Liability insurance covers damages and injuries you cause to others, protecting you from financial responsibility in accidents where you are at fault. Full coverage insurance includes liability protection as well as comprehensive and collision coverage, which pay for damage to your own vehicle regardless of fault. Choosing between liability and full coverage depends on factors like vehicle value, financial risk tolerance, and legal requirements in your state.

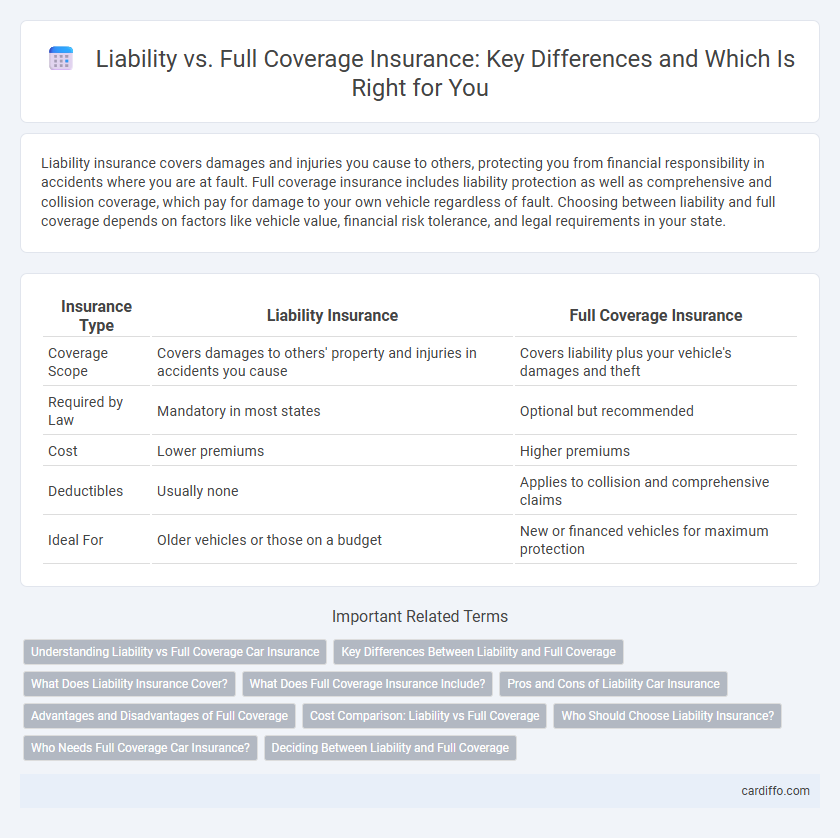

Table of Comparison

| Insurance Type | Liability Insurance | Full Coverage Insurance |

|---|---|---|

| Coverage Scope | Covers damages to others' property and injuries in accidents you cause | Covers liability plus your vehicle's damages and theft |

| Required by Law | Mandatory in most states | Optional but recommended |

| Cost | Lower premiums | Higher premiums |

| Deductibles | Usually none | Applies to collision and comprehensive claims |

| Ideal For | Older vehicles or those on a budget | New or financed vehicles for maximum protection |

Understanding Liability vs Full Coverage Car Insurance

Liability car insurance covers damages and injuries you cause to others in an accident, meeting state minimum requirements but offering no protection for your own vehicle. Full coverage combines liability insurance with comprehensive and collision coverage, protecting against a wider range of risks including theft, vandalism, and damage to your car regardless of fault. Understanding the differences helps drivers select policies that balance legal compliance, financial protection, and peace of mind.

Key Differences Between Liability and Full Coverage

Liability insurance covers damages and injuries you cause to others in an accident, while full coverage includes liability plus additional protections like collision and comprehensive insurance. Liability policies are typically mandatory and more affordable, providing basic financial protection against bodily injury and property damage claims. Full coverage offers broader protection, including repair or replacement of your own vehicle after accidents, theft, or natural disasters, making it ideal for newer or financed cars.

What Does Liability Insurance Cover?

Liability insurance covers bodily injury and property damage that the policyholder causes to others in an accident, including medical expenses, legal fees, and repair costs for the other party. It does not cover damages to the policyholder's own vehicle or injuries sustained by the policyholder. This type of coverage is typically mandatory, providing financial protection against claims for negligence or fault in auto accidents.

What Does Full Coverage Insurance Include?

Full coverage insurance typically includes liability coverage, collision coverage, and comprehensive coverage, providing protection against bodily injury, property damage, vehicle collision, theft, vandalism, and natural disasters. Liability coverage handles costs for injuries and damages you cause to others, while collision coverage pays for repairs to your vehicle after an accident regardless of fault. Comprehensive coverage protects against non-collision incidents like theft, fire, or falling objects, ensuring extensive financial safeguards beyond basic liability.

Pros and Cons of Liability Car Insurance

Liability car insurance covers bodily injury and property damage, offering basic protection at a lower cost compared to full coverage. Pros include affordability and meeting state minimum requirements, while cons involve no coverage for your own vehicle repairs or theft. Drivers with older cars might prefer liability insurance to save money, but it provides limited financial protection in accidents where they're at fault.

Advantages and Disadvantages of Full Coverage

Full coverage insurance combines liability, collision, and comprehensive coverage, offering extensive protection against various risks such as accidents, theft, and natural disasters, which reduces out-of-pocket expenses for repairs and medical bills. It provides peace of mind and financial security but comes with higher premium costs compared to liability-only policies. The main disadvantage is that full coverage may not be cost-effective for older vehicles with low market value, where the premiums might exceed potential claim payouts.

Cost Comparison: Liability vs Full Coverage

Liability insurance generally costs significantly less than full coverage because it only covers damages to others, excluding your own vehicle. Full coverage combines liability, collision, and comprehensive insurance, resulting in higher premiums but increased protection. Factors influencing cost differences include vehicle value, driver history, and coverage limits.

Who Should Choose Liability Insurance?

Liability insurance is ideal for drivers with older or low-value vehicles who seek to meet state minimum requirements while minimizing premium costs. It provides coverage for damages or injuries you cause to others but does not cover your own vehicle repairs. Budget-conscious individuals and those who drive infrequently benefit from liability policies, as they offer essential protection without the higher expenses associated with full coverage.

Who Needs Full Coverage Car Insurance?

Drivers with newer or high-value vehicles benefit most from full coverage car insurance, as it protects against both liability and comprehensive damages such as theft, vandalism, or collision. Individuals financing or leasing their cars often require full coverage to meet lender or lease agreement conditions. Those seeking maximum financial protection from unexpected repair costs or accidents should also consider full coverage for peace of mind.

Deciding Between Liability and Full Coverage

Choosing between liability and full coverage insurance depends largely on the vehicle's value, your financial situation, and risk tolerance. Liability insurance covers damages to others if you cause an accident, typically meeting minimum state requirements and offering cost-effective protection. Full coverage includes liability plus collision and comprehensive protection, safeguarding your vehicle against a wider range of risks such as theft, vandalism, and natural disasters, making it a prudent choice for newer or higher-value cars.

Liability vs Full Coverage Infographic

cardiffo.com

cardiffo.com