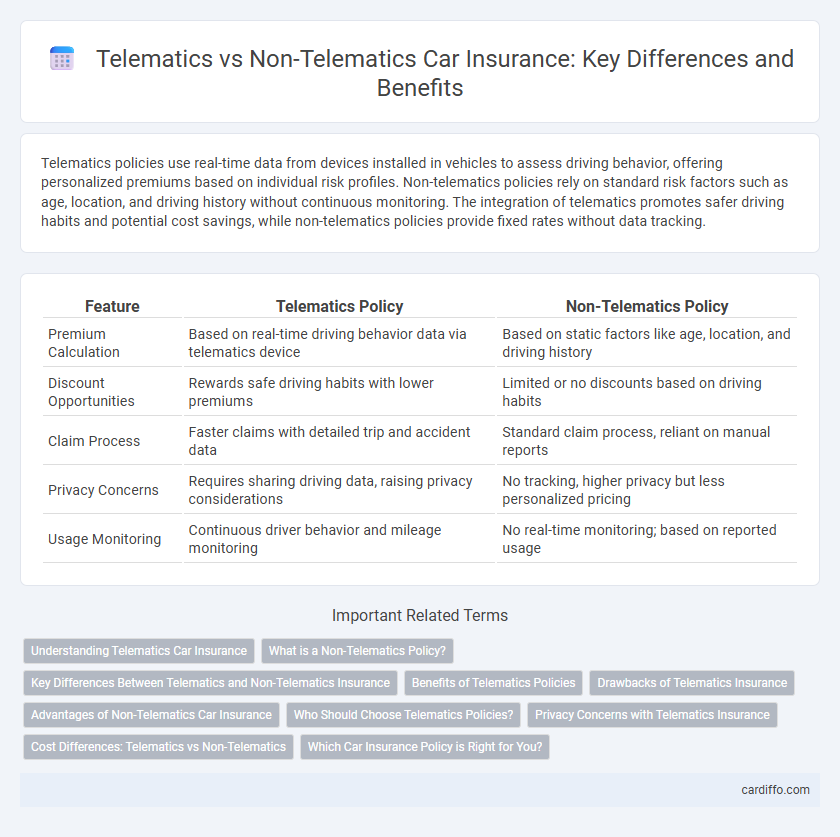

Telematics policies use real-time data from devices installed in vehicles to assess driving behavior, offering personalized premiums based on individual risk profiles. Non-telematics policies rely on standard risk factors such as age, location, and driving history without continuous monitoring. The integration of telematics promotes safer driving habits and potential cost savings, while non-telematics policies provide fixed rates without data tracking.

Table of Comparison

| Feature | Telematics Policy | Non-Telematics Policy |

|---|---|---|

| Premium Calculation | Based on real-time driving behavior data via telematics device | Based on static factors like age, location, and driving history |

| Discount Opportunities | Rewards safe driving habits with lower premiums | Limited or no discounts based on driving habits |

| Claim Process | Faster claims with detailed trip and accident data | Standard claim process, reliant on manual reports |

| Privacy Concerns | Requires sharing driving data, raising privacy considerations | No tracking, higher privacy but less personalized pricing |

| Usage Monitoring | Continuous driver behavior and mileage monitoring | No real-time monitoring; based on reported usage |

Understanding Telematics Car Insurance

Telematics car insurance uses data collected from a vehicle's GPS and onboard diagnostics to assess driving behavior, enabling personalized premiums based on factors like speed, braking, and mileage. Traditional non-telematics policies rely on historical data and demographic factors without real-time monitoring, often leading to higher or less accurately priced premiums. Policyholders with telematics insurance benefit from potential discounts and improved risk management through continuous feedback on driving habits.

What is a Non-Telematics Policy?

A Non-Telematics Policy is a traditional insurance plan that calculates premiums based on general factors such as age, driving history, location, and vehicle type, without tracking real-time driving behavior. This type of policy relies on historical data and statistical models rather than continuous monitoring through a telematics device. Policyholders benefit from a fixed premium structure, but may miss out on personalized discounts linked to safe driving habits.

Key Differences Between Telematics and Non-Telematics Insurance

Telematics insurance uses real-time data from devices installed in vehicles to monitor driving behavior, allowing for personalized premiums based on factors like speed, acceleration, and mileage. Non-telematics policies rely on traditional risk assessment methods, such as age, driving history, and location, resulting in fixed premiums regardless of actual driving habits. The key difference lies in data utilization, with telematics offering potential cost savings and safer driving incentives, while non-telematics provide standardized coverage without behavioral feedback.

Benefits of Telematics Policies

Telematics policies offer personalized insurance premiums based on real-time driving behavior, promoting safer driving and potentially reducing costs. These policies provide detailed insights into driving patterns, enabling insurers to reward low-risk drivers with discounts and incentives. Enhanced risk assessment through telematics data leads to more accurate pricing and improved claims handling efficiency.

Drawbacks of Telematics Insurance

Telematics insurance can raise privacy concerns due to continuous monitoring of driving behavior, potentially leading to data security risks. It may also result in higher premiums for drivers with aggressive or inconsistent driving patterns, unlike non-telematics policies that use traditional risk assessment methods based on demographics and claims history. Limited availability in some regions restricts consumer choice, making non-telematics policies more accessible for many drivers.

Advantages of Non-Telematics Car Insurance

Non-telematics car insurance offers privacy benefits by not requiring the installation of tracking devices that monitor driving behavior. Policyholders avoid potential data security risks and maintain control over their personal information. This traditional insurance model provides straightforward premium calculations based on general risk factors without the complexity of usage-based adjustments.

Who Should Choose Telematics Policies?

Drivers seeking personalized insurance premiums based on actual driving behavior should consider telematics policies, as these plans use real-time data from in-car devices or smartphone apps to assess risk more accurately. Young or low-mileage drivers often benefit from telematics due to potential discounts for safe driving habits. Individuals who want to improve their driving patterns and gain greater control over their insurance costs are ideal candidates for telematics insurance policies.

Privacy Concerns with Telematics Insurance

Telematics insurance policies collect real-time driving data, raising significant privacy concerns regarding data security and unauthorized access to personal information. Policyholders may worry about continuous monitoring, data sharing with third parties, and potential misuse of sensitive driving behaviors. Non-telematics policies avoid these issues by relying on traditional underwriting methods without tracking drivers' activities.

Cost Differences: Telematics vs Non-Telematics

Telematics policies often reduce insurance premiums by monitoring driving behavior, leading to personalized risk assessments and potentially lower costs for safe drivers. Non-telematics policies rely on traditional factors such as age, location, and driving history, which can result in higher or less flexible pricing. Cost differences between these policies hinge on the ability of telematics to incentivize safer driving and offer dynamic pricing models.

Which Car Insurance Policy is Right for You?

Telematics policy uses GPS and driving data to tailor premiums based on actual driving behavior, rewarding safe drivers with lower rates. Non-telematics policy calculates premiums using traditional factors like age, location, and driving history without monitoring real-time behavior. Choosing the right policy depends on whether you prefer personalized pricing and are comfortable with data tracking or want a straightforward, fixed-rate insurance option.

Telematics Policy vs Non-Telematics Policy Infographic

cardiffo.com

cardiffo.com