Pay-per-mile insurance offers a flexible and cost-effective alternative to traditional premiums by charging based on the actual miles driven, making it ideal for low-mileage drivers. Traditional premiums charge a fixed rate regardless of usage, which can result in higher costs for infrequent drivers. Choosing pay-per-mile insurance can lead to significant savings and a more personalized approach to auto coverage.

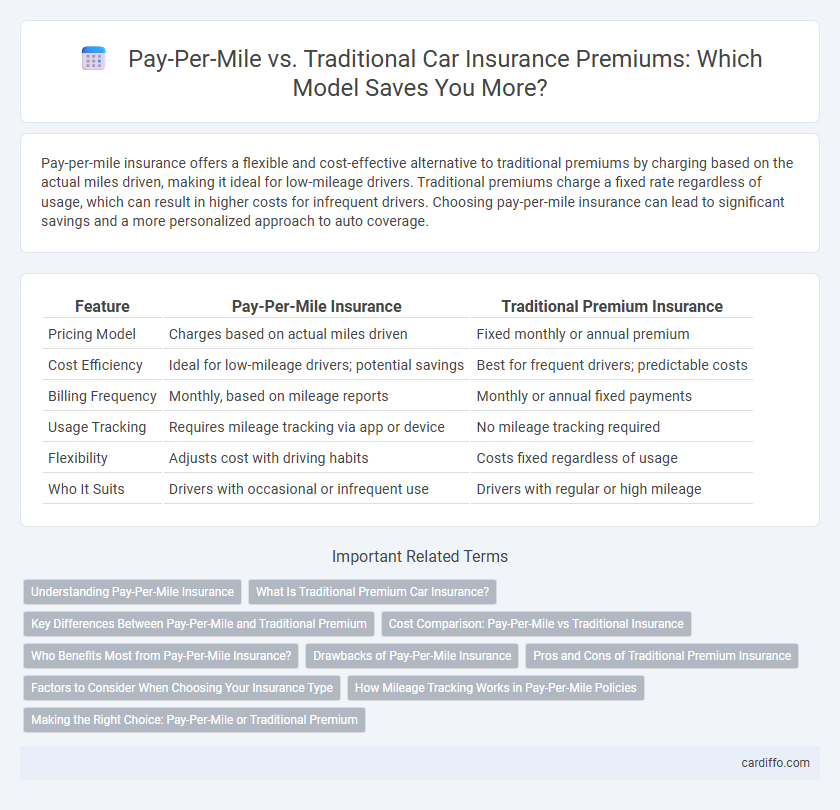

Table of Comparison

| Feature | Pay-Per-Mile Insurance | Traditional Premium Insurance |

|---|---|---|

| Pricing Model | Charges based on actual miles driven | Fixed monthly or annual premium |

| Cost Efficiency | Ideal for low-mileage drivers; potential savings | Best for frequent drivers; predictable costs |

| Billing Frequency | Monthly, based on mileage reports | Monthly or annual fixed payments |

| Usage Tracking | Requires mileage tracking via app or device | No mileage tracking required |

| Flexibility | Adjusts cost with driving habits | Costs fixed regardless of usage |

| Who It Suits | Drivers with occasional or infrequent use | Drivers with regular or high mileage |

Understanding Pay-Per-Mile Insurance

Pay-Per-Mile insurance calculates premiums based on the actual miles driven, offering a cost-effective alternative to traditional fixed-rate policies. This usage-based model provides transparency and potential savings for low-mileage drivers by aligning costs with driving behavior. Understanding the pricing structure helps consumers choose coverage that suits their driving habits and budget more efficiently.

What Is Traditional Premium Car Insurance?

Traditional premium car insurance involves paying a fixed annual or monthly rate based on factors such as the driver's age, location, vehicle type, and driving history. This flat-rate model does not adjust for actual miles driven, making it less flexible for low-mileage drivers. Insurance companies assess risk using historical data and statistical models to establish premium amounts regardless of usage patterns.

Key Differences Between Pay-Per-Mile and Traditional Premium

Pay-per-mile insurance calculates premiums based on the exact miles driven, offering a cost-effective option for low-mileage drivers, whereas traditional premiums rely on fixed rates determined by factors like vehicle type, driving history, and coverage levels. Pay-per-mile policies promote fair pricing by aligning costs directly with usage, while traditional insurance provides predictable, flat-rate payments regardless of mileage fluctuations. Key differences also include the use of telematics devices in pay-per-mile plans for accurate tracking, compared to traditional insurance's reliance on periodic vehicle assessments and historical data.

Cost Comparison: Pay-Per-Mile vs Traditional Insurance

Pay-per-mile insurance offers significant cost savings for low-mileage drivers by charging premiums based on actual miles driven rather than fixed annual rates typical of traditional insurance. Traditional insurance premiums often include higher base costs and do not adjust for usage, leading to overpayment for infrequent drivers. By leveraging telematics data to track mileage, pay-per-mile policies can reduce expenses up to 40% compared to conventional premiums, especially benefiting urban residents and remote workers.

Who Benefits Most from Pay-Per-Mile Insurance?

Pay-per-mile insurance benefits low-mileage drivers, such as urban residents and part-time commuters, by offering cost savings proportional to actual road usage. It is particularly advantageous for those who drive fewer than 10,000 miles annually, as traditional premiums often overestimate their risk and usage. Businesses with fleets of fuel-efficient vehicles also gain financial efficiency and precise cost control through pay-per-mile models.

Drawbacks of Pay-Per-Mile Insurance

Pay-per-mile insurance often results in higher costs for drivers who frequently travel long distances, making it less economical compared to traditional premiums. Limited coverage options and slower claim processing can also reduce the appeal of pay-per-mile plans. Furthermore, the requirement for telematics devices raises privacy concerns and may lead to potential data security risks for policyholders.

Pros and Cons of Traditional Premium Insurance

Traditional premium insurance offers predictable monthly costs, providing policyholders with financial stability and ease of budgeting. Its main drawback includes potentially overpaying for coverage if driving frequency is low, as premiums do not adjust based on actual mileage. Furthermore, traditional premiums may not incentivize safe driving habits, unlike usage-based alternatives that reward lower risk behavior.

Factors to Consider When Choosing Your Insurance Type

When choosing between pay-per-mile and traditional premium insurance, consider factors such as average annual mileage, driving habits, and budget constraints. Pay-per-mile insurance benefits low-mileage drivers by offering variable costs based on miles driven, while traditional premiums provide predictable monthly payments regardless of usage. Assessing your typical driving patterns and financial preferences ensures selecting the insurance type that balances cost savings and coverage needs effectively.

How Mileage Tracking Works in Pay-Per-Mile Policies

Pay-per-mile insurance policies use GPS technology or odometer readings to accurately track the exact number of miles driven, ensuring customers pay based on actual usage rather than estimated mileage. This real-time mileage data is securely transmitted to the insurer via mobile apps or telematics devices, allowing for precise premium calculations. Compared to traditional fixed-rate premiums, this method offers personalized rates that reflect individual driving habits and promote cost savings for low-mileage drivers.

Making the Right Choice: Pay-Per-Mile or Traditional Premium

Choosing between pay-per-mile insurance and traditional premium plans depends on your annual mileage and driving habits. Pay-per-mile insurance offers cost savings for low-mileage drivers by charging based on miles driven, while traditional premiums provide predictable costs suitable for those with consistent or high mileage. Evaluating your driving frequency, vehicle usage, and budget helps determine the most cost-effective and flexible insurance option.

Pay-Per-Mile vs Traditional Premium Infographic

cardiffo.com

cardiffo.com