Gap insurance covers the difference between your car's actual cash value and the amount you still owe on your auto loan if your vehicle is totaled or stolen. Standard auto insurance provides financial protection against damages or liability but typically only reimburses the car's current market value without covering loan or lease balances. Choosing gap insurance is essential for those financing or leasing vehicles to avoid out-of-pocket expenses after a total loss.

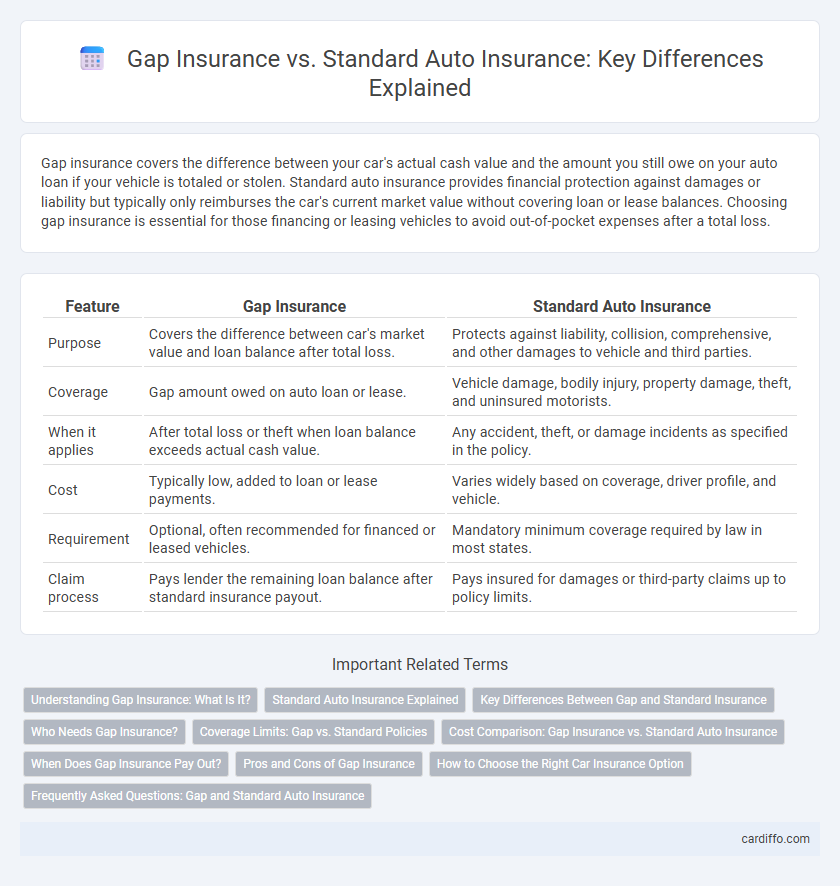

Table of Comparison

| Feature | Gap Insurance | Standard Auto Insurance |

|---|---|---|

| Purpose | Covers the difference between car's market value and loan balance after total loss. | Protects against liability, collision, comprehensive, and other damages to vehicle and third parties. |

| Coverage | Gap amount owed on auto loan or lease. | Vehicle damage, bodily injury, property damage, theft, and uninsured motorists. |

| When it applies | After total loss or theft when loan balance exceeds actual cash value. | Any accident, theft, or damage incidents as specified in the policy. |

| Cost | Typically low, added to loan or lease payments. | Varies widely based on coverage, driver profile, and vehicle. |

| Requirement | Optional, often recommended for financed or leased vehicles. | Mandatory minimum coverage required by law in most states. |

| Claim process | Pays lender the remaining loan balance after standard insurance payout. | Pays insured for damages or third-party claims up to policy limits. |

Understanding Gap Insurance: What Is It?

Gap insurance covers the difference between your car's actual cash value and the amount remaining on your auto loan if your vehicle is totaled or stolen. Standard auto insurance typically pays only the current market value of the vehicle, which can leave you responsible for the outstanding loan balance. Gap insurance is essential for drivers with leases or loans to avoid financial loss during total loss scenarios.

Standard Auto Insurance Explained

Standard auto insurance provides essential coverage including liability for bodily injury and property damage, collision coverage for repair costs after accidents, and comprehensive coverage for non-collision incidents like theft or natural disasters. This type of insurance ensures legal compliance and financial protection against common risks encountered while driving. Unlike gap insurance, which covers the difference between a vehicle's value and loan balance after a total loss, standard auto insurance focuses on everyday accident and damage protection.

Key Differences Between Gap and Standard Insurance

Gap insurance covers the difference between the actual cash value of a totaled vehicle and the outstanding loan or lease balance, while standard auto insurance reimburses based on the car's current market value. Gap insurance is essential for drivers with a loan or lease balance that exceeds the vehicle's depreciated worth. Standard auto insurance typically includes liability, collision, and comprehensive coverage but does not address loan or lease payoff gaps.

Who Needs Gap Insurance?

Gap insurance is essential for drivers who finance or lease a new vehicle, as it covers the difference between the car's actual cash value and the remaining loan or lease balance in the event of a total loss. Standard auto insurance typically reimburses only the market value of the vehicle, leaving those with negative equity vulnerable to out-of-pocket expenses. Individuals with high depreciation vehicles or small down payments benefit most from gap insurance protection.

Coverage Limits: Gap vs. Standard Policies

Gap insurance covers the difference between a vehicle's actual cash value and the remaining loan or lease balance in case of total loss, offering protection that standard auto insurance lacks. Standard auto insurance policies typically reimburse only the current market value of the vehicle, which may leave the policyholder responsible for any outstanding loan amounts. Coverage limits in gap insurance specifically address this financial shortfall, whereas standard coverage limits are tied to the vehicle's depreciated worth.

Cost Comparison: Gap Insurance vs. Standard Auto Insurance

Gap insurance typically costs between $20 and $40 annually, making it a relatively affordable add-on to standard auto insurance policies, which average around $1,500 per year in the United States. While standard auto insurance covers liability, collision, and comprehensive damages, gap insurance specifically covers the difference between the car's actual cash value and the remaining loan balance in the event of a total loss. Choosing gap insurance can be cost-effective for drivers financing or leasing vehicles with rapid depreciation, as standard policies often leave significant out-of-pocket expenses uncovered.

When Does Gap Insurance Pay Out?

Gap insurance pays out when a vehicle is totaled or stolen and the payout from the standard auto insurance policy is less than the outstanding loan or lease balance. It covers the "gap" between the car's actual cash value at the time of the loss and the remaining amount owed to the lender. Standard auto insurance typically reimburses based on market value, which may result in significant out-of-pocket expenses without gap insurance coverage.

Pros and Cons of Gap Insurance

Gap insurance covers the difference between a car's actual cash value and the outstanding loan balance if the vehicle is totaled or stolen, providing financial protection that standard auto insurance lacks. It offers peace of mind for drivers with high loan balances or rapid depreciation but comes with additional premium costs that may not be necessary for those with low loan-to-value ratios or older vehicles. Considering whether gap insurance is worth the extra expense depends on the vehicle's depreciation rate, loan terms, and individual financial risk tolerance.

How to Choose the Right Car Insurance Option

Choosing the right car insurance involves understanding the key differences between gap insurance and standard auto insurance. Standard auto insurance covers damages and liabilities up to your vehicle's current market value, while gap insurance covers the difference between what you owe on your car loan and its depreciated value in case of total loss. Evaluate your loan balance, depreciation rate, and financial risk tolerance to determine if gap insurance provides valuable additional protection beyond standard coverage.

Frequently Asked Questions: Gap and Standard Auto Insurance

Gap insurance covers the difference between your car's actual cash value and the amount you owe on your auto loan if your vehicle is totaled or stolen, while standard auto insurance provides coverage for damages, liability, and theft up to the car's current market value. Frequently asked questions about gap insurance often address eligibility, cost, and whether it is necessary when purchasing a new or leased vehicle, whereas inquiries about standard auto insurance focus on coverage limits, deductibles, and claim processes. Understanding these distinctions helps policyholders choose appropriate protection tailored to their financial risk and vehicle financing situation.

Gap insurance vs Standard auto insurance Infographic

cardiffo.com

cardiffo.com