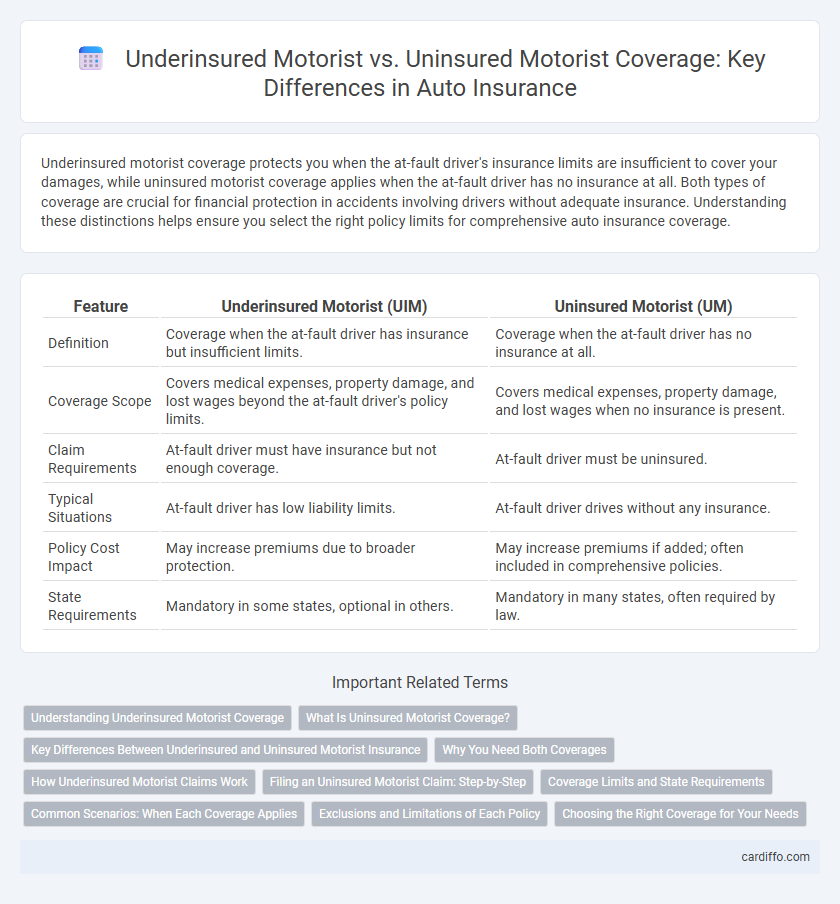

Underinsured motorist coverage protects you when the at-fault driver's insurance limits are insufficient to cover your damages, while uninsured motorist coverage applies when the at-fault driver has no insurance at all. Both types of coverage are crucial for financial protection in accidents involving drivers without adequate insurance. Understanding these distinctions helps ensure you select the right policy limits for comprehensive auto insurance coverage.

Table of Comparison

| Feature | Underinsured Motorist (UIM) | Uninsured Motorist (UM) |

|---|---|---|

| Definition | Coverage when the at-fault driver has insurance but insufficient limits. | Coverage when the at-fault driver has no insurance at all. |

| Coverage Scope | Covers medical expenses, property damage, and lost wages beyond the at-fault driver's policy limits. | Covers medical expenses, property damage, and lost wages when no insurance is present. |

| Claim Requirements | At-fault driver must have insurance but not enough coverage. | At-fault driver must be uninsured. |

| Typical Situations | At-fault driver has low liability limits. | At-fault driver drives without any insurance. |

| Policy Cost Impact | May increase premiums due to broader protection. | May increase premiums if added; often included in comprehensive policies. |

| State Requirements | Mandatory in some states, optional in others. | Mandatory in many states, often required by law. |

Understanding Underinsured Motorist Coverage

Underinsured Motorist (UIM) coverage protects drivers when at-fault parties have insurance but their policy limits are insufficient to cover the full extent of damages or medical expenses. Unlike Uninsured Motorist (UM) coverage, which applies when the at-fault driver has no insurance at all, UIM bridges the gap between the at-fault driver's liability limits and the actual costs incurred. Understanding UIM coverage is crucial for comprehensive auto insurance protection, ensuring policyholders receive adequate compensation in serious accidents where the other driver's insurance falls short.

What Is Uninsured Motorist Coverage?

Uninsured Motorist Coverage protects policyholders from financial losses caused by drivers who lack any auto insurance. This coverage typically pays for medical expenses, lost wages, and vehicle repairs if the at-fault driver cannot cover these costs. It is essential for safeguarding against accidents with uninsured drivers who fail to fulfill their legal liability.

Key Differences Between Underinsured and Uninsured Motorist Insurance

Underinsured motorist insurance covers damages when the at-fault driver's liability limits are insufficient to pay for your losses, while uninsured motorist insurance protects you if the at-fault driver has no insurance at all. Underinsured coverage typically fills the gap between the at-fault driver's policy limits and your actual expenses, including medical bills and vehicle repairs. Uninsured motorist coverage pays for your injuries and property damage directly when the responsible party lacks any insurance, ensuring financial protection in hit-and-run or uninsured driver incidents.

Why You Need Both Coverages

Underinsured Motorist (UIM) coverage protects you when the at-fault driver has insufficient insurance limits to cover your damages, while Uninsured Motorist (UM) coverage applies when the at-fault driver has no insurance at all. Having both coverages ensures comprehensive financial protection against a variety of scenarios where you might otherwise face significant out-of-pocket expenses. This dual coverage mitigates risks associated with varying degrees of liability coverage in accidents, safeguarding you from costly medical bills and property damage.

How Underinsured Motorist Claims Work

Underinsured motorist claims arise when the at-fault driver's insurance coverage is insufficient to cover the damages caused in an accident. Policyholders file underinsured motorist claims to recover the remaining costs, up to their own policy limits, for medical expenses, vehicle repairs, and other losses. This coverage bridges the gap between the at-fault driver's liability limits and the actual financial harm experienced by the insured party.

Filing an Uninsured Motorist Claim: Step-by-Step

Filing an uninsured motorist claim typically involves promptly notifying your insurance provider, submitting a detailed police report, and providing medical and repair documentation to substantiate your damages. It is crucial to verify that your policy includes uninsured motorist coverage and understand the specific limits and conditions outlined in your contract. Early and accurate filing can expedite the claims process and increase the likelihood of receiving appropriate compensation for injuries or damages caused by an uninsured driver.

Coverage Limits and State Requirements

Underinsured Motorist (UIM) coverage protects policyholders when the at-fault driver lacks sufficient insurance to cover damages, often filling gaps between the at-fault driver's liability limits and actual costs. Uninsured Motorist (UM) coverage applies when the at-fault driver has no insurance at all, offering compensation for medical bills, lost wages, and other damages. Insurance coverage limits for UIM and UM vary by state, with mandatory requirements and minimum limits established to ensure adequate protection for insured drivers under state-specific insurance laws.

Common Scenarios: When Each Coverage Applies

Underinsured motorist coverage applies when the at-fault driver has insurance, but their policy limits are insufficient to cover your damages, typically in moderate to severe accident scenarios involving bodily injury or property damage. Uninsured motorist coverage is crucial in accidents where the at-fault driver has no insurance at all, such as hit-and-run situations or collisions with drivers who have never purchased a policy. Both coverages ensure financial protection when the responsible party's insurance fails to cover your costs, but they activate under distinctly different circumstances based on the offender's insurance status.

Exclusions and Limitations of Each Policy

Underinsured Motorist (UIM) coverage excludes claims where the at-fault driver's insurance policy limits sufficiently cover the injury or damage, limiting recovery to the remaining amount not paid by the at-fault insurer. Uninsured Motorist (UM) coverage excludes incidents involving drivers who are insured but deny liability or in states where UM coverage is not mandated, restricting claims to accidents with completely uninsured drivers. Both UIM and UM policies impose limitations such as coverage caps, specific injury thresholds, and exclusions for intentional acts or commercial vehicle accidents.

Choosing the Right Coverage for Your Needs

Choosing the right coverage between underinsured motorist (UIM) and uninsured motorist (UM) insurance depends on assessing your financial risk exposure in accidents involving drivers with inadequate or no insurance. UIM coverage protects you when an at-fault driver's insurance limits are too low to cover your damages, while UM coverage applies when the at-fault driver has no insurance at all. Evaluating factors such as local uninsured driver rates, your state's minimum liability requirements, and personal asset protection priorities ensures optimal coverage selection tailored to your specific needs.

Underinsured Motorist vs Uninsured Motorist Infographic

cardiffo.com

cardiffo.com