Stacked coverage allows policyholders to combine the liability limits of multiple vehicles on one policy, increasing the total available coverage after an accident. Unstacked coverage limits the claim to the coverage amount of the single vehicle involved, offering a lower premium but less overall protection. Understanding the differences helps in selecting the right policy based on budget and risk tolerance.

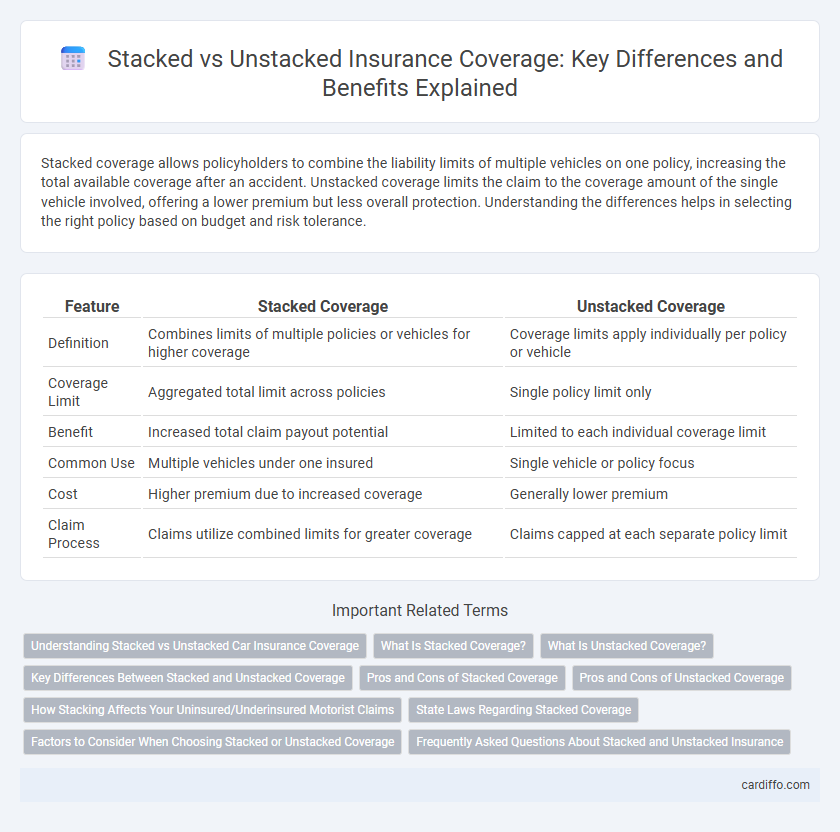

Table of Comparison

| Feature | Stacked Coverage | Unstacked Coverage |

|---|---|---|

| Definition | Combines limits of multiple policies or vehicles for higher coverage | Coverage limits apply individually per policy or vehicle |

| Coverage Limit | Aggregated total limit across policies | Single policy limit only |

| Benefit | Increased total claim payout potential | Limited to each individual coverage limit |

| Common Use | Multiple vehicles under one insured | Single vehicle or policy focus |

| Cost | Higher premium due to increased coverage | Generally lower premium |

| Claim Process | Claims utilize combined limits for greater coverage | Claims capped at each separate policy limit |

Understanding Stacked vs Unstacked Car Insurance Coverage

Stacked coverage in car insurance allows a policyholder to combine uninsured motorist or underinsured motorist coverage limits across multiple vehicles on the same policy, increasing the total available coverage in the event of an accident. Unstacked coverage restricts the coverage to a single vehicle's limit, which may result in lower premiums but less protection if damages exceed those limits. Choosing between stacked and unstacked coverage depends on the insured's risk tolerance, number of vehicles, and the potential financial impact of uninsured or underinsured accidents.

What Is Stacked Coverage?

Stacked coverage in auto insurance allows policyholders to combine the liability limits of multiple vehicles on the same policy, increasing the total available coverage in the event of an accident. This means if you have two vehicles insured with $50,000 each in uninsured motorist coverage, stacked coverage lets you access up to $100,000 for a single claim. Stacked coverage is particularly beneficial for drivers seeking higher protection against bodily injury or property damage from uninsured or underinsured drivers.

What Is Unstacked Coverage?

Unstacked coverage in insurance refers to the policy structure where only the limits of the individual vehicle's coverage apply, rather than combining, or "stacking," the limits across multiple vehicles. This means if you have uninsured motorist coverage on several vehicles, each vehicle's coverage limit is separate and cannot be added together to increase the payout. Unstacked coverage often results in lower premiums but provides less total protection compared to stacked coverage options.

Key Differences Between Stacked and Unstacked Coverage

Stacked coverage allows policyholders to combine uninsured motorist limits across multiple vehicles on one policy, significantly increasing the total available coverage in an accident involving uninsured or underinsured drivers. Unstacked coverage restricts the claim limit to the coverage amount of the individual vehicle involved, limiting the payout to the policy's per-vehicle limit. Key differences include total coverage limits, premium costs, and state-specific regulations, which influence whether stacking is allowed or beneficial for comprehensive uninsured motorist protection.

Pros and Cons of Stacked Coverage

Stacked coverage in insurance allows policyholders to combine coverage limits from multiple vehicles, increasing the total available payout after an accident, which can significantly enhance financial protection. It provides higher compensation for injuries or damages but typically comes with higher premium costs compared to unstacked coverage. A potential downside is increased premium expenses, yet stacked coverage offers greater flexibility and security in multi-vehicle insurance policies.

Pros and Cons of Unstacked Coverage

Unstacked coverage in insurance limits the payout to a single vehicle's liability limit, reducing premium costs significantly compared to stacked coverage. This approach minimizes the financial burden for policyholders by preventing cumulative claims across multiple vehicles on the policy. However, unstacked coverage may leave insured individuals undercompensated in severe accidents where damages exceed the coverage limit, increasing out-of-pocket expenses.

How Stacking Affects Your Uninsured/Underinsured Motorist Claims

Stacked coverage in uninsured/underinsured motorist claims aggregates the coverage limits from multiple vehicles on a policy, increasing the maximum payout available after an accident. This allows policyholders to tap into the combined coverage limits of all insured vehicles, enhancing financial protection when facing serious injuries or damages. Unstacked coverage limits each claim to the individual vehicle's coverage, potentially restricting the available compensation and leaving insured parties underprotected.

State Laws Regarding Stacked Coverage

State laws on stacked coverage vary significantly, with some states permitting stacking of uninsured or underinsured motorist coverage across multiple vehicles on a policy, while others prohibit stacking or impose strict limitations. In states allowing stacking, insured drivers can combine coverage limits from multiple vehicles to increase compensation after an accident, enhancing financial protection. It is crucial to review specific state regulations and insurance policy terms to understand stacking rights and limitations fully.

Factors to Consider When Choosing Stacked or Unstacked Coverage

When choosing between stacked and unstacked coverage in auto insurance, factors to consider include the total coverage limits, cost differences, and individual risk profiles. Stacked coverage combines the limits from multiple policies or vehicles, providing higher payout potential in multi-car accidents, while unstacked coverage limits claims to individual policy amounts. Policyholders should weigh the increased premiums of stacked coverage against the added financial protection it offers in complex claims scenarios.

Frequently Asked Questions About Stacked and Unstacked Insurance

Stacked coverage allows policyholders to combine the liability limits of multiple vehicles under one policy, increasing the total available coverage in the event of an accident. Unstacked coverage limits compensation to the insurance amount of the single vehicle involved, often resulting in lower premiums but less comprehensive protection. Frequently asked questions address the cost differences, state regulations allowing stacking, and scenarios where stacked coverage offers significant financial advantages after multi-vehicle collisions.

Stacked Coverage vs Unstacked Coverage Infographic

cardiffo.com

cardiffo.com