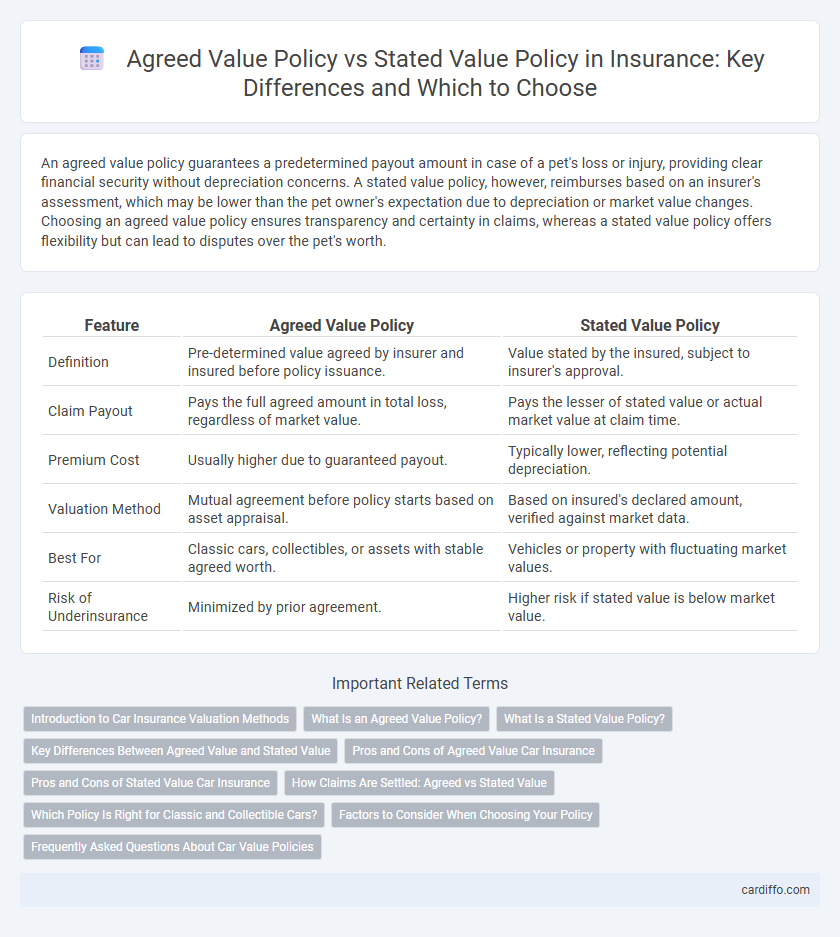

An agreed value policy guarantees a predetermined payout amount in case of a pet's loss or injury, providing clear financial security without depreciation concerns. A stated value policy, however, reimburses based on an insurer's assessment, which may be lower than the pet owner's expectation due to depreciation or market value changes. Choosing an agreed value policy ensures transparency and certainty in claims, whereas a stated value policy offers flexibility but can lead to disputes over the pet's worth.

Table of Comparison

| Feature | Agreed Value Policy | Stated Value Policy |

|---|---|---|

| Definition | Pre-determined value agreed by insurer and insured before policy issuance. | Value stated by the insured, subject to insurer's approval. |

| Claim Payout | Pays the full agreed amount in total loss, regardless of market value. | Pays the lesser of stated value or actual market value at claim time. |

| Premium Cost | Usually higher due to guaranteed payout. | Typically lower, reflecting potential depreciation. |

| Valuation Method | Mutual agreement before policy starts based on asset appraisal. | Based on insured's declared amount, verified against market data. |

| Best For | Classic cars, collectibles, or assets with stable agreed worth. | Vehicles or property with fluctuating market values. |

| Risk of Underinsurance | Minimized by prior agreement. | Higher risk if stated value is below market value. |

Introduction to Car Insurance Valuation Methods

Agreed value and stated value policies represent two common car insurance valuation methods, each determining settlement amounts differently after a total loss. An agreed value policy sets a predetermined amount agreed upon by the insurer and insured at policy inception, ensuring predictable compensation without depreciation deductions. In contrast, a stated value policy allows the insured to declare a vehicle worth that the insurer may accept or adjust, often reflecting a cap for claim settlements while considering actual cash value.

What Is an Agreed Value Policy?

An agreed value policy in insurance establishes a predetermined payout amount for a covered item, mutually agreed upon by the insurer and insured at the policy's inception. This type of policy eliminates depreciation disputes by ensuring the insured receives the agreed sum in the event of a total loss. It is commonly used for high-value or classic vehicles, collectibles, and specialty property where market value fluctuates or is difficult to determine.

What Is a Stated Value Policy?

A stated value policy in insurance specifies an agreed-upon amount the insurer will pay in the event of a total loss, which is typically less than the vehicle's fair market value. This type of policy requires the insured to declare the vehicle's value at the time of policy issuance, and the insurer bases the coverage limits on that stated amount. Unlike agreed value policies, stated value policies may result in lower premiums but could lead to reduced claims payouts if the declared value is set too low.

Key Differences Between Agreed Value and Stated Value

Agreed value policies specify a fixed payout amount mutually set by the insurer and insured at policy inception, ensuring full coverage without depreciation deductions. Stated value policies list a dollar amount chosen by the insured, but settling claims considers the vehicle's market value or stated amount, whichever is lower. Agreed value offers certainty in claims, while stated value may result in lower compensation if the market value declines.

Pros and Cons of Agreed Value Car Insurance

Agreed value car insurance guarantees a predetermined payout amount in the event of a total loss, ensuring the insured receives full market value without depreciation deductions. This policy offers peace of mind for classic or high-value vehicles but often comes with higher premiums compared to stated value policies. However, the downside includes potential disputes if the vehicle's agreed value is set inaccurately, either leading to overpaying premiums or insufficient coverage during a claim.

Pros and Cons of Stated Value Car Insurance

Stated value car insurance offers flexibility by allowing policyholders to set a predetermined coverage amount, potentially lowering premiums compared to agreed value policies. However, the stated value may not cover the full market or replacement value if the car's worth fluctuates or is undervalued, leading to potential out-of-pocket expenses after a claim. This policy suits owners seeking budget-friendly options with some coverage certainty but carries a risk of insufficient payout in total loss scenarios.

How Claims Are Settled: Agreed vs Stated Value

Claims under an agreed value policy are settled based on the pre-determined amount established at the policy's inception, ensuring the insured receives full compensation without depreciation deductions. In contrast, a stated value policy pays out the lesser of the insured value or the actual cash value at the time of loss, which may result in lower reimbursement due to depreciation. This distinction critically impacts claim settlements, especially in cases of total loss or significant damage.

Which Policy Is Right for Classic and Collectible Cars?

Classic and collectible cars benefit most from an agreed value policy because it guarantees a predetermined payout without depreciation in case of total loss, reflecting the vehicle's true market worth. Stated value policies, which pay out based on the insurer's assessment not exceeding the stated amount, may undervalue rare or appreciating vehicles. Owners seeking certainty and adequate coverage for investment-grade automobiles should favor agreed value policies to protect their asset's full value.

Factors to Consider When Choosing Your Policy

Choosing between an Agreed Value policy and a Stated Value policy hinges on factors such as the accuracy of the vehicle's valuation, risk tolerance, and budget constraints. Agreed Value policies offer a predetermined payout amount agreed upon by insurer and insured, ideal for classic or custom vehicles requiring precise coverage, while Stated Value policies depend on the vehicle's estimated worth at the time of loss, often leading to potential disputes or reduced payouts. Consider the vehicle's depreciation rate, usage frequency, and the policyholder's need for financial certainty to select the most appropriate coverage type.

Frequently Asked Questions About Car Value Policies

Agreed value policies guarantee a predetermined payout agreed upon by both insurer and insured at the policy's inception, ensuring full coverage without depreciation factors. Stated value policies set a maximum reimbursement based on the value declared by the insured, subject to depreciation and insurer assessment at claim time. Policyholders should verify how each policy handles total loss scenarios, premium calculations, and vehicle valuation to select the best coverage for their needs.

Agreed value policy vs Stated value policy Infographic

cardiffo.com

cardiffo.com