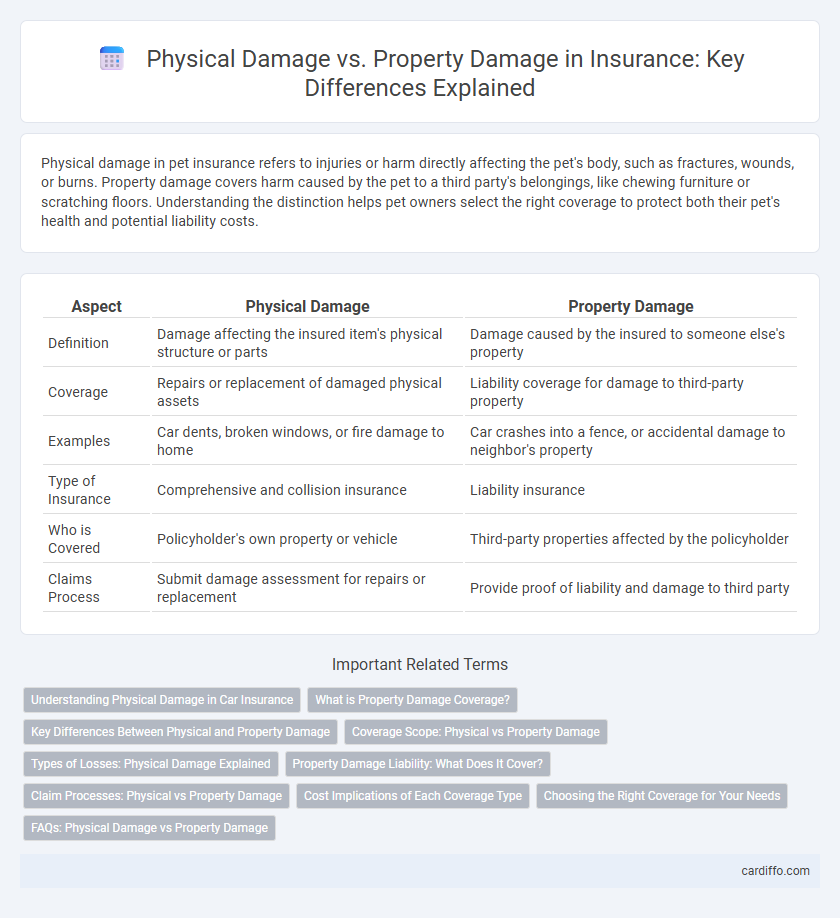

Physical damage in pet insurance refers to injuries or harm directly affecting the pet's body, such as fractures, wounds, or burns. Property damage covers harm caused by the pet to a third party's belongings, like chewing furniture or scratching floors. Understanding the distinction helps pet owners select the right coverage to protect both their pet's health and potential liability costs.

Table of Comparison

| Aspect | Physical Damage | Property Damage |

|---|---|---|

| Definition | Damage affecting the insured item's physical structure or parts | Damage caused by the insured to someone else's property |

| Coverage | Repairs or replacement of damaged physical assets | Liability coverage for damage to third-party property |

| Examples | Car dents, broken windows, or fire damage to home | Car crashes into a fence, or accidental damage to neighbor's property |

| Type of Insurance | Comprehensive and collision insurance | Liability insurance |

| Who is Covered | Policyholder's own property or vehicle | Third-party properties affected by the policyholder |

| Claims Process | Submit damage assessment for repairs or replacement | Provide proof of liability and damage to third party |

Understanding Physical Damage in Car Insurance

Physical damage in car insurance refers to the harm caused to a vehicle resulting from collisions, vandalism, fire, or natural disasters, covering repairs or replacement of the damaged parts. This type of coverage is typically split into collision insurance, which handles damages from accidents with other vehicles or objects, and comprehensive insurance that protects against non-collision incidents such as theft or weather-related damage. Understanding physical damage coverage helps policyholders safeguard their vehicle's value and avoid costly out-of-pocket repairs after unexpected events.

What is Property Damage Coverage?

Property Damage Coverage protects against financial losses resulting from harm to physical property caused by accidents, natural disasters, or vandalism. This insurance typically covers repairs, replacements, and restoration costs for insured assets such as buildings, equipment, and personal belongings. It excludes bodily injuries and focuses exclusively on tangible property damage to limit the insured's liability and repair expenses.

Key Differences Between Physical and Property Damage

Physical damage refers to tangible harm inflicted on a vehicle or object, impacting its structure or function, while property damage encompasses damage to personal or real property caused by an insured party. Key differences include the scope, where physical damage is often specific to insured vehicles under comprehensive or collision coverage, and property damage typically involves liability coverage for harm to others' belongings or real estate. Understanding these distinctions is essential for selecting appropriate insurance policies and ensuring adequate protection against diverse types of risks.

Coverage Scope: Physical vs Property Damage

Physical damage coverage in insurance typically refers to harm affecting tangible, movable assets like vehicles or machinery, ensuring repair or replacement costs are covered. Property damage coverage, conversely, relates to harm caused to real property such as buildings, land, or fixed structures, protecting the insured from losses due to events like fire, vandalism, or natural disasters. Understanding the distinction in coverage scope is crucial for selecting appropriate insurance policies tailored to specific risk exposures.

Types of Losses: Physical Damage Explained

Physical damage in insurance refers to tangible harm to a property or asset, including damage to structures, machinery, vehicles, or inventory caused by events such as fire, vandalism, or natural disasters. This type of loss directly affects the physical condition and usability of the insured item, often necessitating repair or replacement costs. Understanding physical damage is crucial for selecting appropriate coverage, as it differs from property damage liability that covers legal responsibility for injuring others or damaging their property.

Property Damage Liability: What Does It Cover?

Property Damage Liability in insurance covers the financial responsibility for damage caused to someone else's physical property due to your negligence or actions. This includes repairs or replacement costs for buildings, vehicles, fences, or other personal belongings damaged in an accident for which you are legally liable. Coverage typically extends to incidents such as car accidents, vandalism, and accidental damage on your property, protecting you from out-of-pocket expenses and potential lawsuits.

Claim Processes: Physical vs Property Damage

Physical damage claims require detailed documentation of the tangible harm to vehicles or equipment to verify the extent of the loss, often involving inspections and repair estimates. Property damage claims focus on losses to real estate and personal belongings, emphasizing proof of ownership and damage appraisals to determine coverage. Both claim processes demand timely reporting, but physical damage claims typically prioritize immediate assessment for repair or replacement, while property damage claims may involve prolonged evaluations for structural integrity and content valuation.

Cost Implications of Each Coverage Type

Physical damage insurance typically covers repair or replacement costs for your own vehicle after incidents like collisions or vandalism, often resulting in higher premiums due to direct coverage of personal assets. Property damage insurance addresses liability for damages your vehicle causes to others' property, generally leading to lower but essential costs to protect against legal claims or settlements. Understanding these cost implications helps policyholders balance premium expenses with adequate financial protection in the event of an accident.

Choosing the Right Coverage for Your Needs

Understanding the difference between physical damage and property damage insurance is crucial for selecting the right coverage. Physical damage coverage protects your own vehicle or insured property from events like accidents, theft, or natural disasters, while property damage coverage covers liability for damage you cause to others' property. Assessing your assets, risk exposure, and liability limits will help tailor a policy that adequately safeguards your financial interests.

FAQs: Physical Damage vs Property Damage

Physical damage refers specifically to tangible harm inflicted on insured items such as vehicles or equipment, while property damage encompasses any loss or destruction of physical assets, including buildings and personal belongings. Common FAQs clarify coverage differences, claim processes, and policy limits, emphasizing that physical damage is often a subset within broader property damage insurance. Understanding these distinctions helps policyholders select appropriate coverage and accurately assess claims related to accidents, disasters, or vandalism.

Physical Damage vs Property Damage Infographic

cardiffo.com

cardiffo.com