Telematics-based pet insurance policies utilize real-time data from wearable devices to monitor pets' health and activity, allowing for personalized premiums and proactive care recommendations. Non-telematics policies rely on traditional methods such as veterinary records and claim history, offering fixed coverage without behavior-based adjustments. Choosing telematics-based insurance can lead to cost savings and improved pet well-being through continuous monitoring and tailored risk assessment.

Table of Comparison

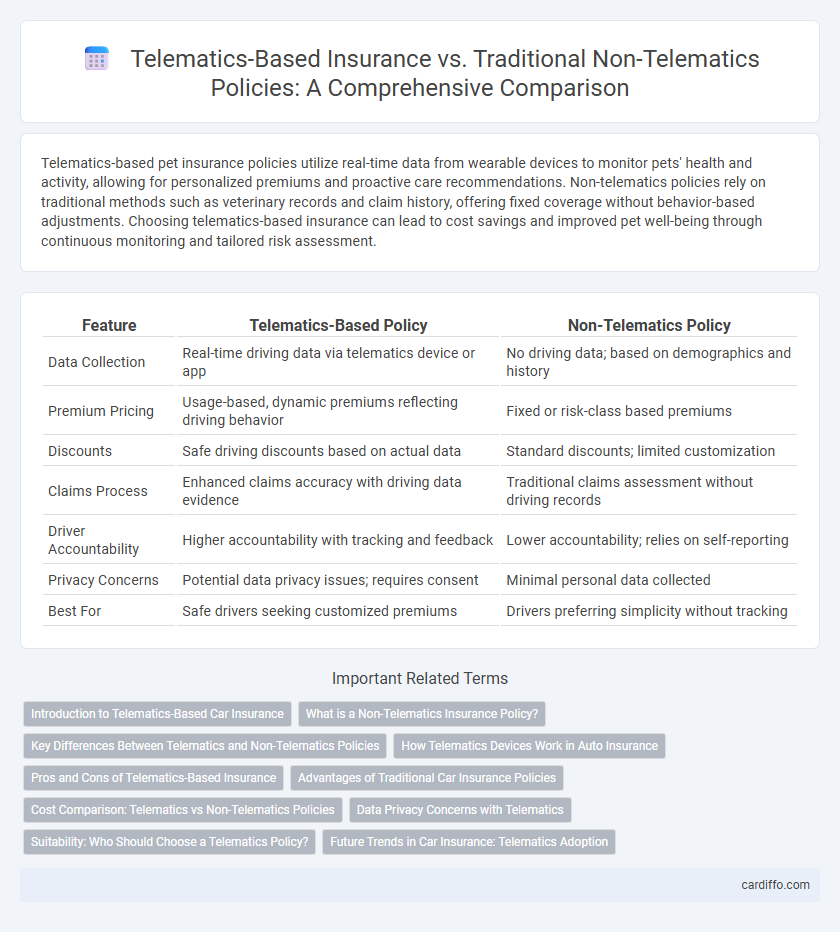

| Feature | Telematics-Based Policy | Non-Telematics Policy |

|---|---|---|

| Data Collection | Real-time driving data via telematics device or app | No driving data; based on demographics and history |

| Premium Pricing | Usage-based, dynamic premiums reflecting driving behavior | Fixed or risk-class based premiums |

| Discounts | Safe driving discounts based on actual data | Standard discounts; limited customization |

| Claims Process | Enhanced claims accuracy with driving data evidence | Traditional claims assessment without driving records |

| Driver Accountability | Higher accountability with tracking and feedback | Lower accountability; relies on self-reporting |

| Privacy Concerns | Potential data privacy issues; requires consent | Minimal personal data collected |

| Best For | Safe drivers seeking customized premiums | Drivers preferring simplicity without tracking |

Introduction to Telematics-Based Car Insurance

Telematics-based car insurance uses real-time data collected from devices installed in vehicles to monitor driving behavior, enabling personalized premiums based on factors like speed, acceleration, and braking patterns. This technology provides insurers with accurate risk assessments, promoting safer driving habits and potential cost savings for policyholders. In contrast, non-telematics policies rely primarily on historical data and demographic factors without real-time behavior tracking.

What is a Non-Telematics Insurance Policy?

A non-telematics insurance policy is a traditional auto insurance plan that sets premiums based on general risk factors such as driving history, age, vehicle type, and location rather than real-time driving behavior. Unlike telematics policies that use devices or smartphone apps to monitor driving patterns and adjust rates accordingly, non-telematics policies rely on static data collected at the time of application. This approach provides predictable premiums without requiring ongoing data collection, making it ideal for drivers who prefer privacy and simplicity over usage-based discounts.

Key Differences Between Telematics and Non-Telematics Policies

Telematics-based policies use real-time data from devices installed in vehicles to track driving behavior, enabling personalized premiums based on factors such as speed, acceleration, and braking patterns. Non-telematics policies rely on traditional risk assessments including age, driving history, and location without continuous monitoring of driving habits. This fundamental difference allows telematics policies to offer dynamic pricing and potentially lower costs for safe drivers, while non-telematics policies maintain fixed rates based on historical data.

How Telematics Devices Work in Auto Insurance

Telematics devices in auto insurance collect real-time driving data such as speed, acceleration, braking patterns, and mileage, which insurers use to assess risk more precisely. This data is transmitted via GPS and cellular networks to provide personalized premiums based on actual driving behavior rather than general statistics. Non-telematics policies rely on historical data and demographic factors, lacking the customized risk assessment enabled by telematics technology.

Pros and Cons of Telematics-Based Insurance

Telematics-based insurance policies leverage real-time driving data to offer personalized premiums, promoting safer driving habits and potentially lowering costs for cautious drivers. However, concerns about data privacy and constant monitoring may deter some policyholders, while inaccurate data can lead to unfair premium adjustments. Traditional non-telematics policies provide stable rates without monitoring but lack individualized pricing and incentives for improved driving behavior.

Advantages of Traditional Car Insurance Policies

Traditional car insurance policies offer straightforward coverage without the need for tracking devices, providing privacy and ease of use for policyholders who prefer not to share driving data. These policies often feature predictable premium costs based on historical factors such as driving history, vehicle type, and location, allowing for consistent budgeting. Additionally, they eliminate concerns about data security and potential biases inherent in telematics-based risk assessments.

Cost Comparison: Telematics vs Non-Telematics Policies

Telematics-based insurance policies typically offer lower premiums than non-telematics policies due to personalized risk assessment from driving behavior data. Non-telematics policies rely on statistical averages and demographic factors, often resulting in higher base costs and less incentive for safe driving. Cost savings from telematics policies can range from 10% to 30%, depending on the insurer and driver profile.

Data Privacy Concerns with Telematics

Telematics-based insurance policies collect real-time driving data such as speed, location, and braking patterns, raising significant data privacy concerns among policyholders. Unlike non-telematics policies, which rely on traditional data sources like credit scores and driving records, telematics systems require continuous monitoring and transmission of sensitive information. Ensuring robust encryption and transparent data usage policies is essential for protecting consumer privacy and building trust in telematics insurance solutions.

Suitability: Who Should Choose a Telematics Policy?

Telematics-based insurance policies are most suitable for safe, low-mileage drivers who seek personalized premiums reflecting their actual driving behavior. These policies benefit individuals willing to share driving data through in-car devices or mobile apps, enabling real-time monitoring and potential discounts. Conversely, drivers with inconsistent driving habits or privacy concerns may prefer non-telematics policies with fixed rates not influenced by monitored behavior.

Future Trends in Car Insurance: Telematics Adoption

Telematics-based car insurance policies leverage real-time driving data to offer personalized premiums, improving risk assessment accuracy compared to non-telematics policies that rely on historical data and general profiles. Future trends indicate increased adoption of telematics technology driven by advances in IoT, AI analytics, and consumer demand for customized coverage and incentives for safe driving. Insurers integrating telematics are expected to enhance fraud detection, optimize claims processing, and promote eco-friendly driving habits, reshaping the competitive landscape of auto insurance.

Telematics-Based Policy vs Non-Telematics Policy Infographic

cardiffo.com

cardiffo.com