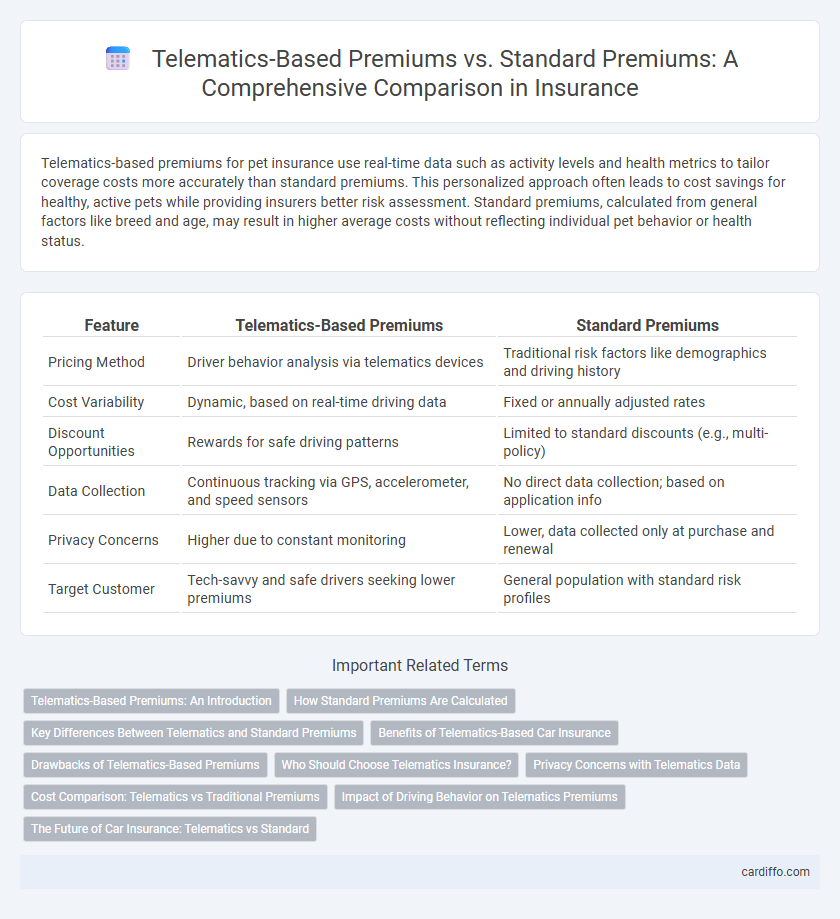

Telematics-based premiums for pet insurance use real-time data such as activity levels and health metrics to tailor coverage costs more accurately than standard premiums. This personalized approach often leads to cost savings for healthy, active pets while providing insurers better risk assessment. Standard premiums, calculated from general factors like breed and age, may result in higher average costs without reflecting individual pet behavior or health status.

Table of Comparison

| Feature | Telematics-Based Premiums | Standard Premiums |

|---|---|---|

| Pricing Method | Driver behavior analysis via telematics devices | Traditional risk factors like demographics and driving history |

| Cost Variability | Dynamic, based on real-time driving data | Fixed or annually adjusted rates |

| Discount Opportunities | Rewards for safe driving patterns | Limited to standard discounts (e.g., multi-policy) |

| Data Collection | Continuous tracking via GPS, accelerometer, and speed sensors | No direct data collection; based on application info |

| Privacy Concerns | Higher due to constant monitoring | Lower, data collected only at purchase and renewal |

| Target Customer | Tech-savvy and safe drivers seeking lower premiums | General population with standard risk profiles |

Telematics-Based Premiums: An Introduction

Telematics-based premiums leverage real-time data from devices installed in vehicles to assess driving behavior, offering personalized insurance rates tailored to individual risk profiles. This technology tracks metrics such as speed, braking patterns, mileage, and time of travel, enabling insurers to reward safe driving with lower premiums. By moving beyond traditional risk factors like age and vehicle type, telematics-based premiums enhance accuracy and encourage safer driving habits.

How Standard Premiums Are Calculated

Standard premiums are calculated using historical data, demographic factors, and risk assessments, relying on variables such as age, gender, location, vehicle type, and driving history. Insurers analyze aggregated statistics and broad market trends to estimate the likelihood of claims and adjust rates accordingly. This method contrasts with telematics-based premiums, which use real-time driving data to personalize pricing more accurately.

Key Differences Between Telematics and Standard Premiums

Telematics-based premiums use real-time driving data collected through devices or apps to assess risk and calculate personalized insurance rates, whereas standard premiums rely on historical data, demographic factors, and statistical averages. Telematics offers dynamic pricing that can reward safe driving behaviors, while standard premiums are fixed and often less reflective of individual driving habits. The key difference lies in the data source and customization level, with telematics promoting risk-based, usage-driven pricing models.

Benefits of Telematics-Based Car Insurance

Telematics-based car insurance offers personalized premiums by analyzing real-time driving behaviors such as speed, braking patterns, and mileage, leading to potential cost savings for safe drivers. This data-driven approach enhances risk assessment accuracy, reducing premiums for low-risk individuals compared to standard flat-rate policies. Moreover, it encourages safer driving habits, resulting in fewer accidents and claims, which benefits both insurers and policyholders.

Drawbacks of Telematics-Based Premiums

Telematics-based premiums pose privacy concerns due to constant tracking of driving behavior, potentially deterring customers uncomfortable with data sharing. These premiums may also disadvantage safe drivers who frequently travel in high-risk areas or during peak hours, leading to higher costs despite prudent driving habits. Furthermore, the reliance on technology can cause inaccuracies from device malfunctions or data errors, resulting in unfair premium adjustments.

Who Should Choose Telematics Insurance?

Drivers with consistent, safe driving habits benefit most from telematics-based premiums, as their real-time data can lead to significant discounts compared to standard premiums. Young drivers, those with limited driving experience, and individuals seeking personalized insurance costs often find telematics insurance more economical. Families or commuters aiming to reduce costs based on actual vehicle usage and driving behavior should consider telematics policies over traditional insurance plans.

Privacy Concerns with Telematics Data

Telematics-based premiums collect real-time driving data, raising significant privacy concerns regarding the extent and sensitivity of personal information shared with insurers. Unlike standard premiums, which rely solely on historical data and demographic factors, telematics programs may track location, driving habits, and behavior patterns, potentially exposing policyholders to data misuse or unauthorized access. Insurers must implement stringent data protection measures and transparent privacy policies to address consumer apprehensions and comply with regulations.

Cost Comparison: Telematics vs Traditional Premiums

Telematics-based premiums typically offer lower costs compared to traditional premiums by using real-time driving data to assess risk more accurately, which can reward safe driving with reduced rates. Standard premiums calculate costs based on broader demographic factors and historical data, often resulting in less personalized and sometimes higher charges. Studies show that drivers with telematics policies can save up to 30% annually, highlighting significant cost advantages over standard insurance pricing models.

Impact of Driving Behavior on Telematics Premiums

Telematics-based insurance premiums adjust costs based on real-time driving behavior data such as speed, braking patterns, and mileage, offering personalized rates that reward safe driving habits. Unlike standard premiums, which rely on static factors like age and vehicle type, telematics premiums incentivize risk reduction by directly correlating lower premiums with safer driving metrics. Insurers leverage this data-driven approach to more accurately assess risk and encourage behavior that minimizes accident likelihood and claim frequency.

The Future of Car Insurance: Telematics vs Standard

Telematics-based premiums leverage real-time driving data collected through GPS and onboard sensors to offer personalized insurance rates, promoting safer driving habits and reducing claims. Standard premiums, typically determined by static factors such as age, location, and driving history, lack the dynamic adjustments that telematics provide. The future of car insurance increasingly favors telematics for its potential to enhance risk assessment accuracy, incentivize responsible behavior, and lower overall premium costs.

Telematics-Based Premiums vs Standard Premiums Infographic

cardiffo.com

cardiffo.com