Choosing the right insurance policy involves balancing the deductible and premium to fit your financial situation. A higher deductible typically lowers your premium costs, offering savings on monthly payments but increasing out-of-pocket expenses during a claim. Conversely, a lower deductible raises your premium but reduces the amount you pay upfront when filing a claim, providing greater immediate financial protection.

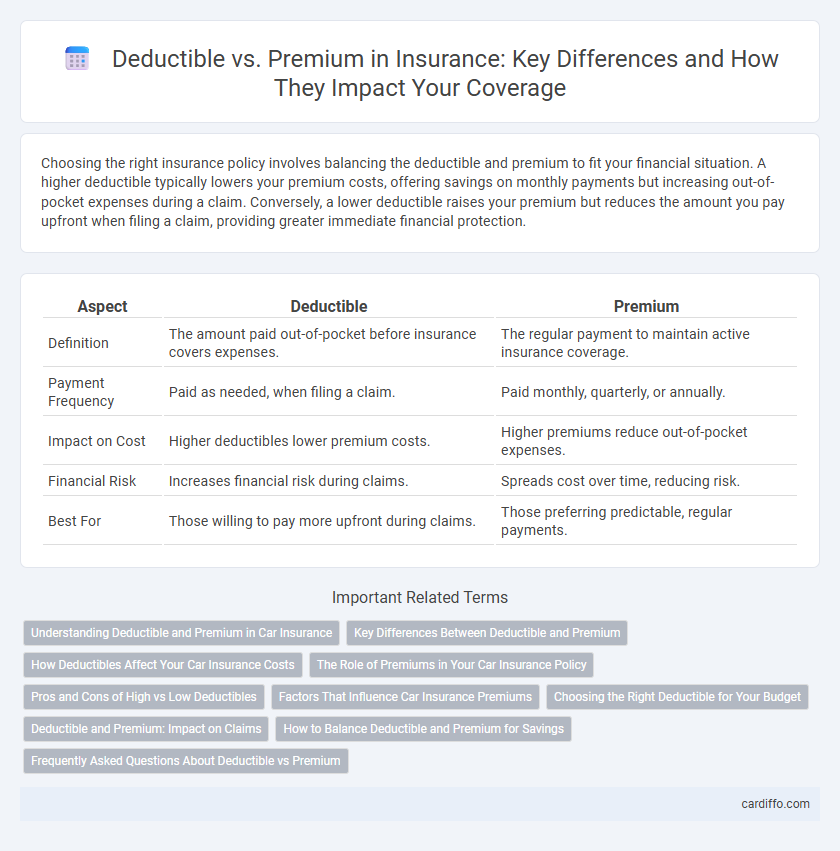

Table of Comparison

| Aspect | Deductible | Premium |

|---|---|---|

| Definition | The amount paid out-of-pocket before insurance covers expenses. | The regular payment to maintain active insurance coverage. |

| Payment Frequency | Paid as needed, when filing a claim. | Paid monthly, quarterly, or annually. |

| Impact on Cost | Higher deductibles lower premium costs. | Higher premiums reduce out-of-pocket expenses. |

| Financial Risk | Increases financial risk during claims. | Spreads cost over time, reducing risk. |

| Best For | Those willing to pay more upfront during claims. | Those preferring predictable, regular payments. |

Understanding Deductible and Premium in Car Insurance

In car insurance, the deductible is the amount you pay out of pocket before your insurer covers a claim, directly impacting your financial responsibility during an accident. Premiums represent the regular payments made to maintain active coverage, influenced by factors such as driving history, vehicle type, and coverage limits. Choosing a higher deductible typically lowers the premium, offering cost savings upfront but increasing expenses if a claim occurs.

Key Differences Between Deductible and Premium

A deductible is the amount a policyholder must pay out-of-pocket before insurance coverage begins, while a premium is the regular payment made to maintain active insurance protection. Deductibles directly impact claim costs, with higher deductibles typically resulting in lower premiums. Premiums represent ongoing costs regardless of claims, serving as the insurer's revenue to cover risk and administrative expenses.

How Deductibles Affect Your Car Insurance Costs

Higher deductibles generally lower your car insurance premium because you agree to pay more out-of-pocket in the event of a claim, reducing the insurer's risk. Choosing a low deductible increases your premium as the insurer assumes greater financial responsibility for claims. Evaluating your financial ability to cover the deductible can help balance upfront savings with potential out-of-pocket expenses after an accident.

The Role of Premiums in Your Car Insurance Policy

Premiums in your car insurance policy represent the recurring cost paid to maintain coverage and protect against financial loss from accidents or theft. These payments directly influence the total amount you pay yearly and can vary based on factors like driving history, vehicle type, and coverage level. Choosing a higher premium often lowers your deductible, balancing upfront costs with out-of-pocket expenses during claims.

Pros and Cons of High vs Low Deductibles

High deductibles typically result in lower insurance premiums, making them cost-effective for those who rarely file claims but risky for individuals who may face unexpected expenses. Low deductibles require higher premiums, providing greater financial protection and peace of mind during frequent or costly claims. Choosing between high and low deductibles depends on balancing upfront costs with potential out-of-pocket expenses based on personal risk tolerance and financial stability.

Factors That Influence Car Insurance Premiums

Car insurance premiums are influenced by factors such as the deductible amount, driver's age, driving history, vehicle type, and location. Higher deductibles typically lower premiums because policyholders assume more initial costs in a claim. Insurance companies assess risk using credit scores, annual mileage, and claims history to determine the premium rate accurately.

Choosing the Right Deductible for Your Budget

Selecting the right deductible hinges on balancing upfront premium costs and potential out-of-pocket expenses. A higher deductible typically lowers your monthly premium, making it ideal for those with a steady budget and emergency savings. Analyzing your financial situation and risk tolerance helps optimize your insurance plan by aligning deductible levels with your ability to absorb unexpected costs.

Deductible and Premium: Impact on Claims

A higher deductible in insurance policies typically results in lower premiums, reducing upfront costs but increasing out-of-pocket expenses during claims. Choosing a lower premium often means accepting a lower deductible, which can lead to higher regular payments but less financial burden when filing claims. Balancing deductible and premium levels is crucial for policyholders to optimize claim-related expenses and overall insurance affordability.

How to Balance Deductible and Premium for Savings

Balancing deductible and premium effectively involves selecting a higher deductible to lower monthly premiums, which can result in significant long-term savings if you rarely file claims. Analyzing your financial situation, risk tolerance, and claim frequency helps determine the optimal deductible amount that keeps premiums affordable while minimizing out-of-pocket expenses during a claim. Utilizing insurance calculators and consulting with agents provides tailored insights to strike the ideal balance between upfront costs and potential savings.

Frequently Asked Questions About Deductible vs Premium

A deductible is the amount a policyholder must pay out-of-pocket before insurance coverage begins, while a premium is the regular payment made to maintain the insurance policy. Frequently asked questions often address how choosing a higher deductible can lower premium costs and when it makes sense to select a deductible based on individual financial circumstances. Understanding the balance between deductible amounts and premium payments helps policyholders optimize their insurance costs and coverage benefits.

Deductible vs Premium Infographic

cardiffo.com

cardiffo.com