Gap insurance covers the difference between your vehicle's actual cash value and the outstanding loan or lease amount if your car is totaled or stolen. Loan/lease payoff protection specifically ensures payments are made to clear your debt in case of disability or involuntary unemployment, preventing default. Understanding the distinction helps drivers protect both their financial investment and credit standing during unforeseen circumstances.

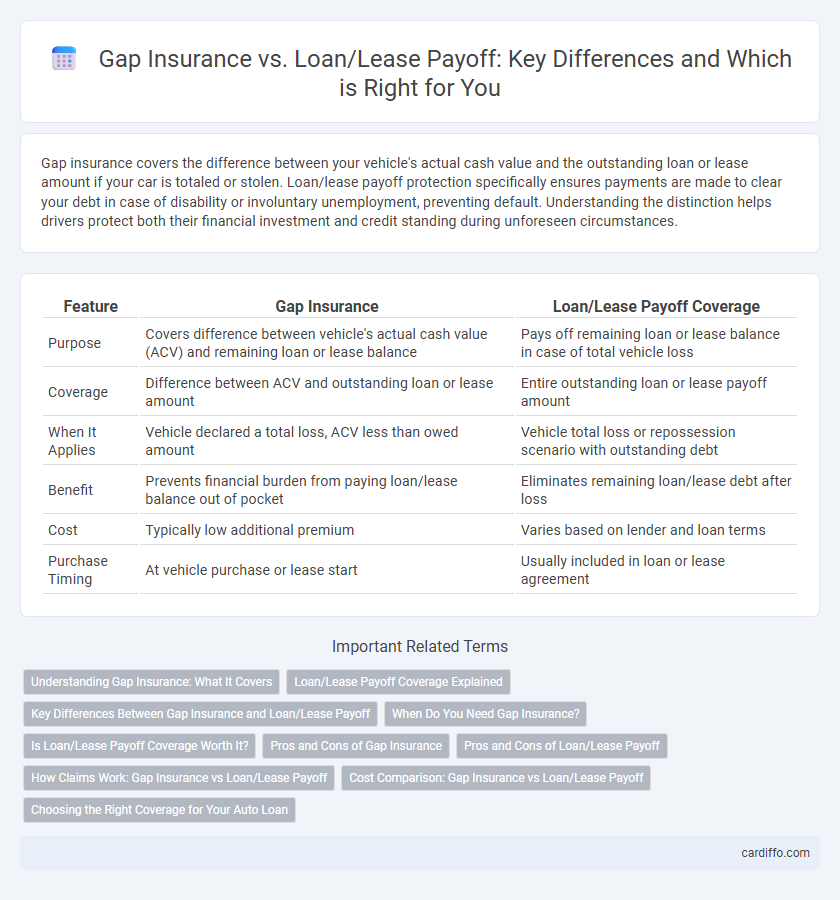

Table of Comparison

| Feature | Gap Insurance | Loan/Lease Payoff Coverage |

|---|---|---|

| Purpose | Covers difference between vehicle's actual cash value (ACV) and remaining loan or lease balance | Pays off remaining loan or lease balance in case of total vehicle loss |

| Coverage | Difference between ACV and outstanding loan or lease amount | Entire outstanding loan or lease payoff amount |

| When It Applies | Vehicle declared a total loss, ACV less than owed amount | Vehicle total loss or repossession scenario with outstanding debt |

| Benefit | Prevents financial burden from paying loan/lease balance out of pocket | Eliminates remaining loan/lease debt after loss |

| Cost | Typically low additional premium | Varies based on lender and loan terms |

| Purchase Timing | At vehicle purchase or lease start | Usually included in loan or lease agreement |

Understanding Gap Insurance: What It Covers

Gap insurance covers the difference between the actual cash value of a vehicle and the remaining balance on a loan or lease if the car is totaled or stolen. It specifically protects borrowers from financial loss when standard auto insurance payouts fall short of paying off their loan or lease obligations. This coverage is essential for individuals with negative equity or low down payments, ensuring they are not responsible for paying the gap out-of-pocket.

Loan/Lease Payoff Coverage Explained

Loan/Lease Payoff Coverage protects borrowers by covering the remaining balance on a car loan or lease if the vehicle is totaled or stolen, bridging the gap between standard insurance payouts and the actual amount owed. This coverage is essential because standard auto insurance typically reimburses only the vehicle's current market value, which can be less than the outstanding loan or lease amount. Gap Insurance is specifically designed to pay off this difference, ensuring borrowers are not financially burdened by paying off a loan for a car they no longer possess.

Key Differences Between Gap Insurance and Loan/Lease Payoff

Gap insurance covers the difference between your vehicle's actual cash value and the amount owed on a loan or lease in the event of total loss. Loan or lease payoff refers to the total remaining balance required to fully satisfy the terms of a vehicle loan or lease contract. While gap insurance protects against financial loss due to depreciation and outstanding debt, loan/lease payoff simply denotes the exact amount needed to clear your financial obligation.

When Do You Need Gap Insurance?

Gap insurance is essential when the outstanding loan or lease balance on a vehicle exceeds its actual cash value, protecting drivers from financial loss after a total loss or theft. It is particularly crucial during the early years of a loan or lease, as cars depreciate rapidly, creating a significant coverage gap. Purchasing gap insurance ensures that borrowers are not responsible for paying the difference between the insurance payout and the remaining loan or lease payoff.

Is Loan/Lease Payoff Coverage Worth It?

Loan/lease payoff coverage protects vehicle owners from owing more than the car's value when totaled, covering the remaining balance beyond what standard GAP insurance pays. This coverage is particularly valuable for those with high-interest loans or long-term leases where depreciation outpaces payments. Evaluating the loan terms, vehicle depreciation rate, and financial risk helps determine if loan/lease payoff coverage is a cost-effective addition to your insurance portfolio.

Pros and Cons of Gap Insurance

Gap insurance covers the difference between your vehicle's actual cash value and the remaining balance on your loan or lease, protecting you from financial loss if your car is totaled or stolen. It offers peace of mind by ensuring that you won't owe money beyond your insurance payout, but it comes with additional premium costs and may not be necessary if your loan amount is low or your vehicle depreciates slowly. While it provides crucial protection in high-risk scenarios, gap insurance does not cover routine repairs or decrease your monthly loan payments.

Pros and Cons of Loan/Lease Payoff

Loan/Lease Payoff insurance covers the remaining balance of a financed vehicle when its actual cash value is less than the owed amount, protecting against financial loss from total loss events. Pros include full coverage of outstanding loan or lease balances, ensuring no out-of-pocket expense beyond regular premiums, and peace of mind for those with high depreciation vehicles or long loan terms. Cons involve higher premium costs compared to standard insurance, potential coverage gaps if the payoff balance changes, and limited benefit once the loan is paid off or the vehicle's value surpasses the payoff amount.

How Claims Work: Gap Insurance vs Loan/Lease Payoff

Gap insurance covers the difference between your vehicle's actual cash value and the remaining loan or lease balance if your car is totaled or stolen, ensuring you're not out-of-pocket for that gap. In contrast, loan or lease payoff coverage directly pays off your lender or leasing company, but may not cover the entire difference if the payoff amount exceeds the vehicle's value. Claims with gap insurance are processed after your primary auto insurance settles the actual cash value, while loan/lease payoff insurance interacts directly with the lender to clear outstanding debts.

Cost Comparison: Gap Insurance vs Loan/Lease Payoff

Gap insurance typically costs between $20 and $40 per month, offering a cost-effective way to cover the difference between a vehicle's actual cash value and the outstanding loan or lease balance in case of a total loss. In contrast, loan or lease payoff coverage, often bundled with comprehensive auto insurance, can increase premiums significantly due to the higher risk exposure borne by the insurer. Choosing gap insurance provides targeted financial protection at a lower cost compared to the inflated premiums associated with full loan or lease payoff coverage.

Choosing the Right Coverage for Your Auto Loan

Gap insurance covers the difference between your car's actual cash value and the remaining balance on your auto loan or lease if your vehicle is totaled or stolen. Loan/lease payoff coverage protects against outstanding loan or lease payments but may not cover the full depreciation gap, leaving potential financial risk. Selecting the right coverage depends on your loan-to-value ratio, vehicle depreciation rate, and personal financial situation to ensure comprehensive protection.

Gap Insurance vs Loan/Lease Payoff Infographic

cardiffo.com

cardiffo.com