Total loss occurs when an insured item's damage exceeds its value, leading to a complete claim payout, whereas partial loss refers to damages that are repairable with a portion of the item's value covered. Insurance policies differentiate these to determine claim settlements and repair processes. Understanding the distinction between total loss and partial loss helps policyholders manage expectations and claim strategies effectively.

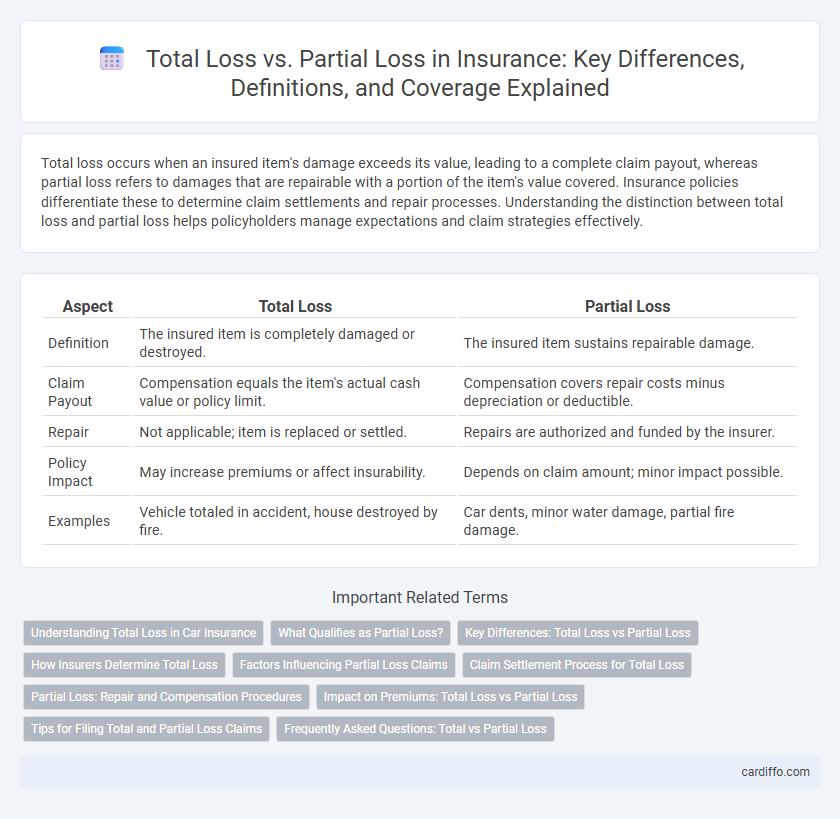

Table of Comparison

| Aspect | Total Loss | Partial Loss |

|---|---|---|

| Definition | The insured item is completely damaged or destroyed. | The insured item sustains repairable damage. |

| Claim Payout | Compensation equals the item's actual cash value or policy limit. | Compensation covers repair costs minus depreciation or deductible. |

| Repair | Not applicable; item is replaced or settled. | Repairs are authorized and funded by the insurer. |

| Policy Impact | May increase premiums or affect insurability. | Depends on claim amount; minor impact possible. |

| Examples | Vehicle totaled in accident, house destroyed by fire. | Car dents, minor water damage, partial fire damage. |

Understanding Total Loss in Car Insurance

Total loss in car insurance occurs when the cost of repairs exceeds a specified percentage of the vehicle's actual cash value, often around 70-80%, making it uneconomical to repair. Insurance companies declare a total loss to provide a settlement amount based on the vehicle's market value before the accident, minus any deductibles. Understanding this concept helps policyholders navigate claim settlements and decide whether to retain or surrender their damaged vehicle.

What Qualifies as Partial Loss?

Partial loss in insurance refers to damage to insured property where the repair cost is less than the total insured value, allowing restoration rather than replacement. Examples include minor vehicle dents, broken windows, or localized fire damage that does not compromise the item's overall functionality or value. Insurers assess partial loss by estimating repair costs, depreciation, and residual value to determine claim settlements.

Key Differences: Total Loss vs Partial Loss

Total loss refers to a situation where the insured property is damaged beyond repair or the cost to repair exceeds its market value, leading to a full claim payout. Partial loss, on the other hand, occurs when damage is limited and repairable, resulting in a claim that covers only the repair costs rather than replacement. The key difference lies in the claim settlement approach: total loss results in full compensation based on actual cash value or replacement cost, whereas partial loss involves proportionate reimbursement for repair expenses.

How Insurers Determine Total Loss

Insurers determine total loss by evaluating whether the cost to repair a damaged vehicle exceeds a specific percentage of its actual cash value (ACV), typically around 70-80%. They consider factors such as repair estimates, salvage value, and the vehicle's pre-accident condition to assess financial feasibility. This assessment ensures claims are settled efficiently, balancing policyholder compensation and insurer cost management.

Factors Influencing Partial Loss Claims

Partial loss claims in insurance are influenced by factors such as the extent of damage, repair costs relative to the insured value, and the necessity of maintaining the asset's functionality. The policy's deductible, depreciation, and coverage limits also play critical roles in determining claim approval and payout amounts. Accurate damage assessment and documentation are essential to ensure fair partial loss settlements.

Claim Settlement Process for Total Loss

In the claim settlement process for a total loss, the insurance company assesses the extent of damage to determine that the repair cost exceeds the vehicle's actual cash value, leading to a total loss declaration. The insured receives a payout based on the agreed-upon insured value or market value minus any deductibles, effectively closing the claim with no repair undertaken. Timely submission of documentation such as the claim form, vehicle registration, and police report accelerates the settlement timeline for total loss claims.

Partial Loss: Repair and Compensation Procedures

Partial loss in insurance refers to damage where the repair costs are less than the vehicle's market value, allowing restoration to its pre-accident condition. The claims process involves a thorough damage assessment by an adjuster, followed by repair estimates submitted to the insurance company for approval. Compensation typically covers repair expenses minus any deductibles, ensuring the insured vehicle is restored without exceeding the policy limits.

Impact on Premiums: Total Loss vs Partial Loss

Total loss claims typically lead to a more significant increase in insurance premiums compared to partial loss claims due to the higher payout and severity of the claim. Partial loss claims may result in smaller premium adjustments, as repairs often involve lower costs and less risk for insurers. Understanding the impact on premiums helps policyholders evaluate the financial consequences of different claim types in insurance coverage.

Tips for Filing Total and Partial Loss Claims

When filing total or partial loss insurance claims, carefully document all damages with detailed photos and repair estimates to support your case. Promptly notify your insurer and submit all required paperwork accurately to avoid delays in claim processing. Maintain clear communication with your claims adjuster and keep copies of all correspondence to ensure a smooth resolution.

Frequently Asked Questions: Total vs Partial Loss

Total loss occurs when repair costs exceed a specified percentage of the insured value, rendering the vehicle uneconomical to fix. Partial loss involves damage repairable within policy limits without reaching that threshold, allowing restoration to pre-accident condition. Policyholders often ask how insurers determine the loss type, how claims payout differs, and the impact on premiums and vehicle value.

Total Loss vs Partial Loss Infographic

cardiffo.com

cardiffo.com