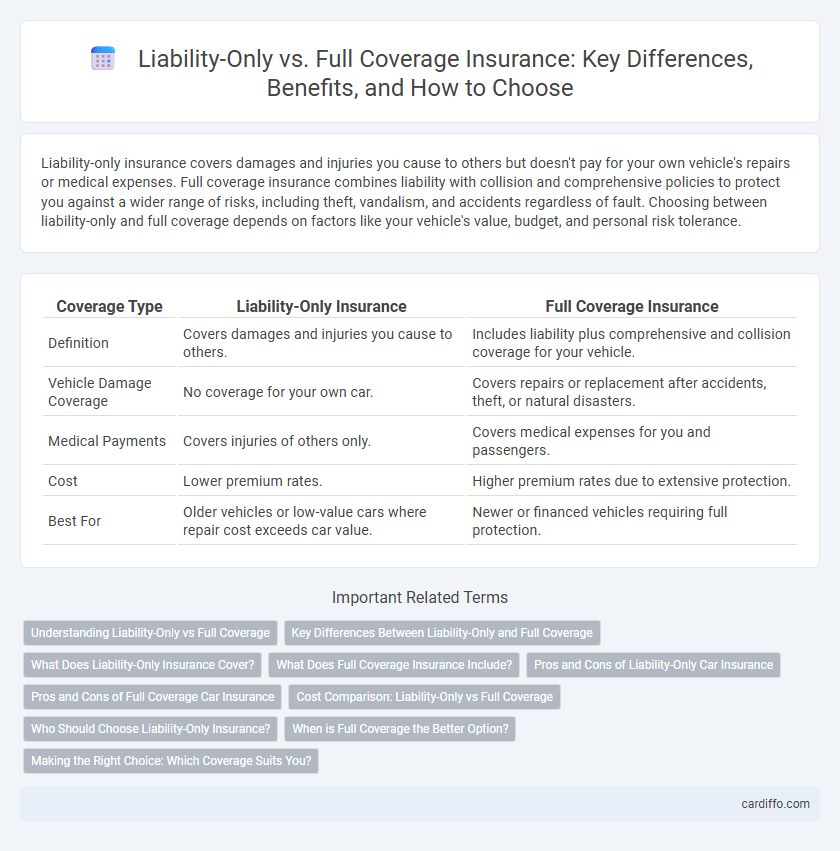

Liability-only insurance covers damages and injuries you cause to others but doesn't pay for your own vehicle's repairs or medical expenses. Full coverage insurance combines liability with collision and comprehensive policies to protect you against a wider range of risks, including theft, vandalism, and accidents regardless of fault. Choosing between liability-only and full coverage depends on factors like your vehicle's value, budget, and personal risk tolerance.

Table of Comparison

| Coverage Type | Liability-Only Insurance | Full Coverage Insurance |

|---|---|---|

| Definition | Covers damages and injuries you cause to others. | Includes liability plus comprehensive and collision coverage for your vehicle. |

| Vehicle Damage Coverage | No coverage for your own car. | Covers repairs or replacement after accidents, theft, or natural disasters. |

| Medical Payments | Covers injuries of others only. | Covers medical expenses for you and passengers. |

| Cost | Lower premium rates. | Higher premium rates due to extensive protection. |

| Best For | Older vehicles or low-value cars where repair cost exceeds car value. | Newer or financed vehicles requiring full protection. |

Understanding Liability-Only vs Full Coverage

Liability-only insurance covers damages and injuries you cause to others in an accident, meeting state minimum requirements but excluding damage to your own vehicle. Full coverage insurance combines liability with comprehensive and collision protections, covering a wider range of incidents such as theft, vandalism, and personal vehicle damages. Choosing between liability-only and full coverage depends on factors like vehicle value, financial protection needs, and budget constraints.

Key Differences Between Liability-Only and Full Coverage

Liability-only insurance covers damages and injuries you cause to others but does not pay for your own vehicle's repairs or medical expenses. Full coverage insurance combines liability protection with collision and comprehensive coverage, offering financial support for vehicle damage caused by accidents, theft, vandalism, or natural disasters. Choosing between liability-only and full coverage depends on factors like vehicle value, budget, and risk tolerance.

What Does Liability-Only Insurance Cover?

Liability-only insurance covers bodily injury and property damage that you cause to others in an accident, including medical expenses, legal fees, and repair costs. It does not cover your own vehicle's damages or medical bills, making it a more affordable option for drivers who want basic protection. State minimum liability requirements vary, so coverage limits and specific inclusions depend on local regulations and policy terms.

What Does Full Coverage Insurance Include?

Full coverage insurance typically includes liability, collision, and comprehensive coverage, protecting policyholders from a wide range of risks such as bodily injury, property damage, theft, vandalism, and natural disasters. Liability-only insurance covers damages and injuries you cause to others but does not cover your own vehicle's repairs or replacement. Choosing full coverage ensures financial protection against both third-party claims and damages to your own car, providing broader security on the road.

Pros and Cons of Liability-Only Car Insurance

Liability-only car insurance offers a lower premium, making it an affordable option for budget-conscious drivers while covering damages and injuries you cause to others. However, it does not cover your vehicle's repairs or medical expenses after an accident, which can result in significant out-of-pocket costs. This coverage is ideal for older cars with low market value but may leave you financially vulnerable in severe accidents or theft situations.

Pros and Cons of Full Coverage Car Insurance

Full coverage car insurance provides extensive protection by combining liability, collision, and comprehensive coverage, reducing out-of-pocket expenses from accidents, theft, or natural disasters. It offers peace of mind and financial security but typically comes with higher premiums compared to liability-only policies. While full coverage is ideal for newer or financed vehicles, it may be cost-inefficient for older cars with low market value.

Cost Comparison: Liability-Only vs Full Coverage

Liability-only insurance typically costs significantly less than full coverage, with average annual premiums ranging from $400 to $700 compared to $1,200 to $1,500 for full coverage policies. Full coverage includes comprehensive and collision protection, increasing the premium cost but offering broader financial security against diverse damages. Factors influencing the price gap include vehicle value, driving history, and coverage limits, with liability-only suitable for older cars and budget-conscious drivers.

Who Should Choose Liability-Only Insurance?

Liability-only insurance is ideal for drivers with older vehicles or those looking to minimize monthly premiums while meeting state minimum requirements. It covers bodily injury and property damage you cause to others, but does not pay for your own vehicle repairs or medical expenses. Budget-conscious drivers who drive infrequently or have alternative transportation options often find liability-only insurance the most cost-effective choice.

When is Full Coverage the Better Option?

Full coverage insurance is the better option when you have a newer or more valuable vehicle, as it protects against both liability and physical damage, including collision and comprehensive risks. It also makes sense if you rely heavily on your car for daily transportation, as it minimizes out-of-pocket expenses in case of accidents or theft. Drivers with loans or leases are often required by lenders to carry full coverage for financial protection.

Making the Right Choice: Which Coverage Suits You?

Choosing between liability-only and full coverage insurance depends on factors such as vehicle value, financial stability, and risk tolerance; liability-only covers damages to others, while full coverage includes damage to your own vehicle from accidents, theft, or natural disasters. Drivers with older cars or limited budgets may prefer liability-only to meet legal requirements without high premiums, whereas those with newer vehicles or loans benefit from the comprehensive protection of full coverage. Assessing your individual needs and budget constraints ensures you select the insurance that provides optimal protection and financial security.

Liability-Only vs Full Coverage Infographic

cardiffo.com

cardiffo.com