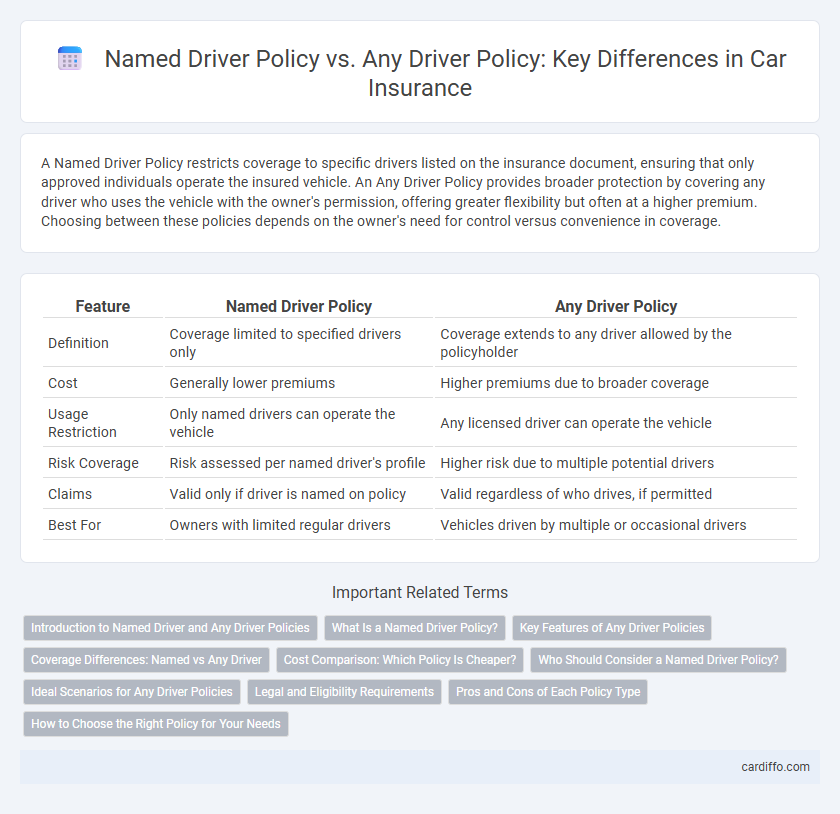

A Named Driver Policy restricts coverage to specific drivers listed on the insurance document, ensuring that only approved individuals operate the insured vehicle. An Any Driver Policy provides broader protection by covering any driver who uses the vehicle with the owner's permission, offering greater flexibility but often at a higher premium. Choosing between these policies depends on the owner's need for control versus convenience in coverage.

Table of Comparison

| Feature | Named Driver Policy | Any Driver Policy |

|---|---|---|

| Definition | Coverage limited to specified drivers only | Coverage extends to any driver allowed by the policyholder |

| Cost | Generally lower premiums | Higher premiums due to broader coverage |

| Usage Restriction | Only named drivers can operate the vehicle | Any licensed driver can operate the vehicle |

| Risk Coverage | Risk assessed per named driver's profile | Higher risk due to multiple potential drivers |

| Claims | Valid only if driver is named on policy | Valid regardless of who drives, if permitted |

| Best For | Owners with limited regular drivers | Vehicles driven by multiple or occasional drivers |

Introduction to Named Driver and Any Driver Policies

Named Driver policies restrict coverage to specific individuals listed on the insurance certificate, offering precise risk assessment and potentially lower premiums. Any Driver policies provide broader protection by allowing any licensed driver to operate the insured vehicle, which increases flexibility but typically results in higher costs due to elevated risk exposure. Understanding the distinction between these policy types is essential for selecting coverage that aligns with driving habits and risk tolerance.

What Is a Named Driver Policy?

A Named Driver Policy specifically covers only those drivers listed on the insurance certificate, ensuring coverage is limited to authorized individuals. This type of policy offers greater control over who is permitted to drive the insured vehicle, which can lead to reduced premiums. It is ideal for policyholders who want to restrict usage to family members or trusted drivers while maintaining targeted protection.

Key Features of Any Driver Policies

Any Driver Policies allow any person permitted by the policyholder to drive the insured vehicle without needing to be specifically named, offering flexible coverage for multiple drivers. These policies often include comprehensive protection, covering a wide range of risks regardless of who is behind the wheel. Premiums for Any Driver Policies tend to be higher due to the increased risk exposure, but they provide convenience and broader protection compared to Named Driver Policies.

Coverage Differences: Named vs Any Driver

Named Driver Policy limits coverage strictly to individuals specifically listed on the insurance certificate, reducing premium costs but restricting who is authorized to drive the insured vehicle. Any Driver Policy offers broader protection, covering any licensed person who drives the vehicle with the owner's permission, increasing flexibility for shared or occasional use. The coverage difference significantly impacts liability and claim scenarios, with Named Driver policies providing targeted risk management and Any Driver policies offering comprehensive driver inclusivity.

Cost Comparison: Which Policy Is Cheaper?

Named Driver Policy typically costs less than an Any Driver Policy because it limits coverage to specific individuals listed in the policy, reducing risk exposure for insurers. Any Driver Policies offer broader coverage and flexibility but generally come with higher premiums due to increased risk and uncertainty. For cost-conscious drivers who only want coverage for specific users, Named Driver Policies are usually the cheaper choice.

Who Should Consider a Named Driver Policy?

Named driver policies suit individuals who want to restrict coverage to specific, approved drivers, often resulting in lower premiums. These policies benefit those with occasional drivers or household members who rarely use the insured vehicle. Named driver coverage is ideal for primary drivers seeking cost-effective insurance while maintaining control over who is authorized to drive.

Ideal Scenarios for Any Driver Policies

Any Driver policies are ideal for households with multiple potential drivers who use a single vehicle, providing flexible coverage without needing to name each driver individually. These policies suit families with teenagers, guests, or occasional drivers, ensuring insurance protection regardless of who is behind the wheel. Choosing an Any Driver policy minimizes administrative tasks and reduces the risk of invalid claims due to unauthorized drivers.

Legal and Eligibility Requirements

Named Driver Policies require specific drivers to be listed on the insurance certificate, limiting coverage strictly to those individuals and ensuring legal compliance with insurer terms. Any Driver Policies legally extend coverage to any qualified driver using the insured vehicle, broadening eligibility but often demanding higher premiums due to increased risk. Eligibility for Named Driver Policies depends on accurate disclosure of regular drivers, while Any Driver Policies necessitate that all potential drivers meet insurer criteria such as age, license status, and driving history.

Pros and Cons of Each Policy Type

Named Driver Policies restrict coverage to specific individuals listed on the insurance certificate, often resulting in lower premiums but limited driver flexibility and potential denial of claims if an unlisted driver uses the vehicle. Any Driver Policies provide broader coverage allowing any licensed individual to drive the insured vehicle, offering greater convenience and shared use but typically at higher premium costs due to increased risk exposure. Choosing between the two depends on driving habits, vehicle use frequency by multiple drivers, and willingness to pay for comprehensive versus restricted coverage options.

How to Choose the Right Policy for Your Needs

Choosing the right insurance policy depends on your driving habits and vehicle use; a Named Driver Policy limits coverage to specified individuals, offering lower premiums for exclusive drivers, while an Any Driver Policy provides flexibility by covering anyone who drives your car, ideal for shared use. Assess factors like the frequency of multiple drivers, risk tolerance, and cost-effectiveness to determine which option aligns with your lifestyle. Reviewing policy terms, coverage limits, and potential exclusions ensures you select the most suitable insurance protection.

Named Driver Policy vs Any Driver Policy Infographic

cardiffo.com

cardiffo.com