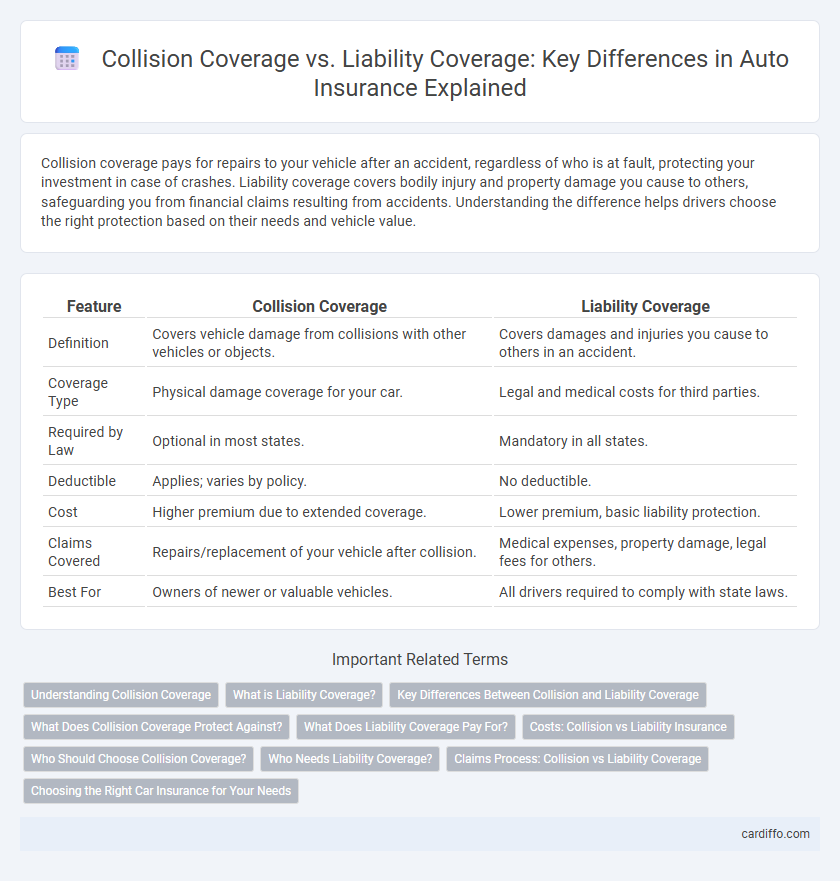

Collision coverage pays for repairs to your vehicle after an accident, regardless of who is at fault, protecting your investment in case of crashes. Liability coverage covers bodily injury and property damage you cause to others, safeguarding you from financial claims resulting from accidents. Understanding the difference helps drivers choose the right protection based on their needs and vehicle value.

Table of Comparison

| Feature | Collision Coverage | Liability Coverage |

|---|---|---|

| Definition | Covers vehicle damage from collisions with other vehicles or objects. | Covers damages and injuries you cause to others in an accident. |

| Coverage Type | Physical damage coverage for your car. | Legal and medical costs for third parties. |

| Required by Law | Optional in most states. | Mandatory in all states. |

| Deductible | Applies; varies by policy. | No deductible. |

| Cost | Higher premium due to extended coverage. | Lower premium, basic liability protection. |

| Claims Covered | Repairs/replacement of your vehicle after collision. | Medical expenses, property damage, legal fees for others. |

| Best For | Owners of newer or valuable vehicles. | All drivers required to comply with state laws. |

Understanding Collision Coverage

Collision coverage protects your vehicle by covering repair or replacement costs after an accident, regardless of fault. It typically applies when your car collides with another vehicle or object, such as a tree or guardrail. Unlike liability coverage, which pays for damage to other parties, collision coverage ensures your own vehicle is financially safeguarded.

What is Liability Coverage?

Liability coverage is an insurance policy component that protects drivers by covering costs related to bodily injury and property damage they cause to others in an accident. This coverage pays for medical expenses, repair bills, and legal fees up to the policy limits, ensuring the policyholder is not personally responsible for these costs. It does not cover the policyholder's own injuries or vehicle damage, distinguishing it from collision coverage.

Key Differences Between Collision and Liability Coverage

Collision coverage pays for damage to your own vehicle after an accident, regardless of fault, while liability coverage reimburses others for injuries and property damage you cause. Collision protects your car in crashes with other vehicles or objects, whereas liability addresses legal costs and claims if you're responsible for an accident. Key differences include the scope of coverage--collision is vehicle-centric and liability is third-party focused--and their role in overall auto insurance premiums.

What Does Collision Coverage Protect Against?

Collision coverage protects against damages to your vehicle resulting from collisions with other cars, objects, or as a result of overturning, regardless of fault. It covers repair or replacement costs for your car after accidents such as hitting a tree, fence, or another vehicle. This type of insurance is essential for safeguarding your own vehicle's value, offering financial protection beyond what liability coverage provides.

What Does Liability Coverage Pay For?

Liability coverage pays for damages and injuries you cause to others in an accident, including medical expenses, property repair costs, and legal fees if you're sued. It does not cover your own vehicle or injuries, which are typically covered under collision or personal injury protection. State laws often require minimum liability coverage limits to protect drivers financially in case of accidents.

Costs: Collision vs Liability Insurance

Collision insurance typically has higher premiums due to coverage for vehicle repairs after accidents regardless of fault, with average annual costs ranging from $300 to $800. Liability coverage, which only pays for damages and injuries you cause to others, generally costs less, averaging between $100 and $400 per year. Factors such as driving history, vehicle type, and location significantly influence the premium differences between collision and liability insurance.

Who Should Choose Collision Coverage?

Drivers with newer or higher-value vehicles should choose collision coverage to protect against repair or replacement costs after an accident, regardless of fault. Individuals who frequently drive in urban areas with heavy traffic or have longer commutes benefit from collision coverage due to higher accident risk. Those without sufficient savings to cover vehicle repairs or replacements also find collision coverage essential for financial security after collisions.

Who Needs Liability Coverage?

Liability coverage is essential for all drivers as it protects against financial losses resulting from injuries or property damage caused to others in an accident. Unlike collision coverage, which pays for damage to your own vehicle, liability coverage is legally required in most states to ensure victims receive appropriate compensation. Without liability coverage, drivers face significant out-of-pocket expenses and potential legal penalties.

Claims Process: Collision vs Liability Coverage

Collision coverage claims require documentation of vehicle damage and may involve repair estimates or total loss evaluations, often necessitating direct interaction with repair shops and adjusters. Liability coverage claims focus on proving fault and the extent of bodily injury or property damage to third parties, with settlements addressing medical expenses, legal fees, and property repairs. The claims process for collision is vehicle-centered, whereas liability claims revolve around third-party damages and legal responsibilities.

Choosing the Right Car Insurance for Your Needs

Collision coverage protects your vehicle by covering repair costs after an accident regardless of fault, making it essential for drivers with newer or financed cars. Liability coverage pays for damages and injuries you cause to others, meeting legal requirements and protecting your assets from lawsuits. Tailoring your insurance depends on factors like car value, driving habits, and financial responsibility, ensuring you balance protection with cost-effectiveness.

Collision Coverage vs Liability Coverage Infographic

cardiffo.com

cardiffo.com