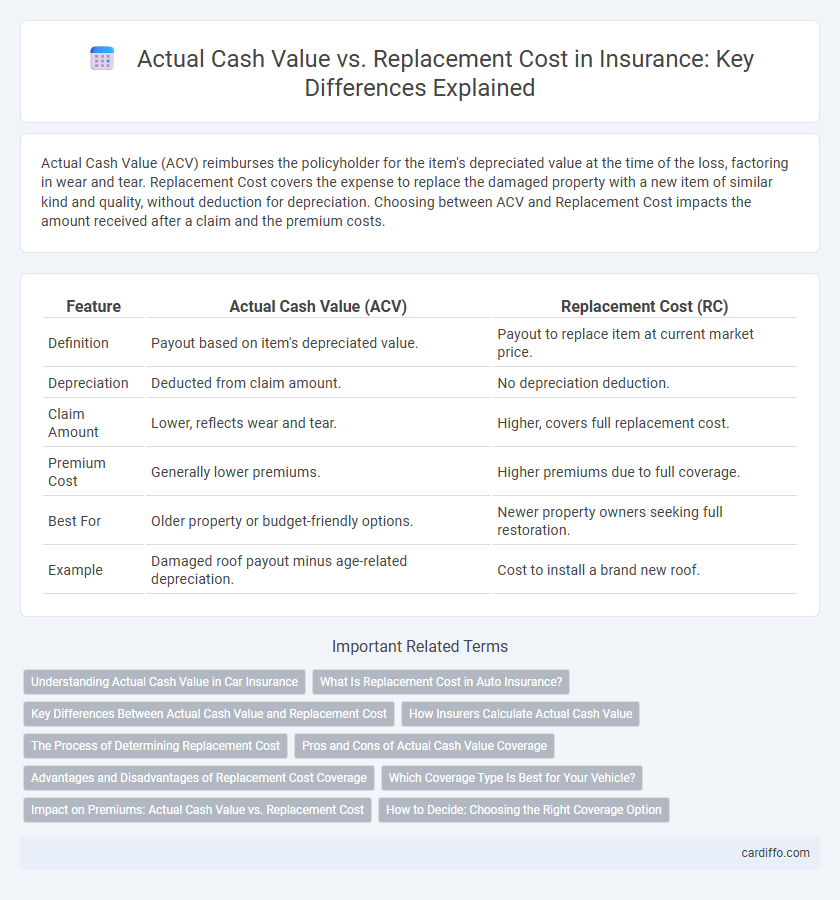

Actual Cash Value (ACV) reimburses the policyholder for the item's depreciated value at the time of the loss, factoring in wear and tear. Replacement Cost covers the expense to replace the damaged property with a new item of similar kind and quality, without deduction for depreciation. Choosing between ACV and Replacement Cost impacts the amount received after a claim and the premium costs.

Table of Comparison

| Feature | Actual Cash Value (ACV) | Replacement Cost (RC) |

|---|---|---|

| Definition | Payout based on item's depreciated value. | Payout to replace item at current market price. |

| Depreciation | Deducted from claim amount. | No depreciation deduction. |

| Claim Amount | Lower, reflects wear and tear. | Higher, covers full replacement cost. |

| Premium Cost | Generally lower premiums. | Higher premiums due to full coverage. |

| Best For | Older property or budget-friendly options. | Newer property owners seeking full restoration. |

| Example | Damaged roof payout minus age-related depreciation. | Cost to install a brand new roof. |

Understanding Actual Cash Value in Car Insurance

Actual Cash Value (ACV) in car insurance refers to the amount a vehicle is worth at the time of a claim, considering depreciation factors such as age, wear and tear, and mileage. Insurers calculate ACV by subtracting depreciation from the vehicle's original purchase price, resulting in a lower payout compared to replacement cost coverage. Understanding ACV is crucial for policyholders to gauge potential financial responsibility after an accident or theft.

What Is Replacement Cost in Auto Insurance?

Replacement Cost in auto insurance refers to the amount required to replace a damaged or stolen vehicle with a new one of the same make, model, and features without deducting depreciation. This coverage ensures policyholders receive sufficient funds to purchase a comparable vehicle at current market prices. Unlike Actual Cash Value, which factors in depreciation, Replacement Cost provides fuller financial protection after a total loss.

Key Differences Between Actual Cash Value and Replacement Cost

Actual Cash Value (ACV) calculates compensation by subtracting depreciation from the item's original purchase price, reflecting its market value at the time of loss. Replacement Cost provides coverage based on the expense to repair or replace the damaged property with new materials or items of similar kind and quality, without factoring in depreciation. The key distinction lies in ACV's depreciation deduction, resulting in typically lower payouts, while Replacement Cost offers full reimbursement to restore the item to its pre-loss condition.

How Insurers Calculate Actual Cash Value

Insurers calculate Actual Cash Value (ACV) by determining the replacement cost of the insured item and then subtracting depreciation based on factors like age, wear and tear, and market value decline. This method ensures that payouts reflect the item's current worth rather than the cost to replace it brand-new. Depreciation schedules and condition assessments are critical elements used to adjust the replacement cost to the final ACV offered in claims settlements.

The Process of Determining Replacement Cost

The process of determining replacement cost involves assessing the current market value of materials and labor required to rebuild or repair a property without deducting for depreciation. Insurance adjusters obtain detailed estimates based on local construction costs, building codes, and quality of materials to calculate an accurate replacement cost. This method ensures policyholders receive sufficient funds to restore their property to its original condition after a loss.

Pros and Cons of Actual Cash Value Coverage

Actual Cash Value (ACV) coverage reimburses policyholders based on the depreciated value of damaged or stolen property, reflecting its current market worth rather than the original purchase price. This approach generally results in lower premium costs, making insurance more affordable for consumers, while potentially leading to higher out-of-pocket expenses when repairs or replacements are needed. However, ACV policies may not cover the full cost to replace items with new ones, which can pose financial challenges after significant losses.

Advantages and Disadvantages of Replacement Cost Coverage

Replacement cost coverage offers policyholders the advantage of receiving full payment to repair or replace damaged property without deductions for depreciation, ensuring adequate compensation after a loss. This coverage typically results in higher premiums due to the increased payout amounts, which may impact affordability for some insured individuals. However, it eliminates out-of-pocket expenses related to wear and tear, providing better financial protection compared to actual cash value policies.

Which Coverage Type Is Best for Your Vehicle?

Actual Cash Value (ACV) coverage reimburses you for your vehicle's depreciated value at the time of a loss, reflecting wear, age, and market conditions, making it a cost-effective option for older cars. Replacement Cost coverage pays the full amount needed to replace your vehicle with a comparable new one, providing comprehensive protection without depreciation concerns, ideal for newer or high-value vehicles. Choosing the best coverage depends on your vehicle's age, condition, and your financial ability to cover a deductible or potential out-of-pocket expenses after a claim.

Impact on Premiums: Actual Cash Value vs. Replacement Cost

Actual Cash Value (ACV) policies typically result in lower premiums since they reimburse the depreciated value of damaged property, reflecting wear and age. Replacement Cost coverage demands higher premiums due to the insurer covering the full expense of replacing damaged items without depreciation deductions. Choosing between ACV and Replacement Cost influences not only premium costs but also out-of-pocket expenses during claims, impacting overall financial protection.

How to Decide: Choosing the Right Coverage Option

Choosing the right coverage option depends on assessing whether you prioritize cost savings or full restoration value for your insured property. Actual Cash Value policies reimburse the item's depreciated value, often resulting in lower premiums but potentially higher out-of-pocket expenses after a claim. Replacement Cost coverage provides payment to repair or replace the item without deduction for depreciation, ideal for property owners seeking comprehensive protection and accurate asset value restoration.

Actual Cash Value vs Replacement Cost Infographic

cardiffo.com

cardiffo.com