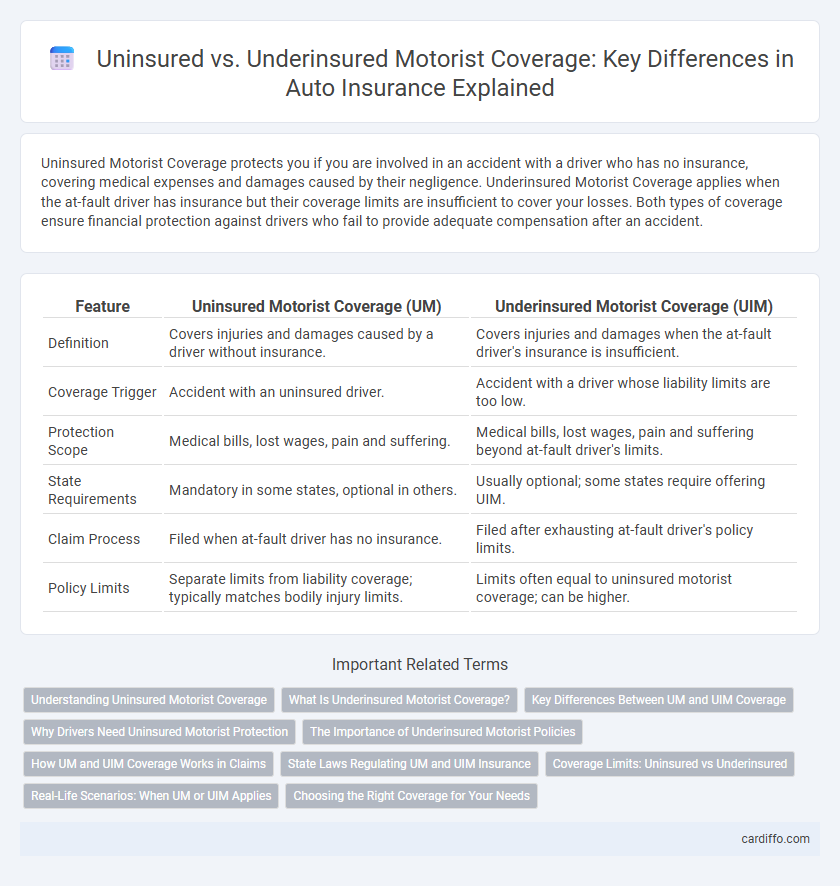

Uninsured Motorist Coverage protects you if you are involved in an accident with a driver who has no insurance, covering medical expenses and damages caused by their negligence. Underinsured Motorist Coverage applies when the at-fault driver has insurance but their coverage limits are insufficient to cover your losses. Both types of coverage ensure financial protection against drivers who fail to provide adequate compensation after an accident.

Table of Comparison

| Feature | Uninsured Motorist Coverage (UM) | Underinsured Motorist Coverage (UIM) |

|---|---|---|

| Definition | Covers injuries and damages caused by a driver without insurance. | Covers injuries and damages when the at-fault driver's insurance is insufficient. |

| Coverage Trigger | Accident with an uninsured driver. | Accident with a driver whose liability limits are too low. |

| Protection Scope | Medical bills, lost wages, pain and suffering. | Medical bills, lost wages, pain and suffering beyond at-fault driver's limits. |

| State Requirements | Mandatory in some states, optional in others. | Usually optional; some states require offering UIM. |

| Claim Process | Filed when at-fault driver has no insurance. | Filed after exhausting at-fault driver's policy limits. |

| Policy Limits | Separate limits from liability coverage; typically matches bodily injury limits. | Limits often equal to uninsured motorist coverage; can be higher. |

Understanding Uninsured Motorist Coverage

Uninsured Motorist Coverage protects policyholders from financial loss when involved in an accident caused by a driver without any insurance. This coverage typically pays for medical expenses, lost wages, and other damages that the at-fault uninsured driver would otherwise be responsible for. Understanding this protection is crucial for drivers in states with high rates of uninsured motorists, as it ensures compensation despite the other party's lack of insurance.

What Is Underinsured Motorist Coverage?

Underinsured Motorist Coverage (UIM) protects policyholders when they are involved in an accident with a driver whose liability insurance is insufficient to cover the damages or medical expenses incurred. This coverage bridges the gap between the at-fault driver's limited insurance limits and the actual cost of injury or property damage, ensuring adequate financial protection. UIM is essential in states with minimum liability limits, offering additional security beyond standard uninsured motorist coverage.

Key Differences Between UM and UIM Coverage

Uninsured Motorist (UM) coverage protects drivers when involved in accidents with motorists who lack any auto insurance, while Underinsured Motorist (UIM) coverage applies when the at-fault driver has insurance but their policy limits are insufficient to cover the full extent of damages. Key differences include UM coverage addressing total absence of liability insurance and UIM coverage bridging the gap between the at-fault party's policy limit and the insured's actual damages. Both coverages safeguard policyholders from out-of-pocket expenses but apply to distinct scenarios based on the at-fault driver's insurance status.

Why Drivers Need Uninsured Motorist Protection

Uninsured Motorist Coverage protects drivers from financial losses when involved in accidents caused by drivers without any insurance, covering medical expenses and property damage. This protection is crucial as nearly 1 in 8 drivers in the United States lack auto insurance, exposing insured drivers to significant out-of-pocket costs. Without this coverage, victims of uninsured motorists may face substantial financial hardships due to uncovered damages and medical bills.

The Importance of Underinsured Motorist Policies

Underinsured Motorist Coverage is crucial because it protects drivers when the at-fault party's insurance limits are insufficient to cover medical expenses and damages after an accident. Unlike Uninsured Motorist Coverage, which applies only when the other driver has no insurance, underinsured policies bridge the financial gap, ensuring adequate compensation. This coverage is essential for minimizing out-of-pocket costs and safeguarding your financial stability in serious accident scenarios.

How UM and UIM Coverage Works in Claims

Uninsured Motorist (UM) coverage compensates policyholders when an at-fault driver lacks any insurance, covering bodily injury and sometimes property damage expenses. Underinsured Motorist (UIM) coverage activates when the at-fault driver's insurance limits are too low to cover the full extent of damages, filling the financial gap between liability limits and actual costs. Both UM and UIM claims require verification of the other driver's insurance status and assessment of damages to determine payout eligibility and limits under the insured's policy.

State Laws Regulating UM and UIM Insurance

State laws regulating Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage vary widely, with some states mandating both coverages while others only require UM coverage. Many states set minimum coverage limits, but policyholders can often purchase higher limits to better protect against uninsured or underinsured drivers. Understanding local insurance statutes is crucial, as some states allow stacking of UM and UIM benefits, which can significantly impact claim settlements and overall protection.

Coverage Limits: Uninsured vs Underinsured

Uninsured Motorist Coverage protects policyholders when the at-fault driver lacks any insurance, covering damages up to the policy's limits. Underinsured Motorist Coverage applies when the at-fault driver's insurance is insufficient to cover all expenses, bridging the gap up to the coverage limit of the policyholder. Understanding the distinction in coverage limits is crucial for ensuring adequate financial protection in accidents involving uninsured or underinsured drivers.

Real-Life Scenarios: When UM or UIM Applies

Uninsured Motorist (UM) coverage applies when a driver without insurance causes an accident, leaving you without sufficient compensation for damages or medical bills. Underinsured Motorist (UIM) coverage kicks in when the at-fault driver has insurance but their policy limits are too low to cover your full losses. In real-life scenarios, UM coverage protects you from drivers who have no insurance, while UIM coverage fills the gap when their insurance is inadequate to cover serious injuries or extensive property damage.

Choosing the Right Coverage for Your Needs

Uninsured Motorist Coverage protects you from drivers without any insurance, while Underinsured Motorist Coverage covers situations where at-fault drivers have insufficient insurance to pay for your damages. Assess your local accident statistics and the minimum insurance requirements in your state to determine the likelihood of encountering uninsured or underinsured drivers. Selecting the right coverage depends on your risk tolerance, financial situation, and the level of protection you need against potential out-of-pocket expenses after an accident.

Uninsured Motorist Coverage vs Underinsured Motorist Coverage Infographic

cardiffo.com

cardiffo.com