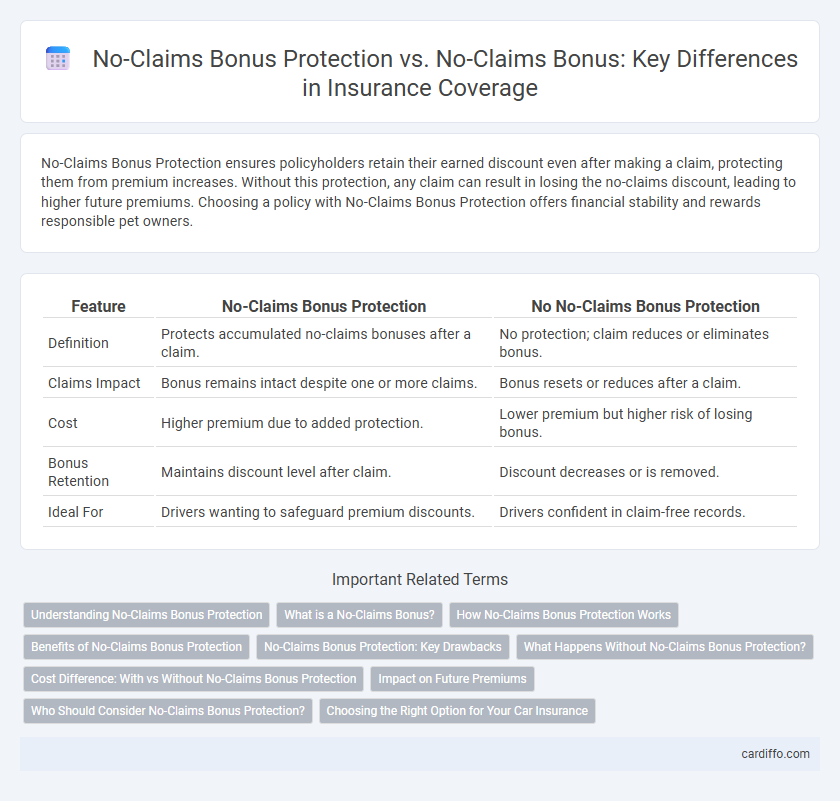

No-Claims Bonus Protection ensures policyholders retain their earned discount even after making a claim, protecting them from premium increases. Without this protection, any claim can result in losing the no-claims discount, leading to higher future premiums. Choosing a policy with No-Claims Bonus Protection offers financial stability and rewards responsible pet owners.

Table of Comparison

| Feature | No-Claims Bonus Protection | No No-Claims Bonus Protection |

|---|---|---|

| Definition | Protects accumulated no-claims bonuses after a claim. | No protection; claim reduces or eliminates bonus. |

| Claims Impact | Bonus remains intact despite one or more claims. | Bonus resets or reduces after a claim. |

| Cost | Higher premium due to added protection. | Lower premium but higher risk of losing bonus. |

| Bonus Retention | Maintains discount level after claim. | Discount decreases or is removed. |

| Ideal For | Drivers wanting to safeguard premium discounts. | Drivers confident in claim-free records. |

Understanding No-Claims Bonus Protection

No-Claims Bonus Protection allows policyholders to maintain their earned discount on premiums even after making a claim, effectively safeguarding their savings and reducing future insurance costs. Without this protection, any claim filed typically results in the loss of accumulated no-claims bonuses, causing a significant increase in premium rates. Insurers offering No-Claims Bonus Protection often require an additional fee, but it provides financial stability and encourages prudent driving habits by minimizing the impact of occasional claims.

What is a No-Claims Bonus?

A No-Claims Bonus (NCB) is a discount on insurance premiums awarded to policyholders who do not file any claims during a policy period, typically reducing the cost of premiums in subsequent years. No-Claims Bonus Protection allows drivers to make a limited number of claims without losing their accumulated discount, preserving their eligibility for future savings. Without NCB Protection, any claim made can result in losing the entire no-claims discount, potentially increasing premium costs significantly.

How No-Claims Bonus Protection Works

No-Claims Bonus Protection allows policyholders to maintain their discount rate even after one or more claims, preventing an immediate increase in premiums. This feature works by "shielding" the accrued no-claims discount from being reduced after a claim, preserving the insured's claim-free record benefits. Without this protection, any claim typically resets the no-claims bonus, leading to higher insurance costs in subsequent renewal periods.

Benefits of No-Claims Bonus Protection

No-Claims Bonus Protection safeguards your earned discount on insurance premiums even after an at-fault claim, preventing premium increases and maintaining cost savings. It encourages responsible driving by rewarding claim-free periods, significantly reducing long-term insurance expenses. This protection enhances financial security and supports continuous savings, making it a valuable addition to any insurance policy.

No-Claims Bonus Protection: Key Drawbacks

No-Claims Bonus Protection limits premium increases after an at-fault claim but often comes with higher initial premiums. Policyholders may face stricter eligibility criteria and reduced discounts on future renewals despite having protection. Some insurers exclude certain claims from NCB protection, diminishing its overall value.

What Happens Without No-Claims Bonus Protection?

Without No-Claims Bonus Protection, any at-fault claim will typically result in a reduction or complete loss of the accumulated discount on your insurance premium, leading to significantly higher costs when renewing the policy. Insurers may reset your no-claims history, causing the insured to lose valuable financial benefits earned through claim-free years. This can increase overall insurance expenses substantially, especially for drivers who have maintained a long record of safe driving.

Cost Difference: With vs Without No-Claims Bonus Protection

No-Claims Bonus Protection typically increases premium costs by 10-30% compared to policies without this feature, providing the advantage of preserving discount levels after a claim. Without No-Claims Bonus Protection, drivers risk losing up to 60% of their discount following a single claim, resulting in substantially higher renewal premiums. Choosing policies with No-Claims Bonus Protection offers cost predictability and long-term savings despite the initial higher expense.

Impact on Future Premiums

No-Claims Bonus Protection helps maintain your discount even after making a claim, preventing significant increases in future premiums and preserving long-term savings. Without No-Claims Bonus Protection, a single claim can reset your bonus, resulting in higher insurance costs and reduced premium discounts over subsequent years. Insurers typically charge more for policies without protection, reflecting the increased risk of premium hikes after claims.

Who Should Consider No-Claims Bonus Protection?

Drivers with a history of safe driving and multiple claim-free years should consider No-Claims Bonus Protection to safeguard their discount even after an accident. This coverage is particularly beneficial for those who rely on maintaining premium reductions to keep insurance costs low. Policyholders who anticipate potential claims but want to avoid losing their accumulated bonus find this protection essential.

Choosing the Right Option for Your Car Insurance

When selecting car insurance, opting for No-Claims Bonus Protection preserves your discount even after a claim, potentially lowering long-term premiums. Without this protection, making a claim typically results in losing the accrued no-claims discount, increasing future insurance costs. Assess your driving habits and risk tolerance to determine if the added premium for protection justifies the financial security and savings over time.

No-Claims Bonus Protection vs No No-Claims Bonus Protection Infographic

cardiffo.com

cardiffo.com