SR-22 and FR-44 are both certificates of financial responsibility required after certain driving offenses, but they differ by state and coverage levels. SR-22 is commonly required for standard high-risk situations, while FR-44 often mandates higher liability limits and more stringent proof of insurance, mainly in California. Choosing between SR-22 and FR-44 depends on your state's regulations and the nature of your driving violation.

Table of Comparison

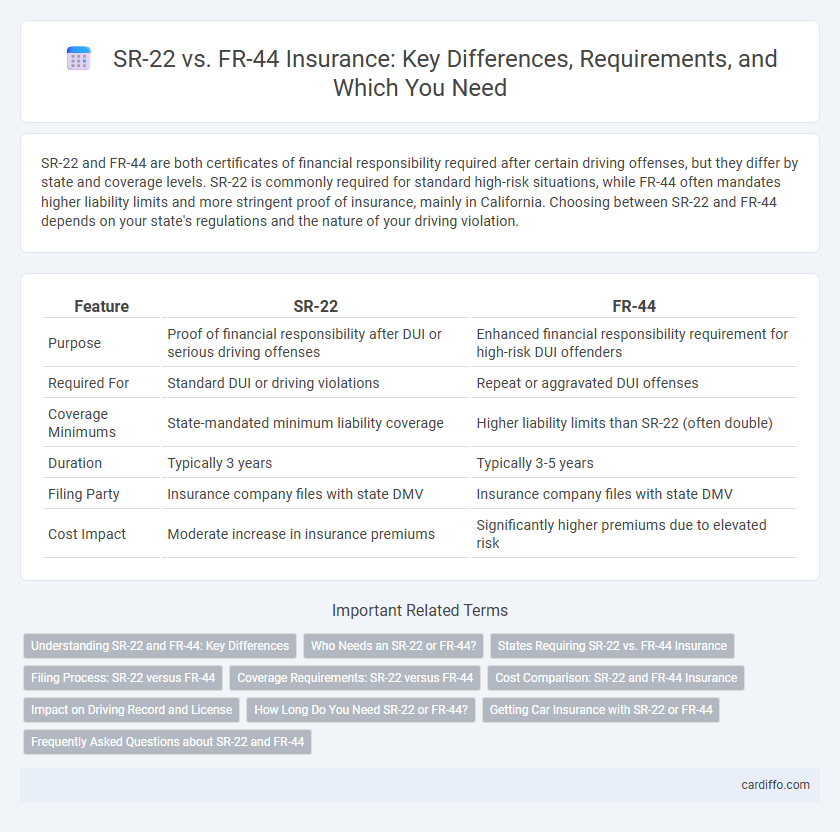

| Feature | SR-22 | FR-44 |

|---|---|---|

| Purpose | Proof of financial responsibility after DUI or serious driving offenses | Enhanced financial responsibility requirement for high-risk DUI offenders |

| Required For | Standard DUI or driving violations | Repeat or aggravated DUI offenses |

| Coverage Minimums | State-mandated minimum liability coverage | Higher liability limits than SR-22 (often double) |

| Duration | Typically 3 years | Typically 3-5 years |

| Filing Party | Insurance company files with state DMV | Insurance company files with state DMV |

| Cost Impact | Moderate increase in insurance premiums | Significantly higher premiums due to elevated risk |

Understanding SR-22 and FR-44: Key Differences

SR-22 and FR-44 are both liability insurance filings required for high-risk drivers, but FR-44 mandates higher liability coverage limits compared to SR-22, specifically designed for repeat offenders or drivers convicted of serious offenses. SR-22 is generally required after DUI convictions or license suspensions, whereas FR-44 is imposed in states like Florida to enforce stricter insurance requirements on high-risk drivers. Understanding these differences helps drivers comply with state laws and maintain their driving privileges.

Who Needs an SR-22 or FR-44?

Drivers required to file an SR-22 typically include those convicted of DUI, reckless driving, or driving without insurance, as it serves as proof of financial responsibility. FR-44 is mandated in states like California and Florida for high-risk drivers with more severe violations, such as multiple DUIs, requiring higher liability coverage than an SR-22. Both certificates ensure compliance with court or state insurance mandates to reinstate or maintain driving privileges.

States Requiring SR-22 vs. FR-44 Insurance

SR-22 insurance is mandated in most states, including California, Texas, and Florida, for high-risk drivers who have committed serious traffic violations such as DUIs or driving without insurance. FR-44 insurance is required exclusively in Florida and covers higher liability limits than SR-22, targeting repeat DUI offenders or drivers involved in severe violations. Understanding state-specific requirements helps drivers maintain legal compliance and avoid license suspension.

Filing Process: SR-22 versus FR-44

The SR-22 filing process requires insured drivers to submit proof of financial responsibility through their insurance provider to the state's Department of Motor Vehicles (DMV), often after traffic violations or DUI offenses. In contrast, the FR-44 filing mandates higher liability coverage limits and stricter reporting to the DMV, primarily used in states like Florida for DUI convictions. Both filings involve a certificate that insurance companies must electronically file, but FR-44 enforces more rigorous compliance due to increased risk assessment.

Coverage Requirements: SR-22 versus FR-44

SR-22 insurance is a state-mandated form filed by insurance companies to prove that high-risk drivers meet minimum liability coverage requirements, typically necessary after serious driving violations like DUIs or license suspensions. FR-44 insurance is a higher coverage requirement specifically for high-risk drivers in states like Florida and California, mandating higher minimum liability limits than SR-22 to ensure greater financial responsibility. While both forms serve as proof of financial responsibility, FR-44 demands increased liability coverage limits, making it more expensive but providing stronger protection against claims.

Cost Comparison: SR-22 and FR-44 Insurance

SR-22 insurance typically costs less than FR-44 insurance due to differing risk levels and state requirements. FR-44 coverage mandates higher liability limits, significantly increasing premiums compared to SR-22 policies. Drivers with FR-44 filings often face premiums that can be two to three times higher than those for SR-22 insurance.

Impact on Driving Record and License

An SR-22 filing typically indicates high-risk driver status, leading to increased insurance premiums and a potential mark on the driving record for three years. An FR-44, required in certain states like Florida, not only mandates higher liability coverage but also results in a longer reporting period, often five years, intensifying the impact on the driver's license. Both filings signal serious violations but FR-44 carries more severe financial and legal consequences due to its enhanced insurance requirements and extended monitoring period.

How Long Do You Need SR-22 or FR-44?

SR-22 and FR-44 insurance filings are typically required for a period of three years, though the duration can vary based on state regulations and the severity of the offense. SR-22 is commonly mandated for high-risk drivers involved in DUI, reckless driving, or driving without insurance, while FR-44 is a more stringent requirement often applied to DUI convictions in states like Florida. Maintaining continuous coverage throughout the entire period is critical to avoid license suspension or additional penalties.

Getting Car Insurance with SR-22 or FR-44

When getting car insurance with SR-22 or FR-44 filings, understanding the distinctions is crucial for compliance and cost management. SR-22 is generally required for drivers with minor driving violations or DUIs, providing proof of financial responsibility to the state, while FR-44 mandates higher liability limits and is typically required for DUI offenders in specific states like California and Florida. Insurance providers assess risk differently for SR-22 and FR-44, often resulting in higher premiums for FR-44 due to its stringent coverage requirements and the serious nature of offenses linked to it.

Frequently Asked Questions about SR-22 and FR-44

SR-22 and FR-44 are both liability insurance certifications required for high-risk drivers, but FR-44 mandates higher liability coverage limits, typically in states like Florida and Massachusetts, reflecting increased financial responsibility. SR-22 serves as a proof of insurance filed by the insurer to the state, often required after DUI convictions or serious traffic violations, whereas FR-44 is a more stringent form of SR-22 with enhanced coverage criteria. Understanding these differences is crucial for drivers needing reinstatement of driving privileges or meeting state-specific financial responsibility laws.

SR-22 vs FR-44 Infographic

cardiffo.com

cardiffo.com