Uninsured motorist coverage protects you if an at-fault driver has no insurance, covering medical expenses and damages that would otherwise be your responsibility. Underinsured motorist coverage applies when the at-fault driver's insurance is insufficient to cover your losses, bridging the gap between their policy limits and your actual expenses. Both types of coverage are essential for comprehensive protection against drivers who cannot fully compensate you after an accident.

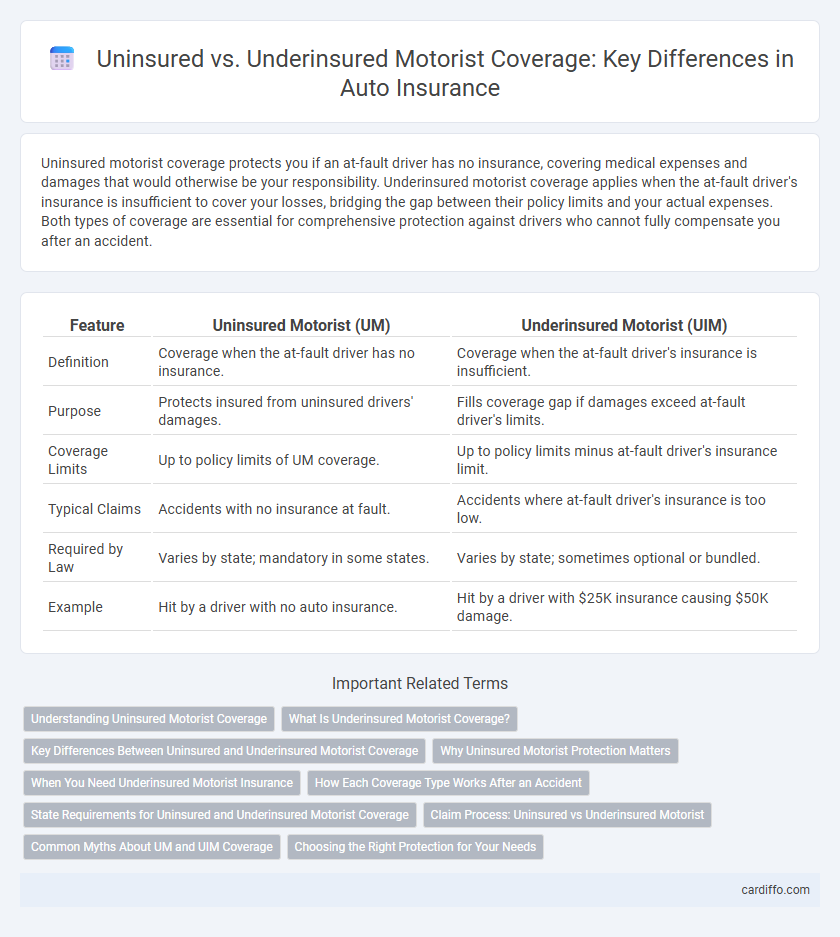

Table of Comparison

| Feature | Uninsured Motorist (UM) | Underinsured Motorist (UIM) |

|---|---|---|

| Definition | Coverage when the at-fault driver has no insurance. | Coverage when the at-fault driver's insurance is insufficient. |

| Purpose | Protects insured from uninsured drivers' damages. | Fills coverage gap if damages exceed at-fault driver's limits. |

| Coverage Limits | Up to policy limits of UM coverage. | Up to policy limits minus at-fault driver's insurance limit. |

| Typical Claims | Accidents with no insurance at fault. | Accidents where at-fault driver's insurance is too low. |

| Required by Law | Varies by state; mandatory in some states. | Varies by state; sometimes optional or bundled. |

| Example | Hit by a driver with no auto insurance. | Hit by a driver with $25K insurance causing $50K damage. |

Understanding Uninsured Motorist Coverage

Uninsured Motorist (UM) coverage protects policyholders against drivers who lack any insurance, covering bodily injury and sometimes property damage incurred in an accident with such drivers. This coverage is essential in states with high rates of uninsured drivers, offering financial protection when at-fault parties cannot pay for damages. Understanding UM coverage helps insured individuals avoid out-of-pocket expenses and ensures medical bills and repairs are covered even if the other driver is uninsured.

What Is Underinsured Motorist Coverage?

Underinsured motorist coverage protects policyholders when an at-fault driver's insurance limits are insufficient to cover the damages or medical expenses resulting from an accident. This insurance bridges the gap between the at-fault driver's liability coverage and the actual costs incurred by the insured, including property damage, medical bills, and lost wages. It ensures financial protection when the responsible party's coverage falls short, unlike uninsured motorist coverage, which applies when the at-fault driver has no insurance at all.

Key Differences Between Uninsured and Underinsured Motorist Coverage

Uninsured motorist coverage protects policyholders from drivers who have no insurance, while underinsured motorist coverage applies when a driver's insurance limits are insufficient to cover the damages. Key differences include liability limits and the type of coverage triggered, with uninsured motorist coverage activated by a completely uninsured driver and underinsured motorist coverage required when the at-fault driver's insurance policy does not meet the policyholder's damage claims. Understanding these distinctions helps ensure adequate protection against financial loss in accidents involving drivers with inadequate or no insurance.

Why Uninsured Motorist Protection Matters

Uninsured Motorist Protection matters because it safeguards policyholders against financial losses when involved in accidents caused by drivers without valid insurance. It covers medical expenses, lost wages, and property damage that would otherwise be unpaid due to the at-fault driver lacking coverage. This protection ensures peace of mind and financial stability regardless of the other party's insurance status.

When You Need Underinsured Motorist Insurance

Underinsured Motorist Insurance is essential when the at-fault driver's liability coverage is insufficient to cover your medical expenses, lost wages, and vehicle damage. This coverage fills the gap between the other driver's insurance limits and your total financial loss, protecting you from significant out-of-pocket costs. It is particularly important in states with lower minimum liability requirements or in serious accidents where medical bills exceed typical coverage amounts.

How Each Coverage Type Works After an Accident

Uninsured Motorist coverage pays for your injuries and damages when the at-fault driver has no insurance, covering medical bills and property repairs up to your policy limits. Underinsured Motorist coverage activates when the at-fault driver's insurance is insufficient to cover your losses, bridging the gap between their policy limits and your actual expenses. Both types of coverage require you to file a claim with your own insurer, allowing for faster compensation while protecting your financial interests after an accident.

State Requirements for Uninsured and Underinsured Motorist Coverage

State requirements for uninsured motorist (UM) and underinsured motorist (UIM) coverage vary significantly across the United States, with some states mandating both coverages while others require only one or neither. For instance, states like California and New York mandate UM coverage but consider UIM coverage optional, whereas states such as Illinois require both UM and UIM coverages as minimum insurance standards. Understanding each state's legislation is crucial for drivers to ensure compliance and adequate protection against financially irresponsible motorists.

Claim Process: Uninsured vs Underinsured Motorist

Uninsured Motorist (UM) claims require proving the other driver has no insurance coverage, often involving police reports and witness statements to validate fault. Underinsured Motorist (UIM) claims focus on covering the gap between the at-fault driver's limited insurance and the actual damages, necessitating detailed documentation of medical expenses and repair costs. Both claim processes involve filing through your own insurer, but UIM claims frequently demand more extensive evidence to substantiate the insufficiency of the other party's coverage.

Common Myths About UM and UIM Coverage

Many drivers mistakenly believe uninsured motorist (UM) and underinsured motorist (UIM) coverage are redundant, but UM protects against drivers with no insurance, while UIM covers those with insufficient limits. Another common myth is that UM and UIM coverage is automatically included in every policy; however, these coverages often require explicit selection and additional premiums. Consumers also wrongly assume state minimum liability guarantees full protection, overlooking that UM and UIM policies provide critical financial safety nets beyond basic liability limits.

Choosing the Right Protection for Your Needs

Choosing the right protection between uninsured motorist (UM) and underinsured motorist (UIM) coverage depends on your risk tolerance and state requirements. Uninsured motorist coverage safeguards you if an at-fault driver lacks any insurance, while underinsured motorist coverage protects against drivers whose liability limits are insufficient to cover your damages. Assessing factors like local uninsured driver rates, average medical costs, and your vehicle's value ensures you select the most effective insurance for comprehensive financial protection.

Uninsured Motorist vs Underinsured Motorist Infographic

cardiffo.com

cardiffo.com