Third-party insurance covers damages or injuries you cause to others, protecting you financially from claims made by third parties. First-party insurance provides coverage for damages or losses you personally incur, such as theft or physical damage to your own property. Understanding the differences helps policyholders choose the appropriate coverage to safeguard their assets and liabilities effectively.

Table of Comparison

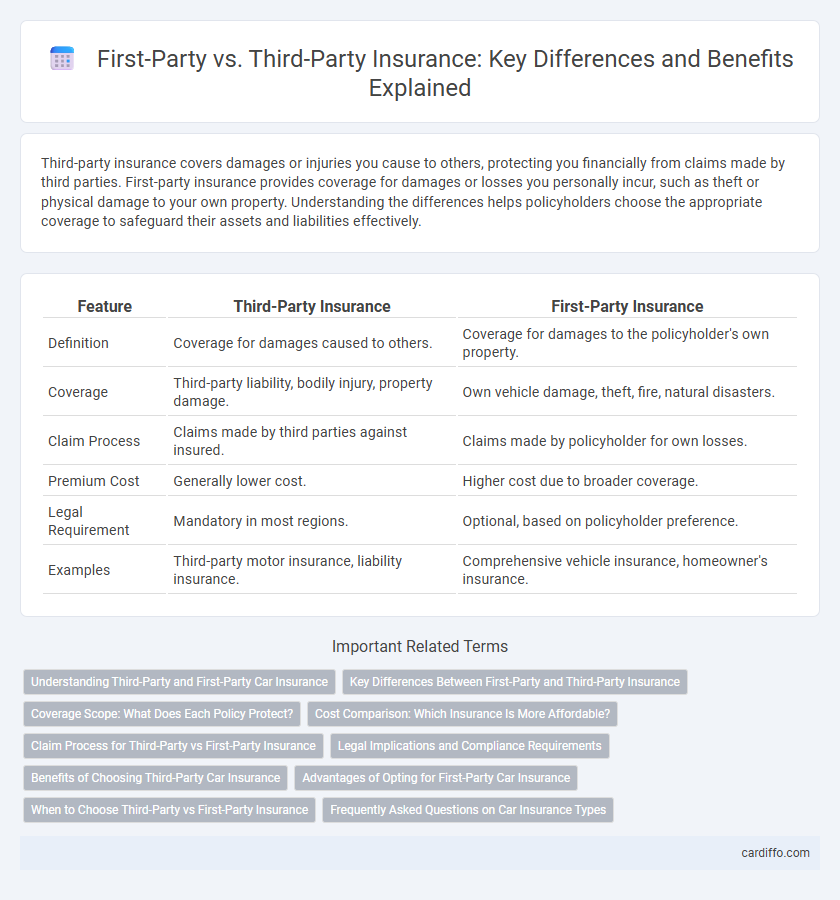

| Feature | Third-Party Insurance | First-Party Insurance |

|---|---|---|

| Definition | Coverage for damages caused to others. | Coverage for damages to the policyholder's own property. |

| Coverage | Third-party liability, bodily injury, property damage. | Own vehicle damage, theft, fire, natural disasters. |

| Claim Process | Claims made by third parties against insured. | Claims made by policyholder for own losses. |

| Premium Cost | Generally lower cost. | Higher cost due to broader coverage. |

| Legal Requirement | Mandatory in most regions. | Optional, based on policyholder preference. |

| Examples | Third-party motor insurance, liability insurance. | Comprehensive vehicle insurance, homeowner's insurance. |

Understanding Third-Party and First-Party Car Insurance

Third-party car insurance covers damages or injuries you cause to others, including their vehicle, property, or bodily injury claims, but does not cover your own losses. First-party car insurance protects your own vehicle and personal injuries resulting from accidents, theft, or natural disasters, providing broader financial security. Understanding the distinction helps drivers choose appropriate coverage based on risk tolerance and legal requirements.

Key Differences Between First-Party and Third-Party Insurance

First-party insurance covers damages or losses sustained by the policyholder, such as property damage or bodily injury, while third-party insurance protects against claims made by others for whom the policyholder is legally liable. Key differences include the insured party's direct benefit in first-party claims versus defending and compensating third parties in third-party coverage. First-party policies typically cover the policyholder's own assets, whereas third-party insurance primarily addresses liabilities arising from the policyholder's actions.

Coverage Scope: What Does Each Policy Protect?

Third-party insurance covers damages or injuries you cause to others, including their property and medical expenses, but does not protect your own losses. First-party insurance provides coverage for your own assets and injuries, such as damage to your vehicle or medical bills resulting from an accident. Understanding the coverage scope helps select policies that align with your risk preferences and financial protection needs.

Cost Comparison: Which Insurance Is More Affordable?

Third-party insurance typically offers a more affordable premium compared to first-party insurance due to its limited coverage, which mainly protects against damages caused to others rather than the policyholder's own vehicle or property. First-party insurance, also known as comprehensive insurance, generally involves higher costs because it covers a broader range of risks such as theft, fire, and personal damages. Choosing between third-party and first-party insurance depends on balancing premium affordability with the desired scope of financial protection.

Claim Process for Third-Party vs First-Party Insurance

Third-party insurance claims involve a process where the insured files a claim against another party's insurer to cover damages or injuries caused, requiring clear documentation and proof of the other party's liability. In contrast, first-party claims are filed directly with the insured's own insurer, typically resulting in faster processing as the insurer manages the claim internally without disputing liability. Understanding the differences in claim procedures, such as liability assessment and payout timelines, is crucial for efficient resolution in both third-party and first-party insurance scenarios.

Legal Implications and Compliance Requirements

Third-party insurance involves coverage protecting against claims made by individuals or entities outside the policyholder, often requiring strict adherence to regulatory frameworks governing liability and compensation processes. First-party insurance covers the policyholder's own losses or damages, necessitating compliance with precise documentation and claims reporting standards to prevent fraud and ensure policy validity. Understanding these distinctions is crucial for aligning with insurance laws, minimizing legal risks, and maintaining regulatory compliance in risk management.

Benefits of Choosing Third-Party Car Insurance

Third-party car insurance offers cost-effective protection by covering damages and liabilities caused to others, making it an economical choice for budget-conscious drivers. It facilitates legal compliance by meeting mandatory insurance requirements in many regions, thereby avoiding penalties and fines. With simpler claims processes and lower premiums, third-party insurance provides efficient financial security without the higher expenses of first-party coverage.

Advantages of Opting for First-Party Car Insurance

First-party car insurance offers direct coverage for the insured's own vehicle damages, ensuring faster claim settlements and reduced reliance on third parties. Policyholders benefit from comprehensive protection including theft, fire, and collision, which third-party insurance typically excludes. This approach minimizes out-of-pocket expenses and provides enhanced peace of mind by safeguarding personal assets against unforeseen incidents.

When to Choose Third-Party vs First-Party Insurance

Choosing third-party insurance is ideal when seeking coverage for damages or injuries caused to others, offering protection against liability claims without covering personal losses. First-party insurance is better suited for those wanting direct coverage for their own property and medical expenses resulting from an incident. Evaluating risk exposure, asset value, and financial capacity helps determine whether third-party or first-party insurance aligns best with individual or business needs.

Frequently Asked Questions on Car Insurance Types

Third-party car insurance covers damages and injuries you cause to others, while first-party insurance covers your own vehicle and medical expenses. Frequently asked questions include what is the difference between these policies, which offers better financial protection, and whether first-party insurance includes theft and accident coverage. Understanding the coverage limits, premiums, and claim processes helps drivers select the right policy based on their needs and budget.

Third-Party vs First-Party Infographic

cardiffo.com

cardiffo.com