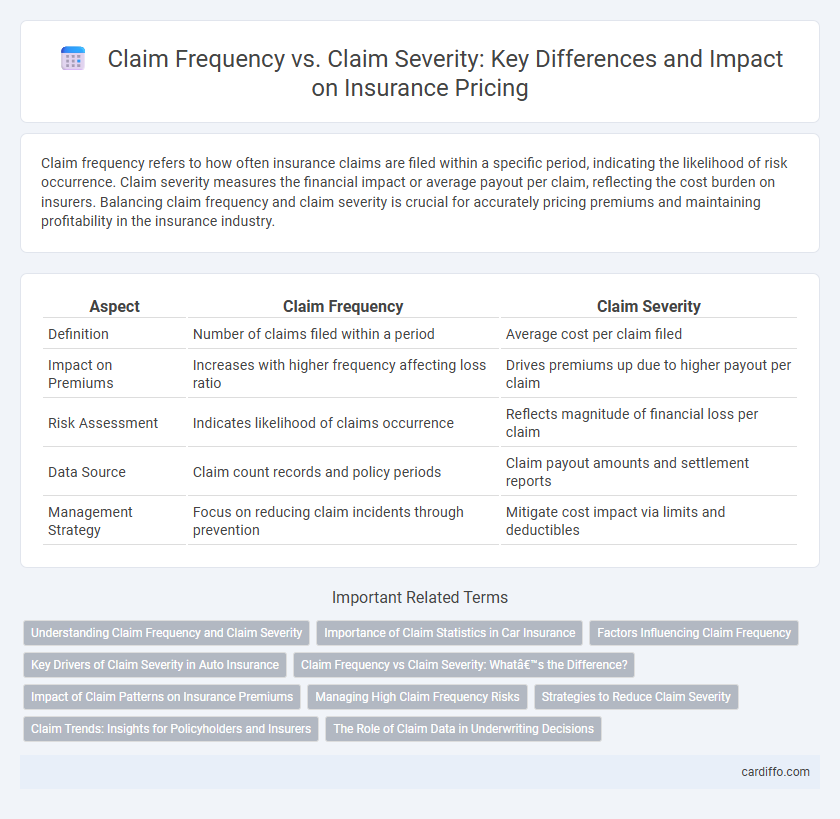

Claim frequency refers to how often insurance claims are filed within a specific period, indicating the likelihood of risk occurrence. Claim severity measures the financial impact or average payout per claim, reflecting the cost burden on insurers. Balancing claim frequency and claim severity is crucial for accurately pricing premiums and maintaining profitability in the insurance industry.

Table of Comparison

| Aspect | Claim Frequency | Claim Severity |

|---|---|---|

| Definition | Number of claims filed within a period | Average cost per claim filed |

| Impact on Premiums | Increases with higher frequency affecting loss ratio | Drives premiums up due to higher payout per claim |

| Risk Assessment | Indicates likelihood of claims occurrence | Reflects magnitude of financial loss per claim |

| Data Source | Claim count records and policy periods | Claim payout amounts and settlement reports |

| Management Strategy | Focus on reducing claim incidents through prevention | Mitigate cost impact via limits and deductibles |

Understanding Claim Frequency and Claim Severity

Claim frequency represents the number of insurance claims filed within a specific period, reflecting the likelihood of policyholders encountering loss events. Claim severity measures the average cost incurred per claim, indicating the financial impact of each reported incident. Understanding both metrics is essential for insurers to accurately assess risk, set premiums, and develop effective risk management strategies.

Importance of Claim Statistics in Car Insurance

Claim frequency and claim severity are critical metrics in car insurance that directly influence premium calculations and risk assessment. High claim frequency indicates a greater number of claims filed, impacting overall loss ratios, while claim severity reflects the average cost per claim, affecting reserve allocation and profitability. Accurate analysis of claim statistics enables insurers to develop competitive pricing models and implement targeted risk mitigation strategies.

Factors Influencing Claim Frequency

Claim frequency is primarily influenced by factors such as policyholder behavior, geographic location, and the type of coverage selected. Higher risk environments or inadequate risk mitigation often lead to more frequent claims, while demographic variables like age and driving history also play crucial roles. Understanding these factors enables insurers to better assess risk and set premiums accurately.

Key Drivers of Claim Severity in Auto Insurance

Key drivers of claim severity in auto insurance include vehicle type, accident type, and repair costs. Luxury or high-performance vehicles typically lead to higher claim amounts due to expensive parts and specialized labor. Severe accidents involving multiple vehicles or personal injuries significantly increase claim severity, influenced further by geographic factors and inflation in medical and repair expenses.

Claim Frequency vs Claim Severity: What’s the Difference?

Claim frequency measures how often insurance claims are filed within a specific period, reflecting the likelihood of a loss event occurring. Claim severity quantifies the average cost or financial impact of each claim, indicating the magnitude of losses incurred. Understanding the difference between claim frequency and claim severity helps insurers accurately price policies and manage risk portfolios.

Impact of Claim Patterns on Insurance Premiums

Claim frequency and claim severity are critical determinants of insurance premiums, with higher frequencies indicating a greater likelihood of loss occurrences, thereby driving up premium costs. Elevated claim severity reflects more significant financial losses per claim, prompting insurers to increase premiums to cover potential payouts. Insurers analyze historical claim patterns to adjust pricing models, balancing risk exposure and maintaining profitability.

Managing High Claim Frequency Risks

Managing high claim frequency risks requires insurers to implement proactive loss control measures such as regular safety audits, employee training programs, and risk mitigation strategies tailored to specific policyholder profiles. Data analytics and predictive modeling enable identification of high-risk segments, facilitating targeted interventions that reduce the frequency of claims while maintaining profitability. Effective claims management systems streamline processing and ensure timely settlements, minimizing operational costs associated with frequent claims.

Strategies to Reduce Claim Severity

Implementing comprehensive risk management programs and enhancing policyholder safety education significantly reduce claim severity by minimizing the impact of incidents. Utilizing advanced data analytics to identify high-risk behaviors enables insurers to tailor interventions and promote proactive loss prevention strategies. Encouraging early reporting and efficient claims handling processes further mitigate claim costs and improve overall loss outcomes.

Claim Trends: Insights for Policyholders and Insurers

Claim frequency measures how often policyholders file claims, impacting insurers' risk assessment and premium calculations, while claim severity gauges the financial cost of those claims, influencing reserve requirements and pricing strategies. Recent claim trends reveal that rising claim frequency in certain sectors often leads to higher overall losses, even if individual claim severity remains stable or decreases. Understanding these patterns enables policyholders to adopt risk mitigation measures and insurers to refine underwriting practices for improved risk management and cost control.

The Role of Claim Data in Underwriting Decisions

Claim frequency and claim severity metrics are critical in evaluating risk profiles during underwriting, as they provide detailed insights into the likelihood and potential cost of future claims. Analyzing historical claim data enables insurers to identify patterns, assess risk levels accurately, and set appropriate premium rates. Leveraging advanced analytics on claim frequency and severity helps underwriters make data-driven decisions that reduce exposure and improve portfolio profitability.

Claim Frequency vs Claim Severity Infographic

cardiffo.com

cardiffo.com