Single-car insurance policies cover only one vehicle, making them ideal for individual car owners who do not require coverage for additional vehicles. Multi-car policies bundle coverage for multiple vehicles under one plan, often providing cost savings and streamlined management for families or households with several cars. Choosing between single-car and multi-car policies depends on the number of vehicles and potential discounts available through combined coverage.

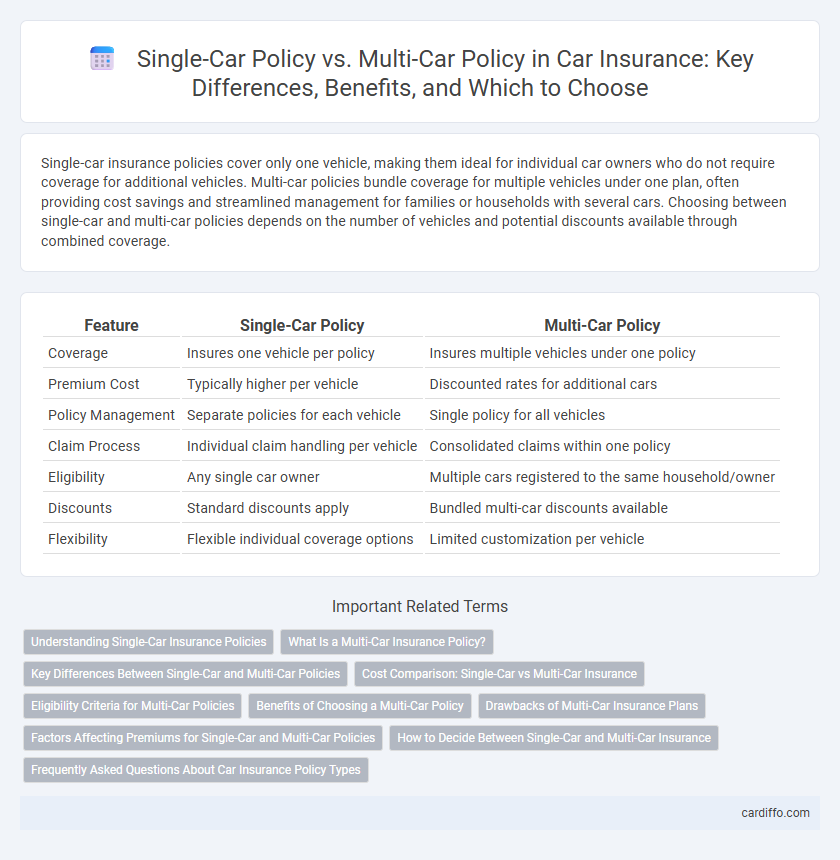

Table of Comparison

| Feature | Single-Car Policy | Multi-Car Policy |

|---|---|---|

| Coverage | Insures one vehicle per policy | Insures multiple vehicles under one policy |

| Premium Cost | Typically higher per vehicle | Discounted rates for additional cars |

| Policy Management | Separate policies for each vehicle | Single policy for all vehicles |

| Claim Process | Individual claim handling per vehicle | Consolidated claims within one policy |

| Eligibility | Any single car owner | Multiple cars registered to the same household/owner |

| Discounts | Standard discounts apply | Bundled multi-car discounts available |

| Flexibility | Flexible individual coverage options | Limited customization per vehicle |

Understanding Single-Car Insurance Policies

Single-car insurance policies provide coverage tailored specifically to one vehicle, offering personalized protection options such as liability, collision, and comprehensive coverage. These policies often feature fixed premiums based on the individual car's usage, model, and driver history, making them ideal for owners with a single vehicle. Understanding the limitations and benefits, such as the inability to share coverage across multiple vehicles, is essential when comparing to multi-car insurance policies.

What Is a Multi-Car Insurance Policy?

A multi-car insurance policy covers two or more vehicles under a single policy, providing convenience and potential cost savings compared to individual policies. This type of coverage allows all listed vehicles to benefit from the same liability, collision, and comprehensive protections, often with discounted premiums. Insurers typically offer multi-car policies to households with multiple drivers or families owning several vehicles.

Key Differences Between Single-Car and Multi-Car Policies

Single-car insurance policies cover only one vehicle, offering tailored coverage options and premiums based on that individual car's usage and risk factors. Multi-car policies bundle coverage for two or more vehicles under a single account, often providing discounted rates and simplified management through consolidated billing. Key differences include cost efficiency, policy management convenience, and potential eligibility for multi-car discounts that are unavailable with single-car policies.

Cost Comparison: Single-Car vs Multi-Car Insurance

Single-car insurance policies generally have higher per-vehicle premiums compared to multi-car policies, which offer discounted rates by bundling multiple vehicles under one account. Multi-car insurance policies reduce overall costs through shared deductibles and multi-vehicle discounts, making them more economical for families or households with two or more cars. Insurance companies often provide savings up to 25% or more when switching from single-car to multi-car coverage, optimizing budget efficiency without compromising protection.

Eligibility Criteria for Multi-Car Policies

Multi-car insurance policies require all vehicles to be registered at the same residential address and insured under one policyholder's name, ensuring eligibility through shared household status. Typically, eligible vehicles must belong to family members living in the same home or dependents, aligning with insurer guidelines to qualify for multi-car discounts. Some insurance providers may also require that all vehicles meet specific criteria such as usage type or vehicle age to maintain eligibility within a multi-car policy.

Benefits of Choosing a Multi-Car Policy

A Multi-Car Policy offers significant savings by bundling coverage for multiple vehicles under one plan, reducing overall premiums compared to separate Single-Car Policies. It enhances convenience through consolidated billing and management, streamlining policy renewals and claims handling for all insured cars. Policyholders also benefit from additional discounts, multi-vehicle coverages, and increased flexibility in customizing coverage tailored to diverse vehicle needs.

Drawbacks of Multi-Car Insurance Plans

Multi-car insurance plans often result in higher premiums if one vehicle has a poor driving record, impacting the entire policy. Limited flexibility can arise since all insured vehicles must share the same coverage type, restricting individual customization. Additionally, multi-car policies may complicate claims processing when multiple vehicles are involved, potentially leading to longer resolution times.

Factors Affecting Premiums for Single-Car and Multi-Car Policies

Premiums for single-car policies are primarily influenced by the driver's individual risk profile, vehicle model, usage patterns, and local accident statistics, making personalized factors crucial. Multi-car policy premiums benefit from combined risk assessments, often resulting in discounts due to bundled coverage, with factors such as the total number of vehicles, overall driving records, and collective claims history impacting costs. Insurance companies also consider geographic location, annual mileage, and coverage limits when calculating premiums for both single-car and multi-car policies.

How to Decide Between Single-Car and Multi-Car Insurance

Choosing between single-car and multi-car insurance depends on the number of vehicles owned and the potential cost savings. Multi-car policies often provide discounts and simplify management by bundling coverage, making them ideal for households with multiple drivers. For individuals with only one vehicle, a single-car policy offers tailored coverage and may be more cost-effective.

Frequently Asked Questions About Car Insurance Policy Types

Single-car policies cover one vehicle under a single contract, offering tailored premiums based on that vehicle's usage and driver history, while multi-car policies bundle coverage for multiple vehicles belonging to the same household, often resulting in discounted rates. Common questions include the cost-effectiveness of multi-car policies compared to single-car coverage, whether drivers can customize coverage levels per vehicle, and how claims are handled when multiple vehicles are insured under one policy. Understanding the differences in liability limits, coverage options, and eligibility criteria between policy types helps policyholders make informed decisions that optimize protection and savings.

Single-Car Policy vs Multi-Car Policy Infographic

cardiffo.com

cardiffo.com