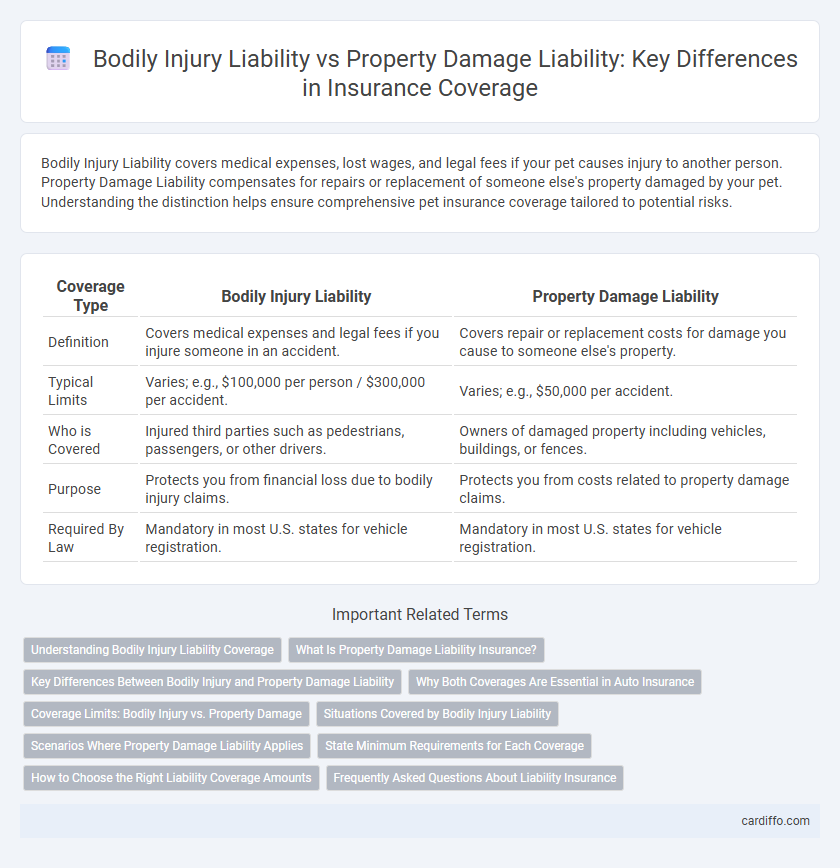

Bodily Injury Liability covers medical expenses, lost wages, and legal fees if your pet causes injury to another person. Property Damage Liability compensates for repairs or replacement of someone else's property damaged by your pet. Understanding the distinction helps ensure comprehensive pet insurance coverage tailored to potential risks.

Table of Comparison

| Coverage Type | Bodily Injury Liability | Property Damage Liability |

|---|---|---|

| Definition | Covers medical expenses and legal fees if you injure someone in an accident. | Covers repair or replacement costs for damage you cause to someone else's property. |

| Typical Limits | Varies; e.g., $100,000 per person / $300,000 per accident. | Varies; e.g., $50,000 per accident. |

| Who is Covered | Injured third parties such as pedestrians, passengers, or other drivers. | Owners of damaged property including vehicles, buildings, or fences. |

| Purpose | Protects you from financial loss due to bodily injury claims. | Protects you from costs related to property damage claims. |

| Required By Law | Mandatory in most U.S. states for vehicle registration. | Mandatory in most U.S. states for vehicle registration. |

Understanding Bodily Injury Liability Coverage

Bodily Injury Liability coverage protects policyholders against financial losses resulting from injuries or deaths they cause to others in an accident, covering medical expenses, lost wages, and legal fees. This coverage differs from Property Damage Liability, which addresses damages to another person's property, such as vehicles or buildings. Understanding Bodily Injury Liability is essential for adequate protection, as it ensures compensation for victims' injuries and shields the insured from potentially significant out-of-pocket costs.

What Is Property Damage Liability Insurance?

Property Damage Liability Insurance covers the costs associated with damage you cause to someone else's property in an accident, including vehicles, buildings, fences, and other structures. This insurance pays for repairs or replacements up to your policy limits when you are found legally responsible. It is a critical component of auto insurance policies to protect you from significant out-of-pocket expenses related to property damage claims.

Key Differences Between Bodily Injury and Property Damage Liability

Bodily Injury Liability covers medical expenses, lost wages, and pain and suffering resulting from injuries to others in an accident you cause, while Property Damage Liability pays for repairs or replacement of someone else's property damaged by your actions. The primary distinction lies in bodily injury involving personal harm and potential legal claims for physical and psychological damages, whereas property damage strictly involves material or tangible property loss. Insurance policies typically separate these coverages, each with distinct limits reflecting the different risk exposures and legal obligations.

Why Both Coverages Are Essential in Auto Insurance

Bodily Injury Liability covers medical expenses, lost wages, and legal fees if you cause injuries to others in an auto accident, while Property Damage Liability pays for repairs to other vehicles or property damaged by your vehicle. Both coverages are essential in auto insurance to protect your financial stability against claims arising from accidents involving personal injury and property damage. Without adequate coverage for both liabilities, you risk facing substantial out-of-pocket expenses and legal consequences stemming from at-fault accidents.

Coverage Limits: Bodily Injury vs. Property Damage

Bodily injury liability coverage limits specify the maximum amount an insurance policy will pay for physical injuries or death caused to others in an accident, typically expressed in per person and per accident amounts. Property damage liability coverage limits represent the maximum payout for damage caused to another person's property, such as vehicles, buildings, or other structures, usually stated as a single aggregate limit. Understanding the differences in coverage limits is critical for selecting adequate insurance protection that balances financial responsibility and policy costs in auto and general liability insurance.

Situations Covered by Bodily Injury Liability

Bodily Injury Liability covers medical expenses, lost wages, and pain and suffering for individuals injured in accidents where the insured is at fault. It applies to scenarios such as car collisions causing physical harm to other drivers, pedestrians, or passengers. This coverage also includes legal defense costs if the insured faces a lawsuit related to bodily injuries sustained in the incident.

Scenarios Where Property Damage Liability Applies

Property Damage Liability applies when an insured driver causes damage to another person's vehicle, fence, building, or other physical property during an accident. Scenarios include hitting a parked car, crashing into a structure such as a mailbox or garage, or damaging public property like street signs and guardrails. This coverage pays for repairs or replacement costs, protecting the policyholder from out-of-pocket expenses related to property damage claims.

State Minimum Requirements for Each Coverage

State minimum requirements for bodily injury liability typically mandate coverage limits per person and per accident, such as $25,000 per injury and $50,000 per accident in many states, ensuring compensation for medical expenses and lost wages. Property damage liability minimums often require coverage to repair or replace another person's property, usually ranging from $10,000 to $25,000 depending on the state. These minimum thresholds differ by jurisdiction but aim to protect victims from financial loss while setting baseline legal compliance for drivers.

How to Choose the Right Liability Coverage Amounts

Selecting the right bodily injury liability and property damage liability coverage amounts depends on evaluating potential risks and financial exposure in accidents. Analyze state minimum requirements, personal assets, and the value of the vehicle or property you want to protect to determine adequate limits. Higher coverage limits provide better protection against lawsuits and medical expenses, ensuring comprehensive financial security in case of liability claims.

Frequently Asked Questions About Liability Insurance

Bodily Injury Liability covers medical expenses, lost wages, and legal fees if you cause injury to another person in an accident, while Property Damage Liability pays for repairs or replacement of another person's property damaged by your vehicle. Frequently asked questions about liability insurance include coverage limits, state minimum requirements, and how claims affect premiums. Understanding the differences between bodily injury and property damage liability helps policyholders select appropriate coverage to protect against financial losses.

Bodily Injury Liability vs Property Damage Liability Infographic

cardiffo.com

cardiffo.com