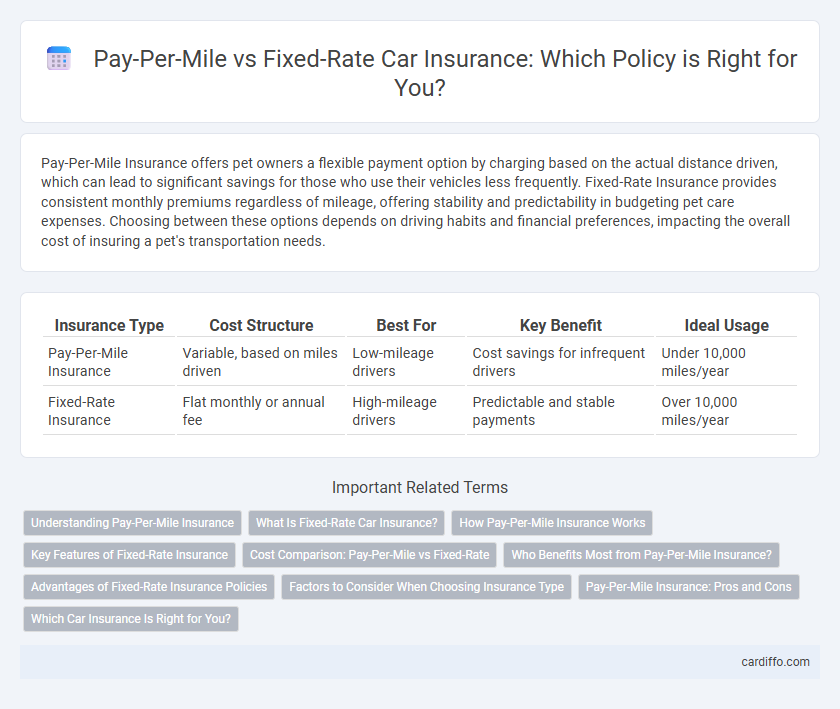

Pay-Per-Mile Insurance offers pet owners a flexible payment option by charging based on the actual distance driven, which can lead to significant savings for those who use their vehicles less frequently. Fixed-Rate Insurance provides consistent monthly premiums regardless of mileage, offering stability and predictability in budgeting pet care expenses. Choosing between these options depends on driving habits and financial preferences, impacting the overall cost of insuring a pet's transportation needs.

Table of Comparison

| Insurance Type | Cost Structure | Best For | Key Benefit | Ideal Usage |

|---|---|---|---|---|

| Pay-Per-Mile Insurance | Variable, based on miles driven | Low-mileage drivers | Cost savings for infrequent drivers | Under 10,000 miles/year |

| Fixed-Rate Insurance | Flat monthly or annual fee | High-mileage drivers | Predictable and stable payments | Over 10,000 miles/year |

Understanding Pay-Per-Mile Insurance

Pay-per-mile insurance offers a cost-effective alternative by charging drivers based on the exact number of miles driven, which is ideal for low-mileage commuters seeking personalized premiums. This model uses telematics devices or smartphone apps to accurately track mileage, ensuring fair pricing tied directly to usage rather than estimated driving habits. Unlike fixed-rate insurance, which requires a consistent premium regardless of mileage, pay-per-mile insurance can lead to significant savings for infrequent drivers or those with fluctuating travel patterns.

What Is Fixed-Rate Car Insurance?

Fixed-rate car insurance provides a predetermined premium based on factors such as the driver's age, vehicle type, and driving history, regardless of miles driven. This traditional policy structure offers predictable monthly costs, making budgeting easier for policyholders. Unlike pay-per-mile insurance, fixed-rate plans do not adjust premiums according to actual vehicle usage or mileage.

How Pay-Per-Mile Insurance Works

Pay-Per-Mile Insurance calculates premiums based on actual miles driven, using telematics devices or smartphone apps to track distance traveled. This usage-based model offers customized pricing by charging a low base rate plus a fixed cost for every mile driven, making it ideal for low-mileage drivers seeking cost savings. Data collected helps insurers assess risk more accurately, promoting fairer pricing compared to traditional fixed-rate insurance that charges a flat premium regardless of mileage.

Key Features of Fixed-Rate Insurance

Fixed-rate insurance offers a predetermined premium that remains constant regardless of driving habits or mileage, providing financial predictability for policyholders. It typically includes comprehensive coverage options such as liability, collision, and uninsured motorist protection, ensuring broad protection on the road. This insurance type is ideal for drivers with consistent mileage and those seeking straightforward budgeting without the need to track usage.

Cost Comparison: Pay-Per-Mile vs Fixed-Rate

Pay-per-mile insurance offers cost savings for low-mileage drivers by charging premiums based on actual miles driven, resulting in lower monthly payments compared to fixed-rate insurance. Fixed-rate insurance provides predictable expenses with a set premium regardless of mileage, often benefiting high-mileage drivers who do not face variable costs. For drivers averaging less than 10,000 miles annually, pay-per-mile plans can reduce premiums by up to 30% compared to traditional fixed-rate policies.

Who Benefits Most from Pay-Per-Mile Insurance?

Pay-per-mile insurance primarily benefits low-mileage drivers who use their vehicles infrequently, such as urban residents, retirees, and remote workers. This model offers significant savings by charging premiums based on actual miles driven, making it ideal for those with predictable and limited annual mileage. Conversely, drivers with high mileage or frequent long-distance commutes may find fixed-rate insurance more cost-effective due to its stable monthly premiums.

Advantages of Fixed-Rate Insurance Policies

Fixed-rate insurance policies offer consistent monthly premiums that simplify budgeting and financial planning for vehicle owners. These policies provide comprehensive coverage without mileage restrictions, ensuring protection regardless of how much the insured drives. Fixed-rate plans eliminate the need for tracking miles, making them a convenient choice for drivers with unpredictable or high mileage.

Factors to Consider When Choosing Insurance Type

Choosing between pay-per-mile insurance and fixed-rate insurance involves evaluating your average annual mileage and driving habits to ensure cost efficiency. Consider the predictability of your driving patterns, as pay-per-mile suits low-mileage drivers seeking variable costs, while fixed-rate plans provide budget stability regardless of distance traveled. Assess potential savings against administrative fees and coverage options to determine which policy aligns best with your financial goals and risk tolerance.

Pay-Per-Mile Insurance: Pros and Cons

Pay-per-mile insurance offers cost savings for low-mileage drivers by charging premiums based on actual miles driven, promoting fairness and potentially reducing expenses compared to fixed-rate insurance. It provides increased control and transparency over insurance costs, but may result in higher overall expenses for frequent drivers and requires accurate mileage tracking through telematics devices. Pay-per-mile insurance is ideal for occasional drivers seeking personalized rates, though the administrative requirements and potential privacy concerns may deter some customers.

Which Car Insurance Is Right for You?

Pay-per-mile insurance offers cost efficiency for low-mileage drivers by charging premiums based on actual miles driven, making it ideal for those who use their car infrequently or primarily for short trips. Fixed-rate insurance provides predictable monthly payments and comprehensive coverage, benefiting drivers who cover high mileage or prefer stable budgeting. Evaluating your driving habits, average annual mileage, and budget flexibility helps determine whether pay-per-mile or fixed-rate insurance aligns better with your needs.

Pay-Per-Mile Insurance vs Fixed-Rate Insurance Infographic

cardiffo.com

cardiffo.com