Non-owner insurance provides liability coverage for drivers who do not own a vehicle but need protection when borrowing or renting cars, while owner insurance covers both liability and physical damage for vehicles registered under the policyholder's name. Non-owner policies typically exclude collision and comprehensive coverage, focusing solely on liability, whereas owner insurance can be customized with additional coverages such as collision, comprehensive, and uninsured motorist protection. Choosing between non-owner and owner insurance depends on vehicle ownership status and driving habits, ensuring appropriate liability safeguards and financial protection in case of an accident.

Table of Comparison

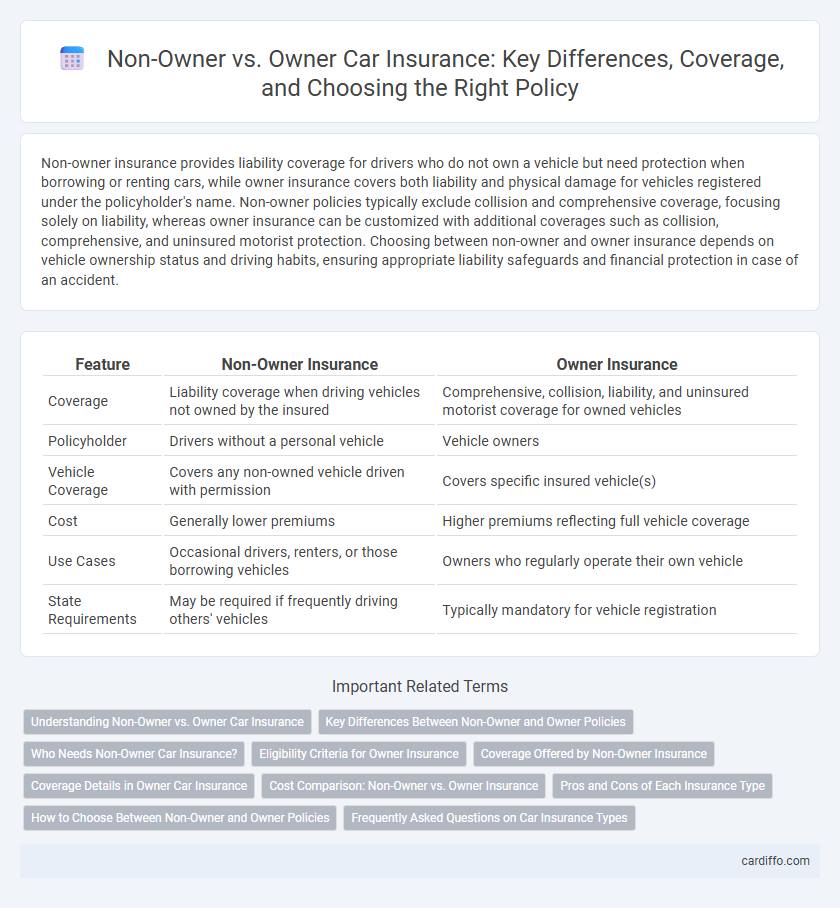

| Feature | Non-Owner Insurance | Owner Insurance |

|---|---|---|

| Coverage | Liability coverage when driving vehicles not owned by the insured | Comprehensive, collision, liability, and uninsured motorist coverage for owned vehicles |

| Policyholder | Drivers without a personal vehicle | Vehicle owners |

| Vehicle Coverage | Covers any non-owned vehicle driven with permission | Covers specific insured vehicle(s) |

| Cost | Generally lower premiums | Higher premiums reflecting full vehicle coverage |

| Use Cases | Occasional drivers, renters, or those borrowing vehicles | Owners who regularly operate their own vehicle |

| State Requirements | May be required if frequently driving others' vehicles | Typically mandatory for vehicle registration |

Understanding Non-Owner vs. Owner Car Insurance

Non-owner car insurance provides liability coverage for drivers who do not own a vehicle but need protection when driving borrowed or rented cars, whereas owner car insurance covers the policyholder's own vehicle, including liability, collision, and comprehensive protections. Non-owner insurance typically offers lower premiums but excludes coverage for damage to the vehicle being driven, which is included in owner insurance policies. Understanding the differences in coverage scope, cost, and eligibility helps drivers select the correct policy based on vehicle ownership and usage patterns.

Key Differences Between Non-Owner and Owner Policies

Non-owner insurance provides liability coverage for drivers who do not own a vehicle, offering protection when driving a borrowed or rented car but excluding physical damage coverage. Owner insurance includes comprehensive and collision coverage tied to the insured's own vehicle, covering damages to the vehicle and liability for accidents. The primary distinction lies in ownership status, with owner policies covering both liability and vehicle damages, while non-owner policies focus solely on liability protection for non-owned vehicles.

Who Needs Non-Owner Car Insurance?

Non-owner car insurance is essential for individuals who frequently drive vehicles they do not own, such as renters, car-sharing users, or those borrowing cars regularly. This policy provides liability coverage when driving someone else's vehicle, protecting against bodily injury and property damage claims. Drivers without a personal vehicle or those with lapses in their primary insurance benefit most from non-owner insurance to maintain financial protection and meet state minimum insurance requirements.

Eligibility Criteria for Owner Insurance

Owner insurance eligibility requires proof of vehicle ownership, typically verified through a valid title or registration in the applicant's name. Applicants must also possess a valid driver's license and meet the insurer's minimum age requirements, often 18 years or older. Insurers may consider the applicant's driving history and credit score to assess risk before issuing owner insurance coverage.

Coverage Offered by Non-Owner Insurance

Non-owner insurance provides liability coverage for drivers who frequently operate vehicles they do not own, protecting against bodily injury and property damage claims. This policy typically excludes coverage for the vehicle itself but offers essential protection for medical expenses and legal fees arising from accidents. Non-owner insurance is especially valuable for individuals who rent cars or drive infrequently without owning a personal vehicle.

Coverage Details in Owner Car Insurance

Owner car insurance provides comprehensive coverage including liability for bodily injury and property damage, collision coverage, and comprehensive protection against theft, vandalism, and natural disasters. It also typically covers medical payments for the policyholder and passengers, uninsured/underinsured motorist protection, and may offer rental car reimbursement and roadside assistance. These extensive protections distinguish owner insurance from non-owner insurance, which generally offers more limited liability coverage without physical damage or personal injury protection for a vehicle not owned by the insured.

Cost Comparison: Non-Owner vs. Owner Insurance

Non-owner insurance typically costs between $200 and $500 annually, offering a more affordable option for drivers who do not own a vehicle. In contrast, owner insurance averages $1,200 to $1,600 per year due to coverage for the insured vehicle's comprehensive and collision protection. Choosing non-owner insurance can result in significant savings for infrequent drivers or those who often rent cars, while owner insurance provides broader financial protection and legal liability coverage.

Pros and Cons of Each Insurance Type

Non-owner insurance provides liability coverage for drivers using vehicles they do not own, offering affordable protection for occasional drivers but excluding coverage for vehicle damage or theft. Owner insurance combines liability, collision, and comprehensive coverage, protecting both the driver and the insured vehicle; however, it typically incurs higher premiums due to broader protection. Choosing between non-owner and owner insurance depends on driving frequency, vehicle ownership, and desired extent of coverage.

How to Choose Between Non-Owner and Owner Policies

Choosing between non-owner and owner insurance policies depends on vehicle usage and ownership status; non-owner insurance is ideal for drivers who frequently rent or borrow cars without owning one, while owner insurance suits individuals who have their own vehicle. Assess your driving habits, state requirements, and risk exposure to determine which policy aligns with your needs for liability coverage and financial protection. Consulting with an insurance agent can help tailor coverage options, ensuring compliance with legal mandates and optimal safeguarding against potential claims.

Frequently Asked Questions on Car Insurance Types

Non-owner insurance provides liability coverage for drivers operating vehicles they do not own, typically required for those who frequently rent cars or drive borrowed vehicles. Owner insurance, on the other hand, covers both liability and physical damage for vehicles registered under the policyholder's name. Understanding the distinctions between these policies helps clarify coverage limits, premiums, and eligibility for drivers with varying vehicle ownership statuses.

Non-Owner Insurance vs Owner Insurance Infographic

cardiffo.com

cardiffo.com