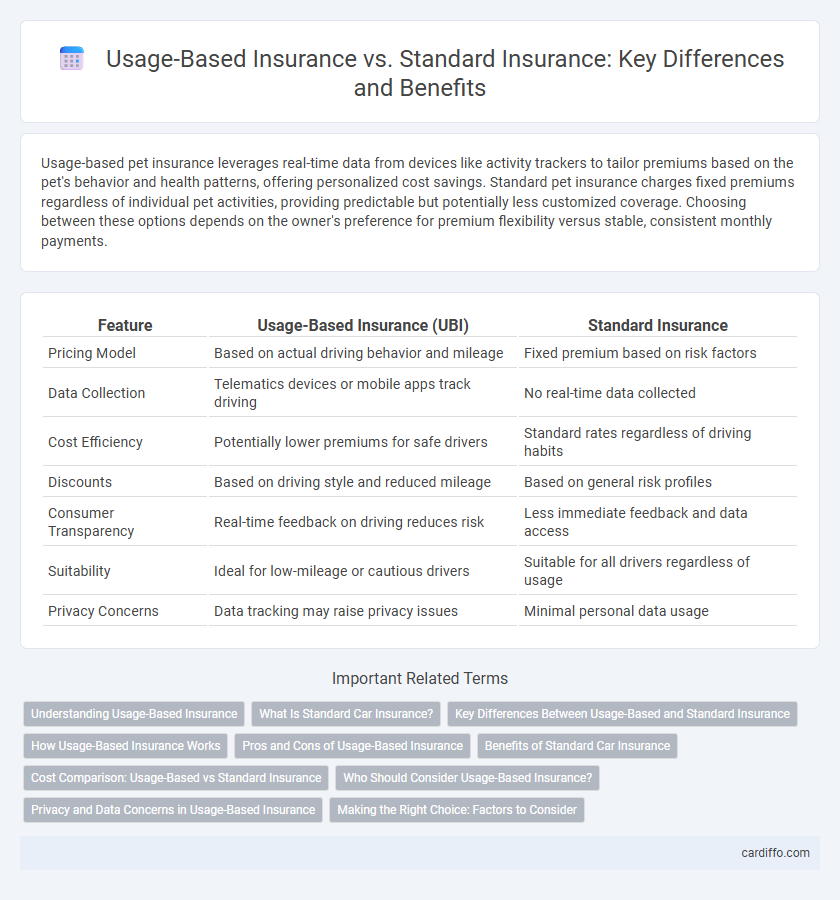

Table of Comparison

| Feature | Usage-Based Insurance (UBI) | Standard Insurance |

|---|---|---|

| Pricing Model | Based on actual driving behavior and mileage | Fixed premium based on risk factors |

| Data Collection | Telematics devices or mobile apps track driving | No real-time data collected |

| Cost Efficiency | Potentially lower premiums for safe drivers | Standard rates regardless of driving habits |

| Discounts | Based on driving style and reduced mileage | Based on general risk profiles |

| Consumer Transparency | Real-time feedback on driving reduces risk | Less immediate feedback and data access |

| Suitability | Ideal for low-mileage or cautious drivers | Suitable for all drivers regardless of usage |

| Privacy Concerns | Data tracking may raise privacy issues | Minimal personal data usage |

Understanding Usage-Based Insurance

Usage-Based Insurance (UBI) leverages telematics technology to monitor driving behavior, enabling insurers to personalize premiums based on actual vehicle usage and driving patterns. Unlike Standard Insurance, which relies on demographic data and historical claims, UBI offers dynamic pricing reflecting real-time risk assessment. This approach incentivizes safer driving and often results in cost savings for low-mileage or cautious drivers.

What Is Standard Car Insurance?

Standard car insurance provides coverage based on predetermined factors such as age, driving history, vehicle type, and location, offering fixed premiums regardless of actual driving behavior. It typically includes liability, collision, comprehensive, and uninsured motorist coverage with set terms and conditions. Unlike usage-based insurance, standard policies do not adjust rates dynamically based on mileage or driving patterns.

Key Differences Between Usage-Based and Standard Insurance

Usage-based insurance (UBI) leverages telematics technology to monitor real-time driving behaviors, enabling personalized premium adjustments based on factors like mileage, speed, and braking patterns, whereas standard insurance relies on static criteria such as age, driving history, and vehicle type. UBI promotes safer driving practices through continuous data collection, often resulting in potential cost savings for low-risk drivers, contrasting with the fixed rate structures of standard policies. Claims processing in UBI can be expedited due to detailed driving data, offering enhanced transparency and accuracy compared to the traditional insurance model.

How Usage-Based Insurance Works

Usage-Based Insurance (UBI) leverages telematics technology to monitor driving behavior, collecting data such as speed, braking patterns, mileage, and time of day. This data is transmitted to insurers who analyze it to calculate personalized premiums that reflect individual risk profiles more accurately than standard insurance models. By rewarding safer driving habits, UBI incentivizes policyholders to reduce risky behaviors, potentially lowering overall insurance costs.

Pros and Cons of Usage-Based Insurance

Usage-Based Insurance (UBI) offers personalized premiums by tracking driving behavior through telematics, rewarding safe drivers with lower costs and promoting road safety. However, UBI raises privacy concerns due to continuous data collection and may result in higher premiums for high-mileage or aggressive drivers. Standard Insurance provides predictable rates without monitoring but lacks the potential savings and customization available in usage-based models.

Benefits of Standard Car Insurance

Standard car insurance offers predictable premiums and broad coverage options, providing financial security against a wide range of risks such as accidents, theft, and liability. It allows drivers to choose coverage levels tailored to their needs, including collision, comprehensive, and uninsured motorist protection. This traditional approach ensures stability and peace of mind without the need for continuous driving data monitoring.

Cost Comparison: Usage-Based vs Standard Insurance

Usage-based insurance (UBI) often results in lower premiums for low-mileage or safe drivers by tailoring costs based on actual driving behavior, whereas standard insurance relies on fixed rates derived from demographic and historical data. UBI reduces expenses through real-time monitoring, enabling personalized discounts and minimizing costs linked to high-risk behaviors. Standard insurance premiums tend to be higher on average due to generalized risk assessments and less individualized pricing models.

Who Should Consider Usage-Based Insurance?

Drivers with low annual mileage, safe driving habits, and those seeking personalized premiums should consider Usage-Based Insurance (UBI) as it offers cost-saving opportunities based on actual driving behavior. Telematics devices in UBI monitor speed, braking, and distance, providing insurers with accurate risk assessments tailored to individual usage patterns. This insurance model benefits infrequent or cautious drivers by potentially lowering premiums compared to standard insurance, which relies on generalized risk profiles.

Privacy and Data Concerns in Usage-Based Insurance

Usage-Based Insurance (UBI) collects continuous driving data through telematics devices, raising significant privacy concerns due to the extensive monitoring of location, speed, and behavior patterns. Unlike standard insurance, which relies on historical data and broad risk categories, UBI's granular data collection can lead to potential misuse or unauthorized access of sensitive personal information. Ensuring robust data encryption, transparent usage policies, and strict regulatory compliance is critical to protect consumers' privacy in the evolving UBI landscape.

Making the Right Choice: Factors to Consider

When deciding between Usage-Based Insurance (UBI) and standard insurance, consider your driving habits, vehicle usage, and the importance of premium flexibility. UBI often rewards low-mileage and safe driving behavior with personalized rates, ideal for occasional drivers or those seeking cost-effective coverage. Standard insurance provides consistent premiums and broader coverage options, better suited for frequent drivers or those who prefer predictable payments.

Usage-Based Insurance vs Standard Insurance Infographic

cardiffo.com

cardiffo.com