Exclusion in insurance refers to specific risks or conditions that are intentionally left out of coverage, limiting the insurer's liability. An endorsement, on the other hand, modifies the original policy by adding or altering coverage terms to better suit the policyholder's needs. Understanding the distinction allows policyholders to customize their protection while recognizing potential gaps in their insurance coverage.

Table of Comparison

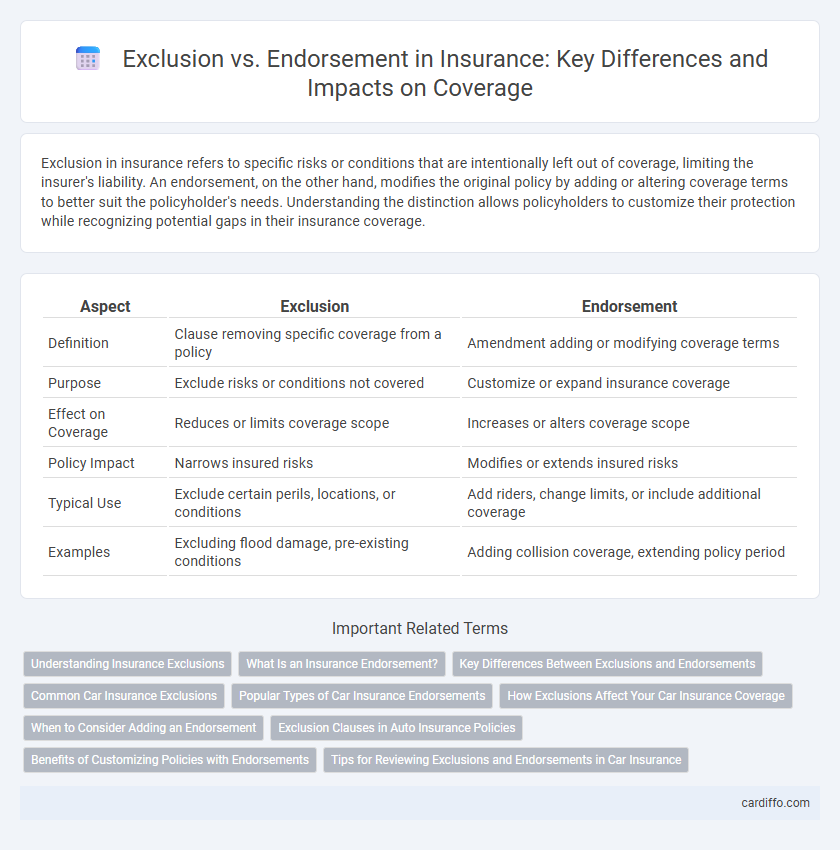

| Aspect | Exclusion | Endorsement |

|---|---|---|

| Definition | Clause removing specific coverage from a policy | Amendment adding or modifying coverage terms |

| Purpose | Exclude risks or conditions not covered | Customize or expand insurance coverage |

| Effect on Coverage | Reduces or limits coverage scope | Increases or alters coverage scope |

| Policy Impact | Narrows insured risks | Modifies or extends insured risks |

| Typical Use | Exclude certain perils, locations, or conditions | Add riders, change limits, or include additional coverage |

| Examples | Excluding flood damage, pre-existing conditions | Adding collision coverage, extending policy period |

Understanding Insurance Exclusions

Insurance exclusions define specific risks, conditions, or circumstances that are not covered by a policy, limiting the insurer's liability and protecting against unforeseen losses. Understanding these exclusions is essential for policyholders to avoid coverage gaps and ensure adequate protection tailored to their needs. Endorsements, in contrast, modify or add coverage to standard policies, offering customized solutions that address exclusions or extend benefits.

What Is an Insurance Endorsement?

An insurance endorsement is a written document that modifies the coverage terms of an existing insurance policy by adding, deleting, or altering provisions to tailor protection to the policyholder's specific needs. Unlike exclusions, which remove coverage for particular risks, endorsements actively expand or customize the scope of an insurance policy without issuing a new contract. Common endorsements include adding additional insured parties, expanding coverage limits, or including new types of property or perils.

Key Differences Between Exclusions and Endorsements

Exclusions in insurance policies outline specific risks or conditions that are not covered, thereby limiting the insurer's liability and defining policy boundaries. Endorsements modify or add to the existing policy terms, either expanding coverage or altering specific provisions to better suit the policyholder's needs. The key difference lies in exclusions reducing coverage scope by specifying what is not included, whereas endorsements adjust coverage by adding or changing policy features.

Common Car Insurance Exclusions

Common car insurance exclusions include damages from wear and tear, intentional damage, and using the vehicle for commercial purposes without proper coverage. Endorsements modify standard policies by adding or removing specific coverages to tailor protection according to individual needs. Understanding exclusions and available endorsements helps policyholders avoid unexpected gaps in coverage and expensive out-of-pocket costs.

Popular Types of Car Insurance Endorsements

Popular types of car insurance endorsements include glass coverage, roadside assistance, and rental car reimbursement, which enhance the base policy by adding specific protections. Exclusions, on the other hand, list scenarios or damages not covered by the insurance, such as intentional damage or use in illegal activities. Understanding the difference between endorsements and exclusions helps policyholders customize coverage and avoid unexpected gaps in protection.

How Exclusions Affect Your Car Insurance Coverage

Exclusions in car insurance policies specify situations or damages that are not covered, directly limiting the scope of your protection and potentially leaving you financially responsible for certain accidents or repairs. Understanding these exclusions, such as damages from racing or using the vehicle for commercial purposes, is crucial to avoid unexpected out-of-pocket expenses. Endorsements, by contrast, modify or expand coverage, but they do not override standard policy exclusions unless explicitly stated.

When to Consider Adding an Endorsement

Consider adding an endorsement to an insurance policy when specific coverage gaps emerge that standard policies do not address, such as valuable personal property or specialized business equipment. Endorsements provide tailored protection by modifying existing terms to suit unique risks or evolving needs. This customization ensures comprehensive coverage without the higher cost of purchasing a separate policy.

Exclusion Clauses in Auto Insurance Policies

Exclusion clauses in auto insurance policies specifically outline risks and damages that are not covered, such as intentional damage, racing incidents, or driving under the influence. These clauses limit the insurer's liability and protect against high-risk claims, ensuring policyholders understand the boundaries of their coverage. Clear exclusion definitions are essential to avoid disputes during claim settlements and to provide transparency in auto insurance agreements.

Benefits of Customizing Policies with Endorsements

Endorsements enhance insurance policies by enabling tailored coverage that addresses specific risks not included in the base policy, unlike exclusions which remove coverage. Customizing with endorsements provides policyholders with flexibility, ensuring protection aligns closely with their unique needs and circumstances. This targeted approach improves risk management and financial security by filling potential coverage gaps effectively.

Tips for Reviewing Exclusions and Endorsements in Car Insurance

Carefully examine the specific wording of exclusions and endorsements in your car insurance policy to understand coverage limitations and additional protections. Compare endorsements against standard coverage to identify valuable enhancements or potential gaps caused by exclusions. Consult with your insurance agent to clarify ambiguous terms and negotiate endorsements that better align with your driving habits and risk profile.

Exclusion vs Endorsement Infographic

cardiffo.com

cardiffo.com