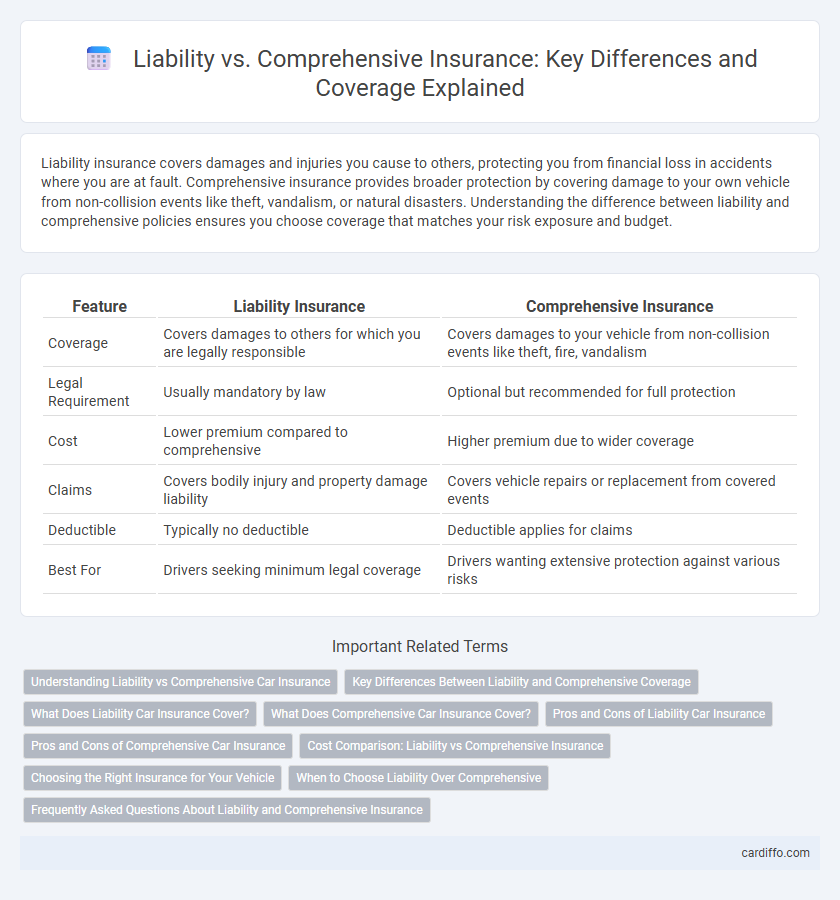

Liability insurance covers damages and injuries you cause to others, protecting you from financial loss in accidents where you are at fault. Comprehensive insurance provides broader protection by covering damage to your own vehicle from non-collision events like theft, vandalism, or natural disasters. Understanding the difference between liability and comprehensive policies ensures you choose coverage that matches your risk exposure and budget.

Table of Comparison

| Feature | Liability Insurance | Comprehensive Insurance |

|---|---|---|

| Coverage | Covers damages to others for which you are legally responsible | Covers damages to your vehicle from non-collision events like theft, fire, vandalism |

| Legal Requirement | Usually mandatory by law | Optional but recommended for full protection |

| Cost | Lower premium compared to comprehensive | Higher premium due to wider coverage |

| Claims | Covers bodily injury and property damage liability | Covers vehicle repairs or replacement from covered events |

| Deductible | Typically no deductible | Deductible applies for claims |

| Best For | Drivers seeking minimum legal coverage | Drivers wanting extensive protection against various risks |

Understanding Liability vs Comprehensive Car Insurance

Liability car insurance covers damages and injuries you cause to others in an accident, protecting your financial responsibility up to policy limits. Comprehensive car insurance provides broader protection by covering non-collision incidents such as theft, vandalism, natural disasters, and animal impacts. Understanding these differences helps drivers select the appropriate coverage for their risk tolerance and vehicle value.

Key Differences Between Liability and Comprehensive Coverage

Liability coverage primarily protects against damages or injuries you cause to others in an accident, covering bodily injury and property damage, while comprehensive coverage safeguards your own vehicle from non-collision events such as theft, vandalism, natural disasters, and animal collisions. Liability insurance is mandatory in most states, setting minimum financial responsibility, whereas comprehensive coverage is optional but highly recommended for extensive protection. Understanding these key differences helps consumers make informed decisions based on legal requirements and personal risk tolerance.

What Does Liability Car Insurance Cover?

Liability car insurance covers bodily injury and property damage that you cause to others in an accident, including medical expenses, legal fees, and repair costs for the other party. It does not cover damages to your own vehicle or injuries sustained by you or your passengers. This coverage is mandatory in most states and provides financial protection against claims resulting from your responsibility in an accident.

What Does Comprehensive Car Insurance Cover?

Comprehensive car insurance covers damages to your vehicle caused by non-collision events such as theft, vandalism, fire, natural disasters, and falling objects. It also protects against animal-related incidents like hitting a deer, offering broader protection beyond liability coverage that only addresses damages to others. This policy is essential for safeguarding your car against unpredictable risks not included in collision or liability insurance.

Pros and Cons of Liability Car Insurance

Liability car insurance provides essential protection by covering damages and injuries you cause to others, typically at a lower cost than comprehensive insurance, making it ideal for budget-conscious drivers. However, it does not cover your own vehicle's damage or theft, leaving you exposed to potentially high out-of-pocket expenses after an accident. This limited coverage makes liability insurance less suitable for newer or more valuable cars, where comprehensive policies offer broader protection against a range of risks including vandalism, weather damage, and collisions.

Pros and Cons of Comprehensive Car Insurance

Comprehensive car insurance covers a broad range of damages beyond collisions, including theft, vandalism, fire, and natural disasters, providing extensive protection for your vehicle. It often comes with a higher premium compared to liability insurance but minimizes out-of-pocket expenses for repairs or replacements from covered incidents. However, comprehensive coverage may include deductibles and does not cover every type of damage, such as mechanical breakdowns or routine maintenance, which limits its scope in certain situations.

Cost Comparison: Liability vs Comprehensive Insurance

Liability insurance typically offers lower premiums compared to comprehensive insurance due to its limited coverage scope, focusing only on damages to others and their property. Comprehensive insurance, while more costly, provides extensive protection including theft, vandalism, weather damage, and collision, resulting in higher monthly or annual payments. Consumers often evaluate the trade-off between cost and coverage breadth when choosing between liability and comprehensive auto insurance policies.

Choosing the Right Insurance for Your Vehicle

Liability insurance covers damages or injuries you cause to others in an accident, making it essential for meeting legal requirements and protecting your financial responsibility. Comprehensive insurance extends coverage to non-collision-related incidents such as theft, vandalism, natural disasters, and animal strikes, offering broader protection. Evaluating factors like vehicle value, driving habits, and risk tolerance helps determine whether liability alone or adding comprehensive coverage best suits your needs.

When to Choose Liability Over Comprehensive

Choose liability insurance when your vehicle is older with low market value, as comprehensive coverage may not be cost-effective relative to potential claim payouts. Liability insurance is ideal for drivers seeking minimum legal requirements to cover damages or injuries to others without covering their own vehicle. Opt for liability over comprehensive if budgeting constraints exist and the risk of collision, theft, or natural damage is minimal.

Frequently Asked Questions About Liability and Comprehensive Insurance

Liability insurance covers damages and injuries you cause to others in an accident, protecting your financial responsibility for bodily injury and property damage. Comprehensive insurance includes coverage for non-collision incidents like theft, vandalism, natural disasters, and falling objects, providing broader protection beyond liability. Policyholders often ask about coverage limits, deductibles, and whether comprehensive insurance is mandatory with liability in certain states.

Liability vs Comprehensive Infographic

cardiffo.com

cardiffo.com